Question

Aquanor ASA is financed by equity and debt. The outstanding debt has a book value of $75,000,000. The debt is trading at 90% of

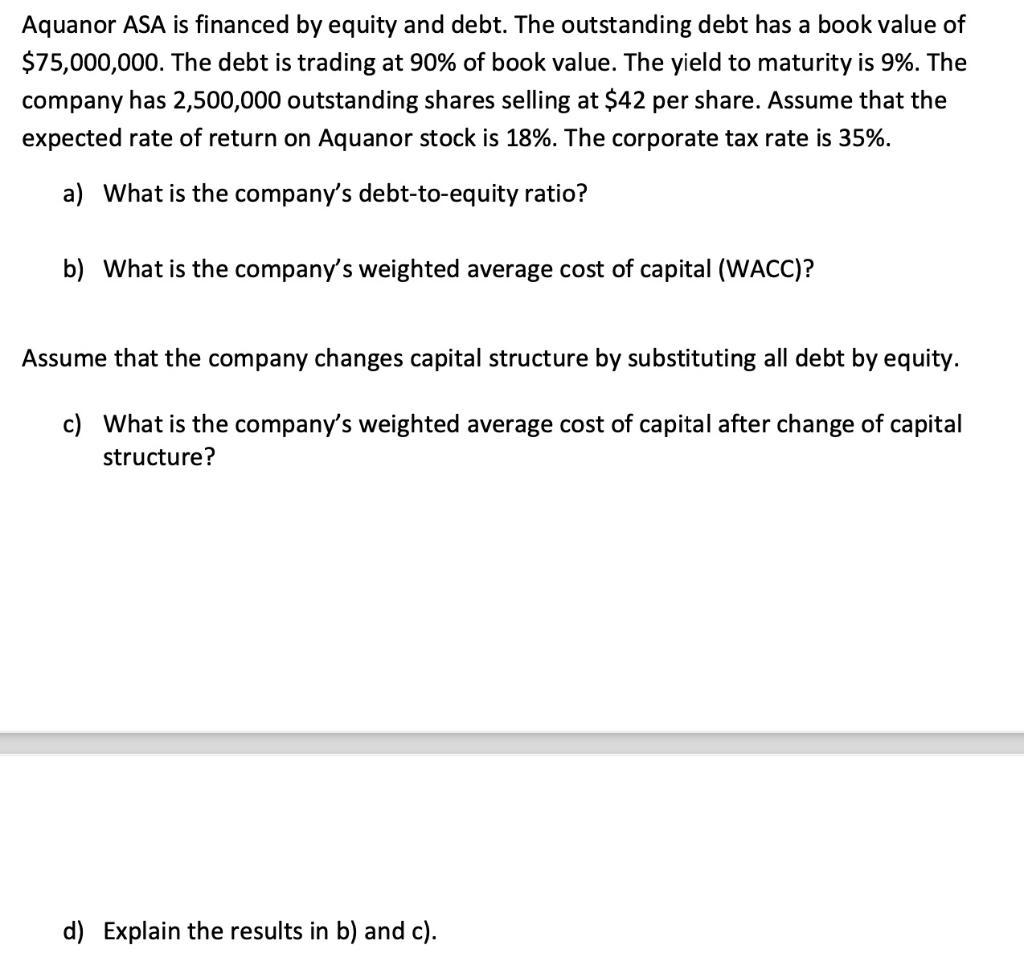

Aquanor ASA is financed by equity and debt. The outstanding debt has a book value of $75,000,000. The debt is trading at 90% of book value. The yield to maturity is 9%. The company has 2,500,000 outstanding shares selling at $42 per share. Assume that the expected rate of return on Aquanor stock is 18%. The corporate tax rate is 35%. a) What is the company's debt-to-equity ratio? b) What is the company's weighted average cost of capital (WACC)? Assume that the company changes capital structure by substituting all debt by equity. c) What is the company's weighted average cost of capital after change of capital structure? d) Explain the results in b) and c).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the companys debttoequity ratio we first need to determine the market value of the de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Finance

Authors: Julie Dahlquist, Rainford Knight

1st Edition

979-8439388899

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App