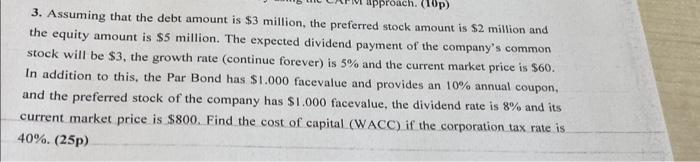

Question: approach. (10p) 3. Assuming that the debt amount is $3 million, the preferred stock amount is $2 million and the equity amount is $5

approach. (10p) 3. Assuming that the debt amount is $3 million, the preferred stock amount is $2 million and the equity amount is $5 million. The expected dividend payment of the company's common stock will be $3, the growth rate (continue forever) is 5% and the current market price is $60. In addition to this, the Par Bond has $1.000 facevalue and provides an 10% annual coupon, and the preferred stock of the company has $1.000 facevalue, the dividend rate is 8% and its current market price is $800. Find the cost of capital (WACC) if the corporation tax rate is 40%. (25p)

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

To find the Weighted Average Cost of Capital WACC we need to calculate the cost of each component of ... View full answer

Get step-by-step solutions from verified subject matter experts