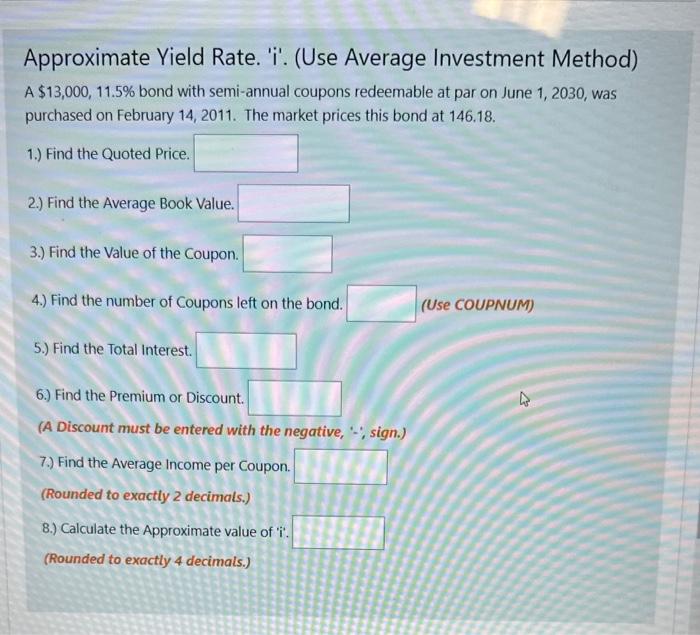

Question: Approximate Yield Rate. 'i'. (Use Average Investment Method) A $13,000,11.5% bond with semi-annual coupons redeemable at par on June 1,2030 , was purchased on February

Approximate Yield Rate. 'i'. (Use Average Investment Method) A $13,000,11.5% bond with semi-annual coupons redeemable at par on June 1,2030 , was purchased on February 14,2011 . The market prices this bond at 146.18. 1.) Find the Quoted Price. 2.) Find the Average Book Value. 3.) Find the Value of the Coupon. 4.) Find the number of Coupons left on the bond. (Use COUPNUM) 5.) Find the Total Interest. 6.) Find the Premium or Discount. (A Discount must be entered with the negative, ; sign.) 7.) Find the Average Income per Coupon. (Rounded to exactly 2 decimals.) 8.) Calculate the Approximate value of i '. (Rounded to exactly 4 decimals.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts