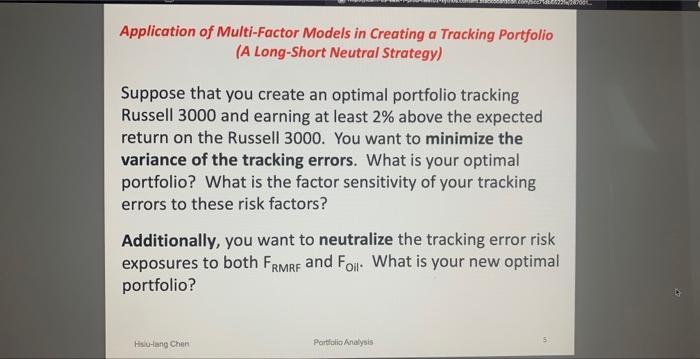

Question: Application of Multi-Factor Models in Creating a Tracking Portfolio (A Long-Short Neutral Strategy) ended221 Suppose that you create an optimal portfolio tracking Russell 3000

Application of Multi-Factor Models in Creating a Tracking Portfolio (A Long-Short Neutral Strategy) ended221 Suppose that you create an optimal portfolio tracking Russell 3000 and earning at least 2% above the expected return on the Russell 3000. You want to minimize the variance of the tracking errors. What is your optimal portfolio? What is the factor sensitivity of your tracking errors to these risk factors? Additionally, you want to neutralize the tracking error risk exposures to both FRMRF and Foll. What is your new optimal portfolio? Hsiu-lang Chen Portfolio Analysis 5

Step by Step Solution

There are 3 Steps involved in it

The optimal portfolio would be composed of a mix of stocks from the Russell 3000 index and a mix of ... View full answer

Get step-by-step solutions from verified subject matter experts