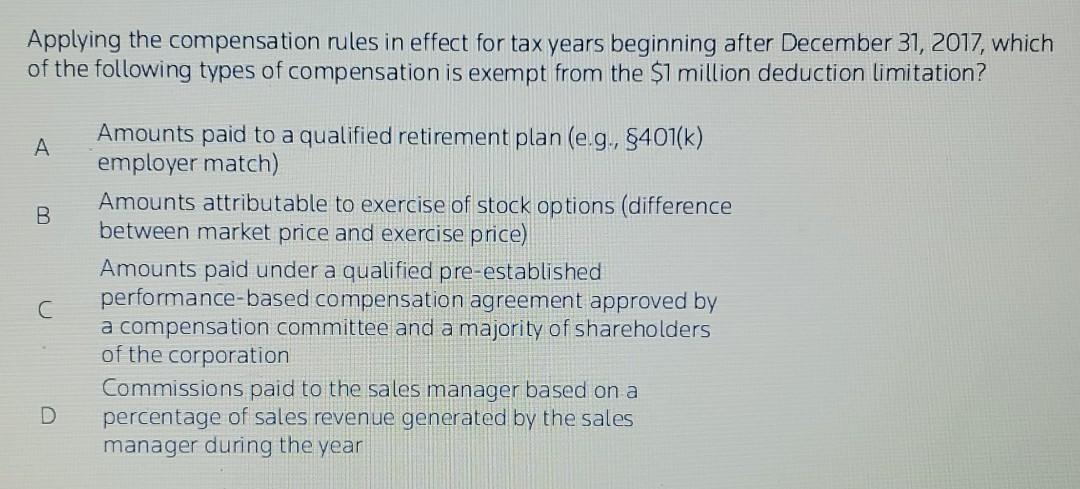

Question: Applying the compensation rules in effect for tax years beginning after December 31, 2017, which of the following types of compensation is exempt from the

Applying the compensation rules in effect for tax years beginning after December 31, 2017, which of the following types of compensation is exempt from the $1 million deduction limitation? A B Amounts paid to a qualified retirement plan (e.g., $401(k) employer match) Amounts attributable to exercise of stock options (difference between market price and exercise price) Amounts paid under a qualified pre-established performance-based compensation agreement approved by a compensation committee and a majority of shareholders of the corporation Commissions paid to the sales manager based on a percentage of sales revenue generated by the sales manager during the year U D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts