Question: Apps * Bookmarks G Google M Gmail YouTube Contemporary Mathematics MATH1300 2021Fall HW Score: 92.31%, 12 of 13 points Homework: Homework 8.1 Question 13, 8.1.69

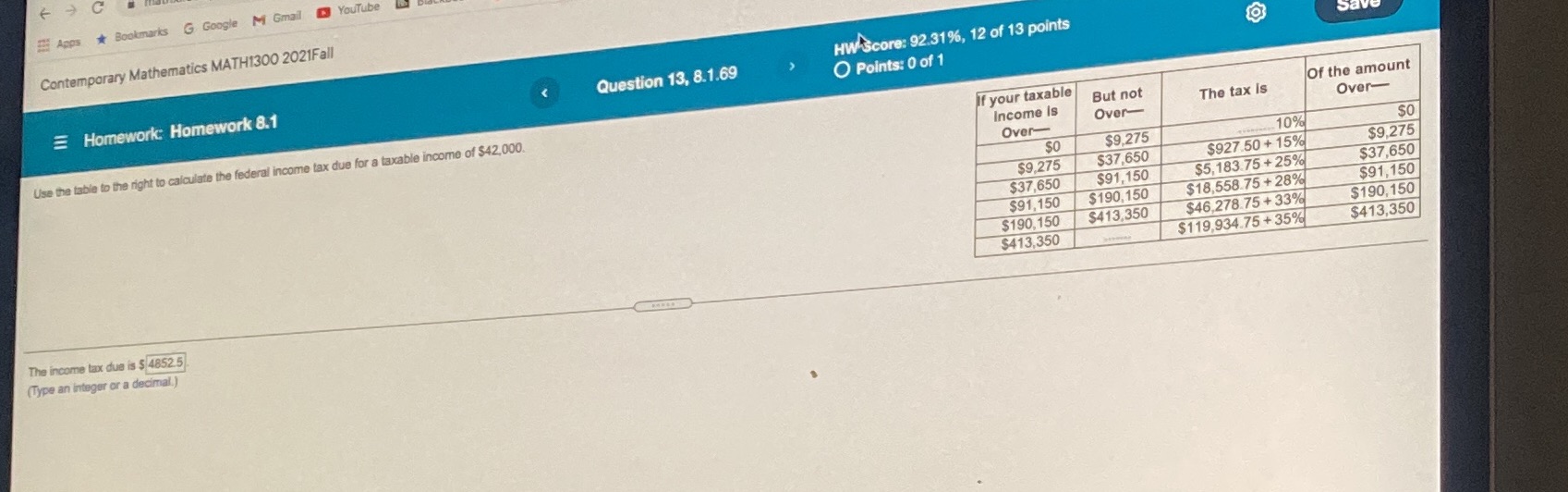

Apps * Bookmarks G Google M Gmail YouTube Contemporary Mathematics MATH1300 2021Fall HW Score: 92.31%, 12 of 13 points Homework: Homework 8.1 Question 13, 8.1.69 O Points: 0 of 1 Use the table to the right to calculate the federal income tax due for a taxable income of $42,000. If your taxable But not Of the amount Income Is The tax is Over- Over- Over- $0 $9,275 10% $0 $9,275 $37,650 $927 50 + 15% $9,275 $37,650 $91,150 $5,183 75 + 25% $37,650 $91,150 $190, 150 $18,558.75 + 28% $91,150 $190, 150 $413,350 $46,278.75 + 33% $190, 150 $413,350 $119,934.75 + 35% $413,350 The income tax due is $ 4852.5 (Type an integer or a decimal.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts