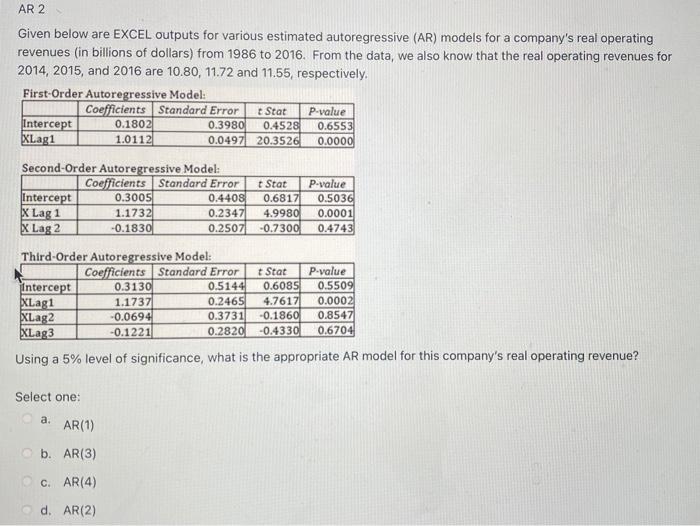

Question: AR 2 Given below are EXCEL out for various estimated regress Rodels fora.com revenues in billions of dollars from 1966 to 2016. From the data

AR 2 Given below are EXCEL out for various estimated regress Rodels fora.com revenues in billions of dollars from 1966 to 2016. From the data wew that the rest 2014 2015 and 2016 are 1080, 1172 and 1155, respect ForOrder Malai 0045205 1011 0.100 Second order Autor Model Intercept 100 0440 ORTE 016 1.17 02 CODE ta OLEM OOO 2014 Third Grder streg Model Com 03130 50 11233 0246 0.000 KATE -0.066 TRO 0.854 Land 0200401 D. Using a 5 level of significance, what is the core AR model for this company great Select one AREN ARDI AR (4) ARI21 AR 2 Given below are EXCEL outputs for various estimated autoregressive (AR) models for a company's real operating revenues (in billions of dollars) from 1986 to 2016. From the data, we also know that the real operating revenues for 2014, 2015, and 2016 are 10.80, 11.72 and 11.55, respectively. First Order Autoregressive Model: Coefficients Standard Error Stat P-value Intercept 0.1802 0.3980 0.4528 0.6553 XLag1 1.01121 0.0497 20.3526 0.0000 Second-Order Autoregressive Model: Coefficients Standard Error Intercept 0.3005 0.4408 X Lag 1 1.1732 0.2347 X Lag 2 -0.1830 0.2507 Stat P-value 0.6817 0.5036 4.9980 0.0001 -0.7300 0.4743 Third-Order Autoregressive Model: Coefficients Standard Error Intercept 0.3130 0.5144 XLagi 1.1737 0.2465 XLag2 -0.0694 0.3731 XLag3 -0.1221 0.2820 t Stat 0.6085 4.7617 -0.1860 -0.4330 P-value 0.5509 0.0002 0.8547 0.6704 Using a 5% level of significance, what is the appropriate AR model for this company's real operating revenue? Select one: a. AR(1) b. AR(3) CAR(4) d. AR(2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts