Question: Application Problem 5-5A a-b (Part Level Submission) Organic Developments Ltd. (ODL) is an importer of organic produce from California. The company has been experiencing significant

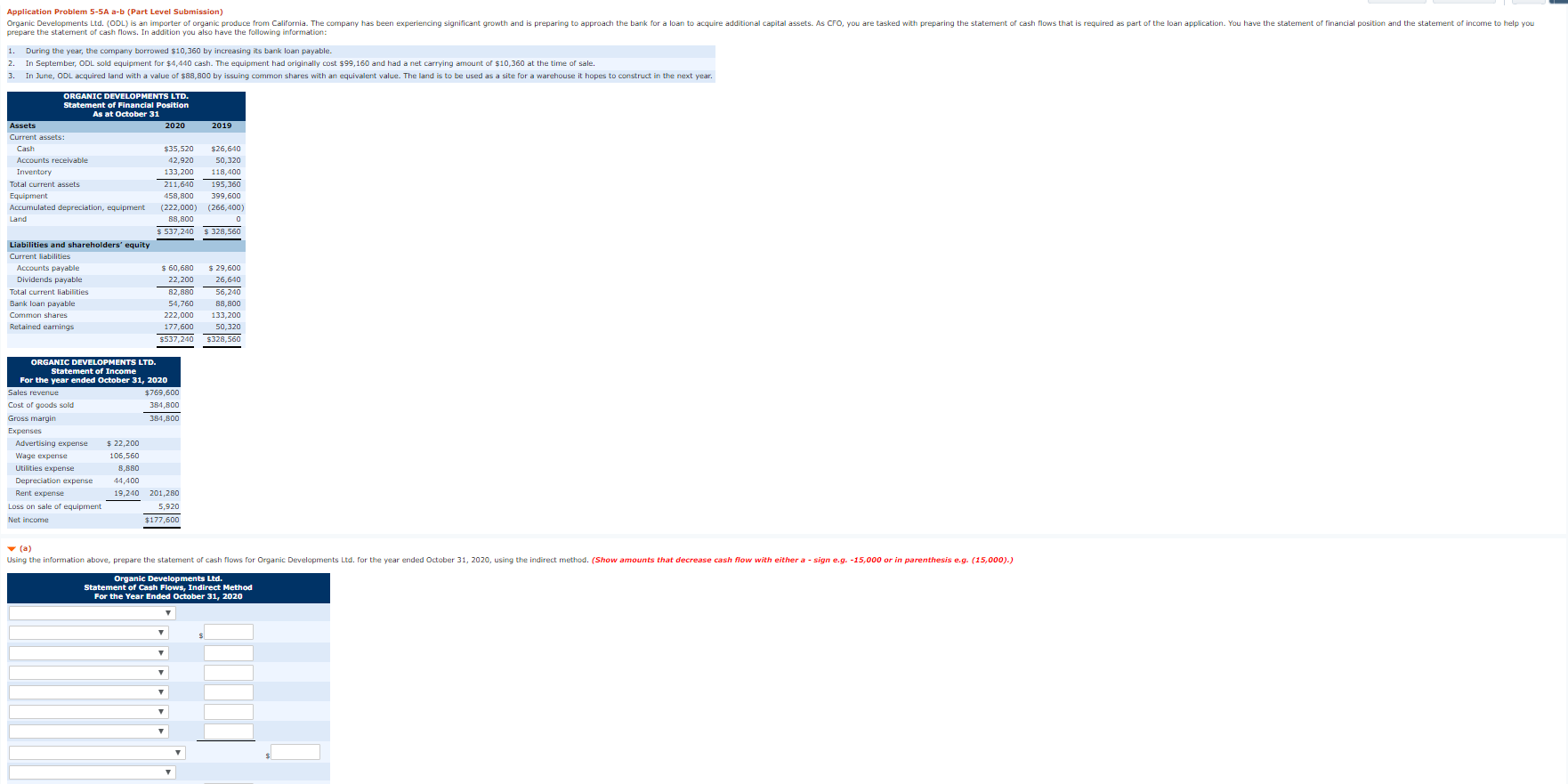

Application Problem 5-5A a-b (Part Level Submission) Organic Developments Ltd. (ODL) is an importer of organic produce from California. The company has been experiencing significant growth and is preparing to approach the bank for a loan to acquire additional capital assets. As CFO, you are tasked with preparing the statement of cash flows that is required as part of the loan application. You have the statement of financial position and the statement of income to help you prepare the statement of cash flows. In addition you also have the following information: 1. During the year, the company borrowed $10,360 by increasing its bank loan payable. In September, ODL sold equipment for $4,440 cash. The equipment had originally cost $99,160 and had a net carrying amount of $10,360 at the time of sale. 3. In June, ODL acquired land with a value of s88,800 by issuing common shares with an equivalent value. The land is to be used as a site for a warehouse it hopes to construct in the next year ORGANIC DEVELOPMENTS LTD. Statement of Financial Position Assets $35,520 $26,640 Accounts receivable 133,20 Inventory 118,400 211,640 195,360 Total current assets Equipment Accumulated depreciation, equipment 399,600 (222,000) (266,400) Liabilities and shareholders' equity Current liabilities $ 60,680 Accounts payable Dividends payable 22,200 26,640 82,880 56,240 Total current liabilities Bank loan payable 54,760 88,800 Common shares 222,000 133,200 Retained eamings 177,600 50,320 $537,240 ORGANIC DEVELOPMENTS LTD. Statement of Income For the year ended October 31, 2020 $769,600 Cost of goods sold 384,800 Gross margin Expenses Advertising expense 22,200 Wage expense 106,560 Utilities expense 8,880 Depreciation expense Rent expense 44,400 19,240 201,280 Loss on sale of equipment 5,920 $177,600 (a) Using the information above, prepare the statement of cash flows for Organic Developments Ltd. for the year ended October 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a sign e.g. -15,000 or in parenthesis e.g. (15,000).) Organic Developments Ltd. Statement of Cash Flows, Indirect Method For the Year Ended October 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts