Question: Are the beta estimates consistent with your expectation of cyclical stocks or defensive stocks? Is the firm-specific risk in your 5-security portfolio lower than that

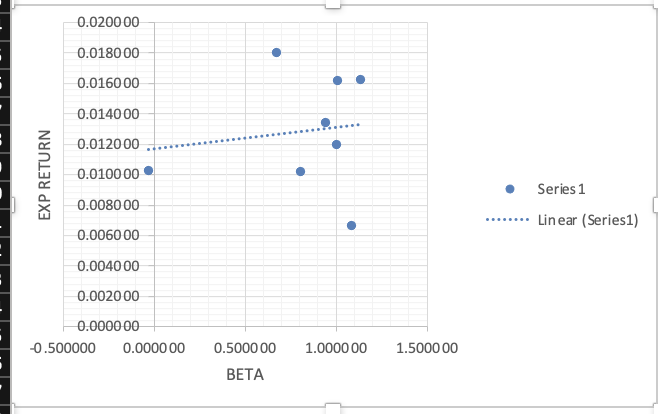

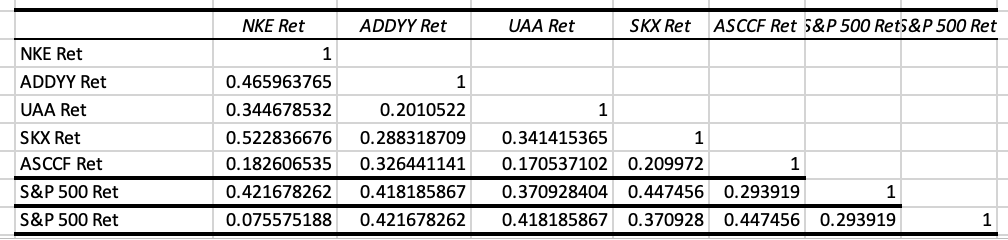

Are the beta estimates consistent with your expectation of cyclical stocks or defensive stocks? Is the firm-specific risk in your 5-security portfolio lower than that of an individual stock? What does that imply? From the graph of the security market line, please discuss which stocks are overvalued or undervalued.

0.0200 00 0.018000 0.0160 00 0.014000 0.0120 00 0.0100 00 0.0080 00 0.0060 00 0.004000 0.0020 00 0.000000 -0.500000 0.0000 00 EXP RETURN 0.5000 00 BETA 1.0000 00 1.5000 00 Series 1 Linear (Series1) NKE Ret ADDYY Ret UAA Ret SKX Ret ASCCF Ret S&P 500 Ret S&P 500 Ret NKE Ret UAA Ret SKX Ret ASCCF Ret S&P 500 Rets&P 500 Ret 1 0.465963765 1 0.344678532 0.2010522 1 0.522836676 0.288318709 0.341415365 1 1 0.182606535 0.326441141 0.170537102 0.209972 0.421678262 0.418185867 0.370928404 0.447456 0.293919 0.075575188 0.421678262 0.418185867 0.370928 0.447456 0.293919 1 1 ADDYY Ret 0.0200 00 0.018000 0.0160 00 0.014000 0.0120 00 0.0100 00 0.0080 00 0.0060 00 0.004000 0.0020 00 0.000000 -0.500000 0.0000 00 EXP RETURN 0.5000 00 BETA 1.0000 00 1.5000 00 Series 1 Linear (Series1) NKE Ret ADDYY Ret UAA Ret SKX Ret ASCCF Ret S&P 500 Ret S&P 500 Ret NKE Ret UAA Ret SKX Ret ASCCF Ret S&P 500 Rets&P 500 Ret 1 0.465963765 1 0.344678532 0.2010522 1 0.522836676 0.288318709 0.341415365 1 1 0.182606535 0.326441141 0.170537102 0.209972 0.421678262 0.418185867 0.370928404 0.447456 0.293919 0.075575188 0.421678262 0.418185867 0.370928 0.447456 0.293919 1 1 ADDYY Ret

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts