Question: Application of Multi-Factor Models in Creating a Tracking Portfolio (A Long-Short Neutral Strategy) Suppose that you create an optimal portfolio tracking Russell 3000 and earning

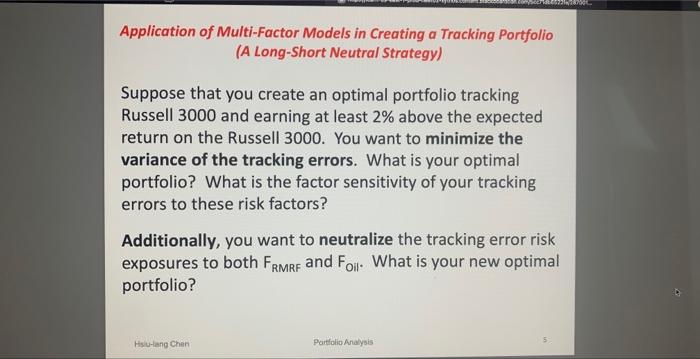

Application of Multi-Factor Models in Creating a Tracking Portfolio (A Long-Short Neutral Strategy) Suppose that you create an optimal portfolio tracking Russell 3000 and earning at least 2% above the expected return on the Russell 3000 . You want to minimize the variance of the tracking errors. What is your optimal portfolio? What is the factor sensitivity of your tracking errors to these risk factors? Additionally, you want to neutralize the tracking error risk exposures to both FRMRF and Foil.. What is your new optimal portfolio? Application of Multi-Factor Models in Creating a Tracking Portfolio (A Long-Short Neutral Strategy) Suppose that you create an optimal portfolio tracking Russell 3000 and earning at least 2% above the expected return on the Russell 3000 . You want to minimize the variance of the tracking errors. What is your optimal portfolio? What is the factor sensitivity of your tracking errors to these risk factors? Additionally, you want to neutralize the tracking error risk exposures to both FRMRF and Foil.. What is your new optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts