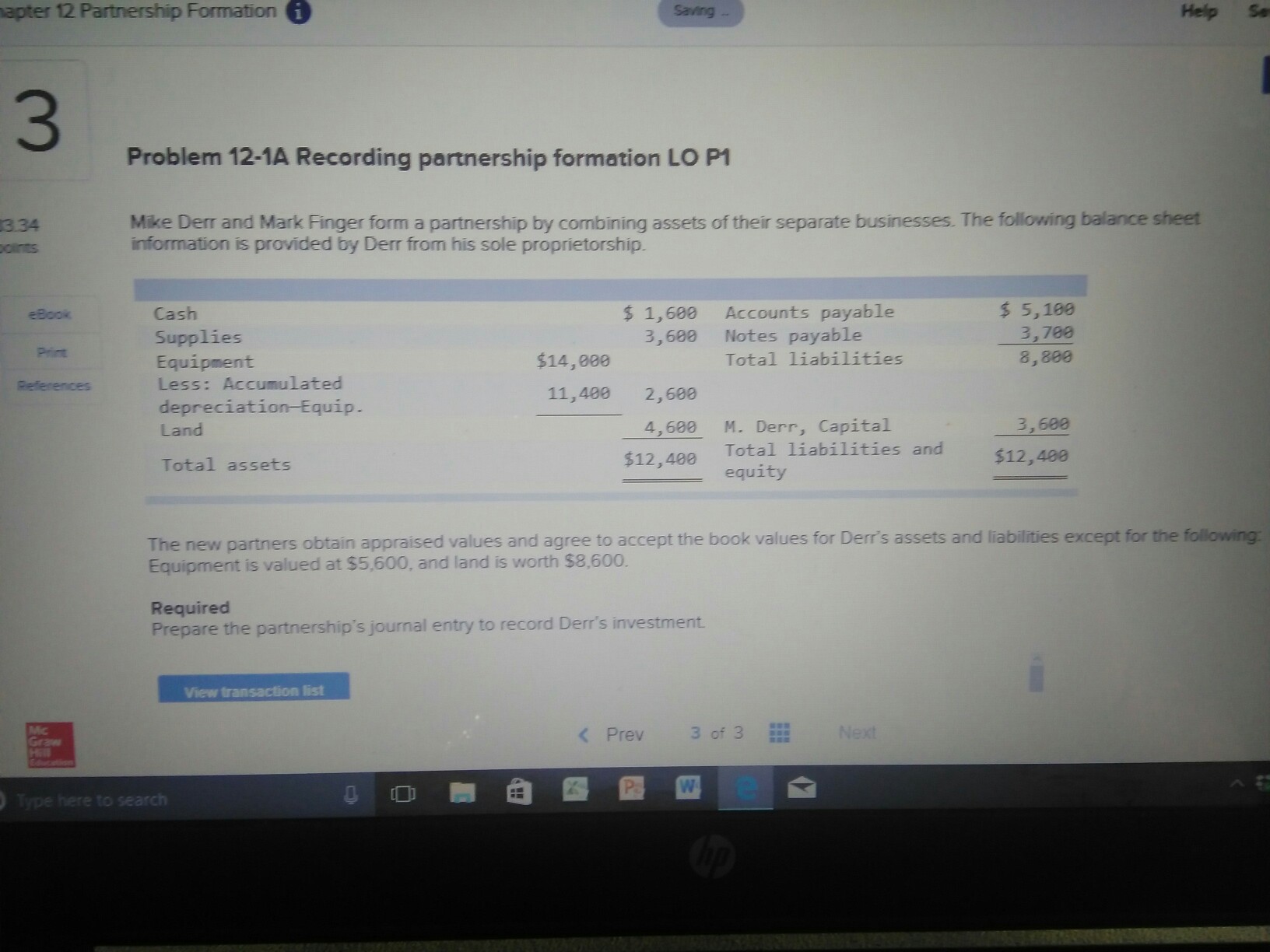

Question: apter 12 Partnership Formation Help Se Saving 3 Problem 12-1A Recording partnership formation LO P1 334 oints Mike Derr and Mark Finger form a partnership

apter 12 Partnership Formation Help Se Saving 3 Problem 12-1A Recording partnership formation LO P1 334 oints Mike Derr and Mark Finger form a partnership by combining assets of their separate businesses. The following balance sheet information is provided by Derr from his sole proprietorship. $1,680 Accounts payable 3,6 Notes payable $ 5,180 3,780 8,8ee Cash Supplies Equipment Less: Accumulated depreciation-Equip Land eBook Print $14,880 Total liabilities 11,400 2,680 3,600 4,600 M. Derr, Capital $12,400 Total liabilities and $12,480 Total assets equity The new partners obtain appraised values and agree to accept the book values for Derr's assets and liabilities except for the following Equipment is valued at $5,600, and land is worth $8,600. Required Prepare the partnership's journal entry to record Derr's investment View transaction list

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts