Question: apter 2 Ho Chapter 2 Homework Saved Help Save &Exit Submit 12 RKE & Associates is considering the purchase of a building it currently leases

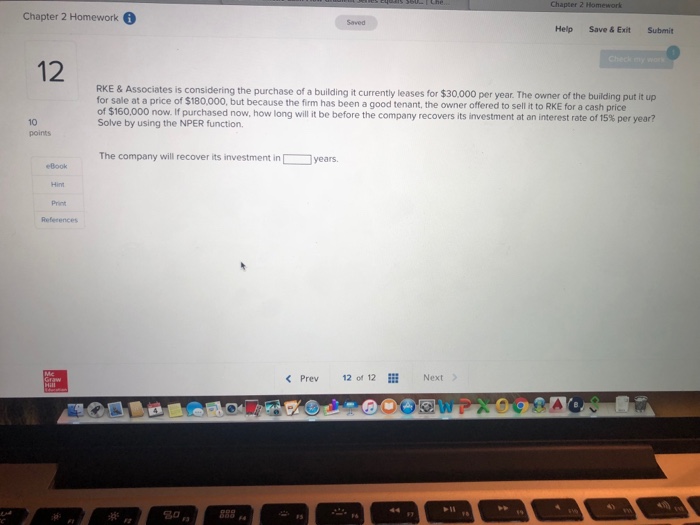

apter 2 Ho Chapter 2 Homework Saved Help Save &Exit Submit 12 RKE & Associates is considering the purchase of a building it currently leases for $30,000 per year. The owner of the building put it up for sale at a price of $180,000, but because the firm has been a good tenant, of $160,000 the owner offered to sell it to RKE for a cash price now. If purchased now, how long will it be before the company recovers its investment at an interest rate of 15% per year? 10 points Solve by using the NPER function. The company will recover its investment inyears Print Refecences Prev 12 of 12Next 10 888 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts