Question: Apple & Pear Company is considering three mutually exclusive projects Project A, Project B. and Project C-as it aims to expand its manufacturing capacity.

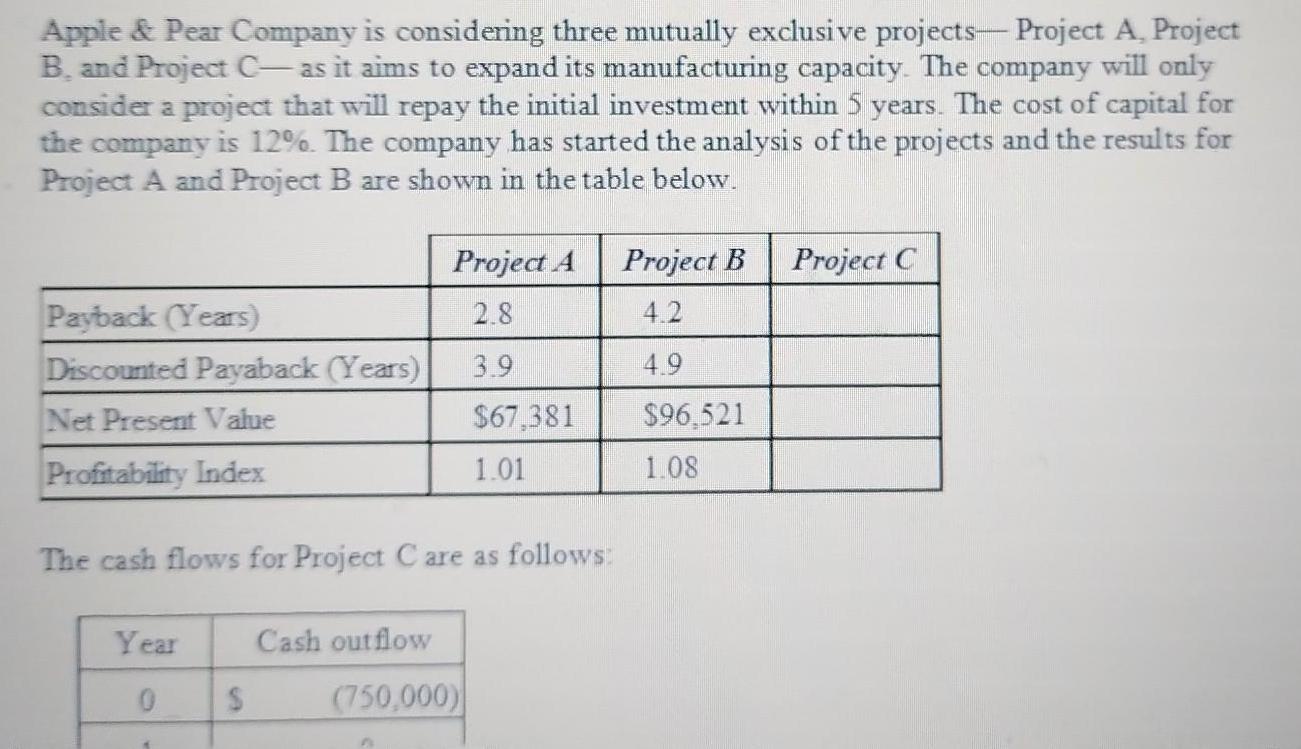

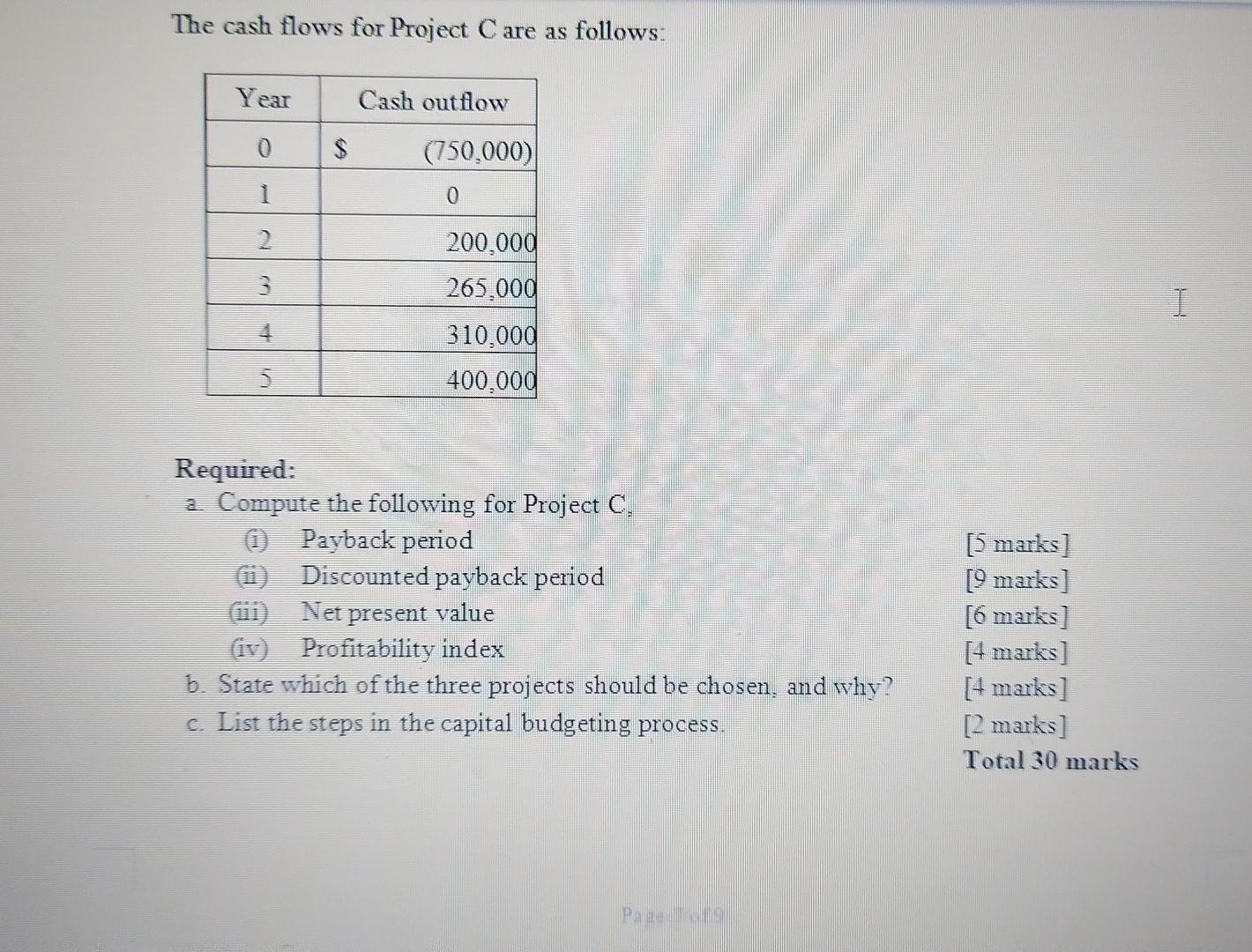

Apple & Pear Company is considering three mutually exclusive projects Project A, Project B. and Project C-as it aims to expand its manufacturing capacity. The company will only consider a project that will repay the initial investment within 5 years. The cost of capital for the company is 12%. The company has started the analysis of the projects and the results for Project A and Project B are shown in the table below. Payback (Years) Discounted Payaback (Years) Net Present Value Profitability Index The cash flows for Project C are as follows: Year 0 S Project A 2.8 3.9 $67,381 1.01 Cash outflow (750,000) Project B 4.2 4.9 $96,521 1.08 Project C The cash flows for Project Care as follows: Year 0 1 2 3 h 5 $ Cash outflow (750,000) 0 200,000 265,000 310,000 400,000 Required: a. Compute the following for Project C Payback period Discounted payback period Net present value Profitability index 1 ) (iv) b. State which of the three projects should be chosen, and why? c. List the steps in the capital budgeting process. [5 marks] [9 marks] [6 marks] [4 marks] [4 marks] [2 marks] Total 30 marks I

Step by Step Solution

There are 3 Steps involved in it

Year Cash flow Discounted at 12 Cumulative flow of cash flow Discounted cumulative cash flow 0 75000... View full answer

Get step-by-step solutions from verified subject matter experts