Question: Can you please answer this all question step by step And i added picture of 13th question 1. An investor bought 5,000 preferred shares, par

Can you please answer this all question step by step And i added picture of 13th question 1. An investor bought 5,000 preferred shares, par value $1.00, of BC Resources at $0.755 (i.e., seventy-five and a half cents) and received a dividend of $0.05. They were then sold at $0.80. What was the investor's total gain in dollars? (4 marks)2. What was the percentage gain in Problem 1? (4 marks)3. If money is worth 10%, compounded semi-annually, what is the value of a $5000 bond bearing interest at 5% every 6 months if it is bought today and matures in 7 years? (8 marks)4. What should be the purchase price of a $1,000 bond redeemable at 105 and bearing semi-annual coupons at 9.75% if it is sold 2 years before maturity and money is worth 11%, compounded annually? (8 marks)5. A $2,500 bond redeemable at par on September 1, 2020 bearing interest at 9.5%, payable semi-annually, is bought to yield 13% semi-annually on June 6, 2015. What was the price? (8 marks)6. At what price should I offer to buy a $500 bond on December 11, 2018 if I want it to yield 13%, compounded quarterly? The bond matures on April 1, 2022 and bears 11.5% coupons, payable on April 1 and October 1. (8 marks)7. Calculate the premium or discount on the sale of a $1,000 bond carrying semi-annual coupons at 4%, redeemable at 102 in 3.5 years, if it is bought to yield 6%, compounded semi-annually. (4 marks)8. What is the purchase price of the bond sold in Problem 7? (2 marks)9. Compute the premium or discount on the sale of a $2,000 bond, redeemable at 101.5 in 4 years' time, if it is bought to yield 12%, compounded quarterly, and the coupon rate is 10.75% semi-annually. (8 marks)10. What is the purchase price of the bond sold in Problem 9? (3 marks)11. Calculate the premium or discount on the sale of a $1,000 bond that is redeemable at 103 on June 1, 2020 if it is sold to yield 10.5% annually. The coupons are payable semi-annually at a rate of 13%, and the date of the sale is December 1, 2017. (5 marks)12. What is the purchase price of the bond sold in Problem 11? (2 marks)12.13. Construct a bond schedule for a $1,000 bond with interest payable at 10% semi-annually, redeemable at par, and bought to yield 12% semi-annually 1.5 years before maturity. (12 marks)End of Payment PeriodCoupon ValueInterest on Book Accum.Amount of DiscountBook ValueRemaining Discount14. What is the gain or loss on a $5,000 bond sold at 99.5 to yield 13%, compounded semi-annually, with 14% semi-annual coupons redeemable at 103 in 3 years? (8 marks)15. If a $500 bond bearing 12% semi-annual coupons is purchased at 97.5 and is redeemable at 102 in 4 years' time, what is the approximate yield rate? (8 marks)16. A $36,000 serial bond that has an annual interest rate of 12%, paid semi-annually, will be redeemed in three equal annual instalments of $12,000. The bond is purchased on an interest date 1 year prior to the first annual redemption. If an investor wants 18%, compounded monthly, what is the purchase price? (8 marks)

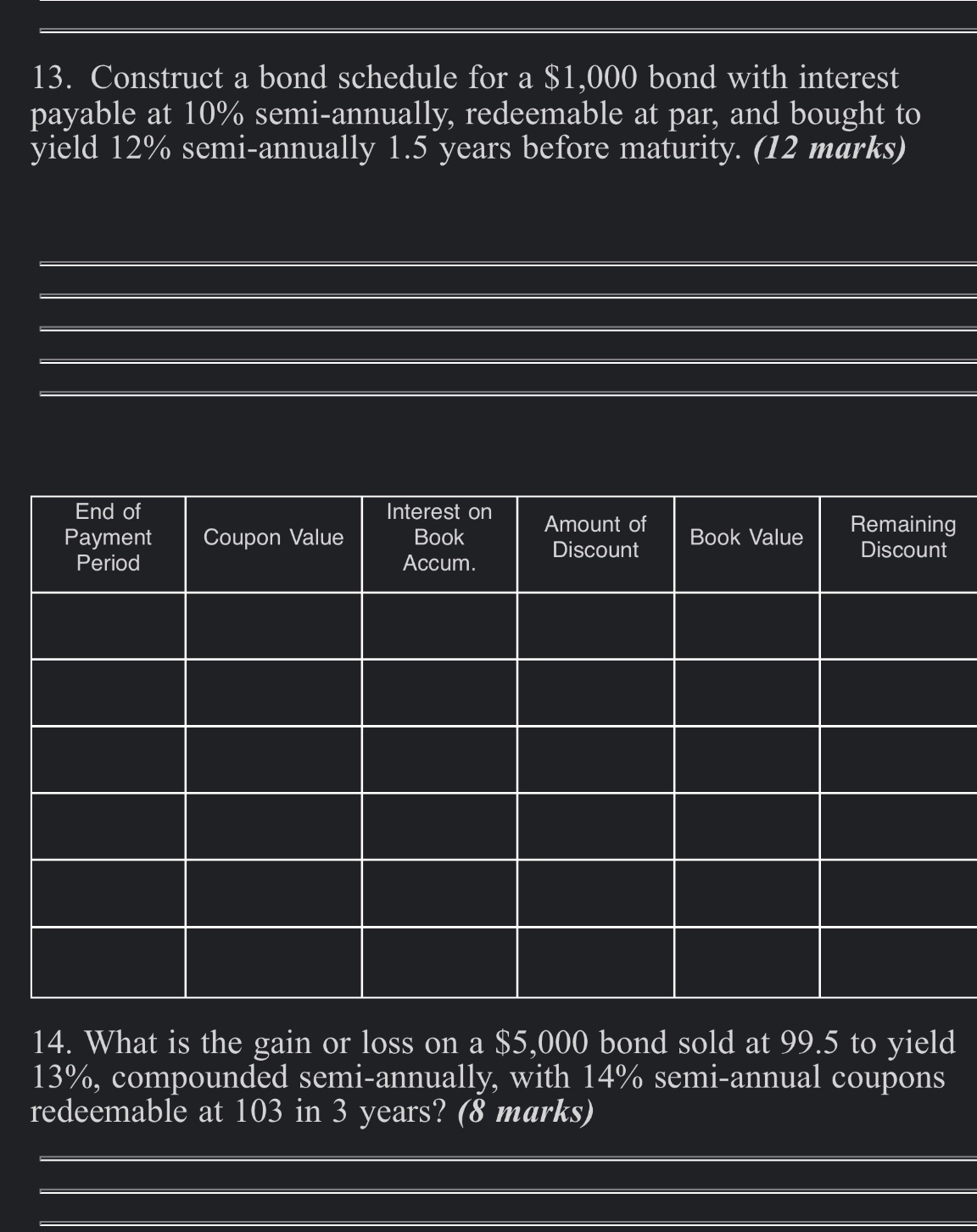

13. Construct a bond schedule for a $1,000 bond with interest payable at 10% semi-annually, redeemable at par, and bought to yield 12% semi-annually 1.5 years before maturity. (12 marks) End of Interest on Amount of Payment Coupon Value Book Discount Book Value Remaining Discount Period Accum. 14. What is the gain or loss on a $5,000 bond sold at 99.5 to yield 13%, compounded semi-annually, with 14% semi-annual coupons redeemable at 103 in 3 years? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts