Question: Apple Computer's (AAPL) most recent quarterly dividend was $0.22. The recent market price was $177.00 per share. < a. Compute AAPL's expected price using

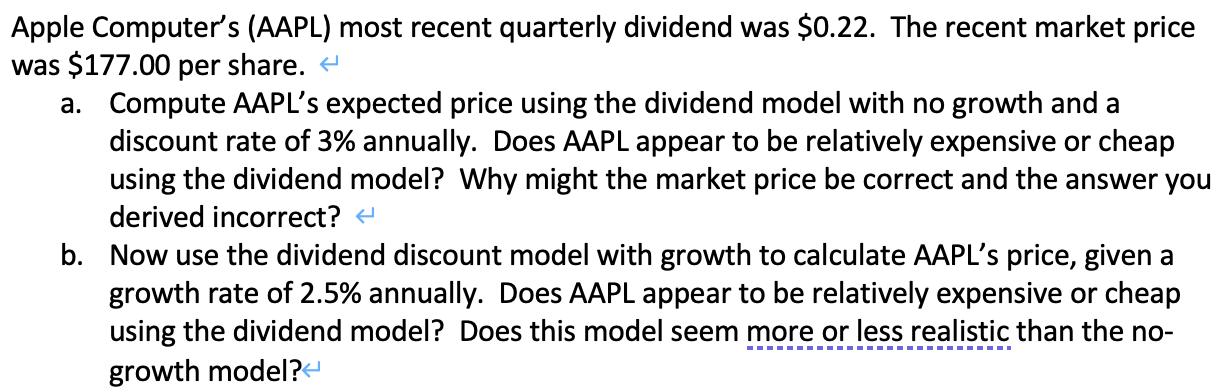

Apple Computer's (AAPL) most recent quarterly dividend was $0.22. The recent market price was $177.00 per share. < a. Compute AAPL's expected price using the dividend model with no growth and a discount rate of 3% annually. Does AAPL appear to be relatively expensive or cheap using the dividend model? Why might the market price be correct and the answer you derived incorrect? < b. Now use the dividend discount model with growth to calculate AAPL's price, given a growth rate of 2.5% annually. Does AAPL appear to be relatively expensive or cheap using the dividend model? Does this model seem more or less realistic than the no- growth model?

Step by Step Solution

There are 3 Steps involved in it

a To compute AAPLs expected price using the dividend model with no growth and a discount rate of 3 a... View full answer

Get step-by-step solutions from verified subject matter experts