Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Applecross Dental Services is investigating expanding its operations by acquiring additional teeth cleaning equipment. The equipment would cost $155,000 and management has estimated that

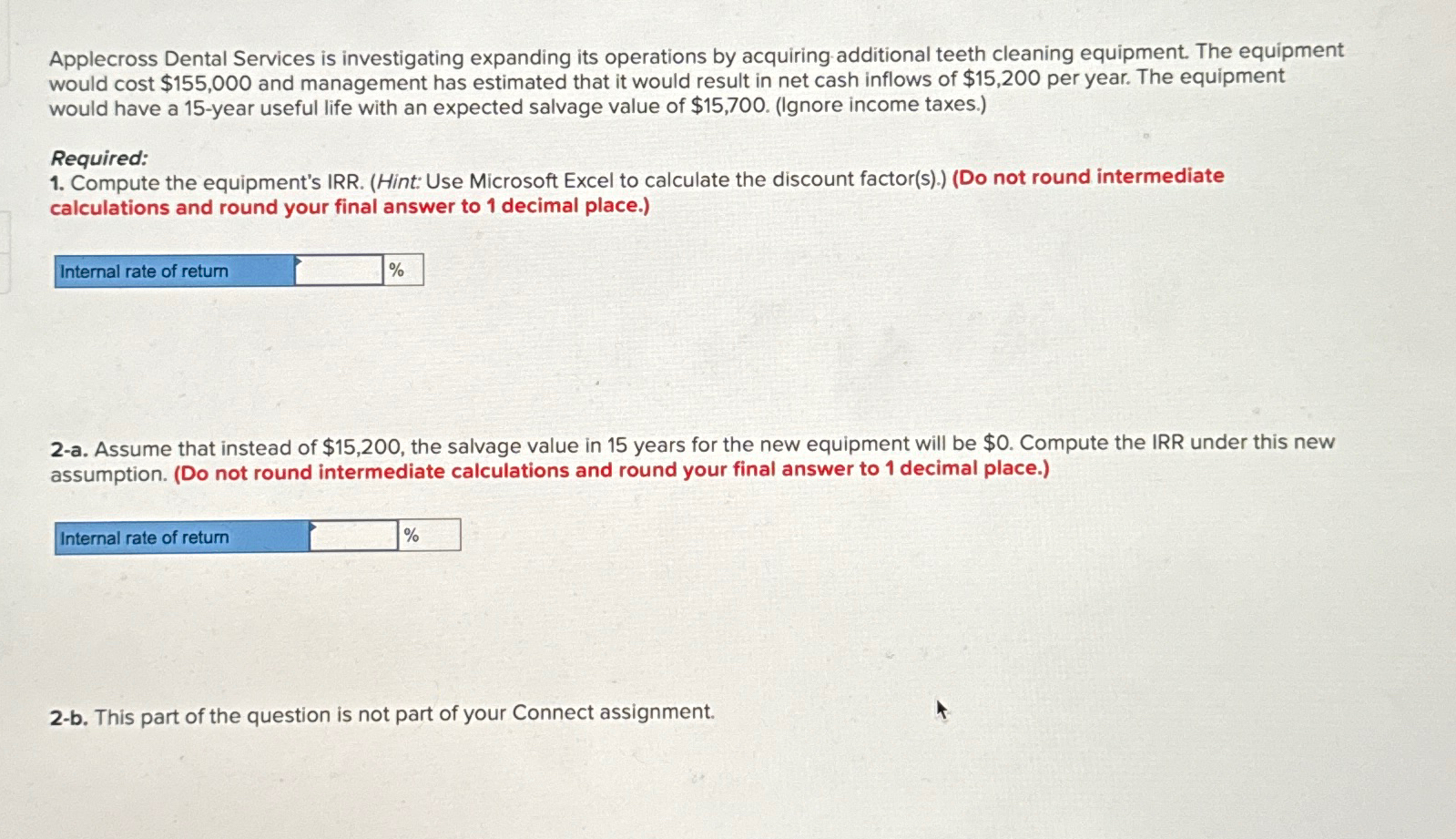

Applecross Dental Services is investigating expanding its operations by acquiring additional teeth cleaning equipment. The equipment would cost $155,000 and management has estimated that it would result in net cash inflows of $15,200 per year. The equipment would have a 15-year useful life with an expected salvage value of $15,700. (Ignore income taxes.) Required: 1. Compute the equipment's IRR. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations and round your final answer to 1 decimal place.) Internal rate of return % 2-a. Assume that instead of $15,200, the salvage value in 15 years for the new equipment will be $0. Compute the IRR under this new assumption. (Do not round intermediate calculations and round your final answer to 1 decimal place.) Internal rate of return % 2-b. This part of the question is not part of your Connect assignment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Lets start by calculating the Internal Rate of Return IRR for the equipment under the given a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66428f0cb5445_979146.pdf

180 KBs PDF File

66428f0cb5445_979146.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started