Question: Approximate yield = for stock one blank options are 0.02% , 15.76% , 0.06% , 8.13% & 9.64% stock 2 blanks are 9.64% , 0.02%

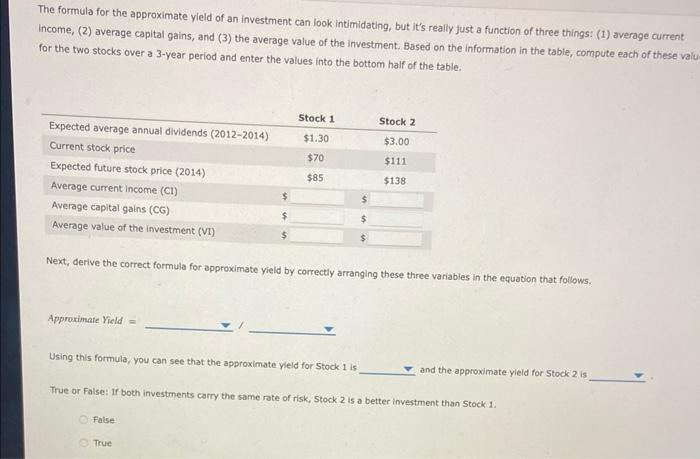

The formula for the approximate yield of an investment can look intimidating, but it's really just a function of three things: (1) average current Income, (2) average capital gains, and (3) the average value of the investment. Based on the information in the table, compute each of these valit for the two stocks over a 3-year period and enter the values into the bottom half of the table. Next, derive the correct formula for approximate yield by correctly arranging these three variables in the equation that follows. Approximate Yield = Using this formula, you can see that the approximate yield for stock 1 is and the approximate yield for Stock 2 is True or False: If both investments carry the same rote of risk, stock 2 is a better investment than Stock 1. False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts