Question: Are the following statements true or false? Please briefly explain your answer. A correct answer without an explanation is worth 0 points. A correct answer

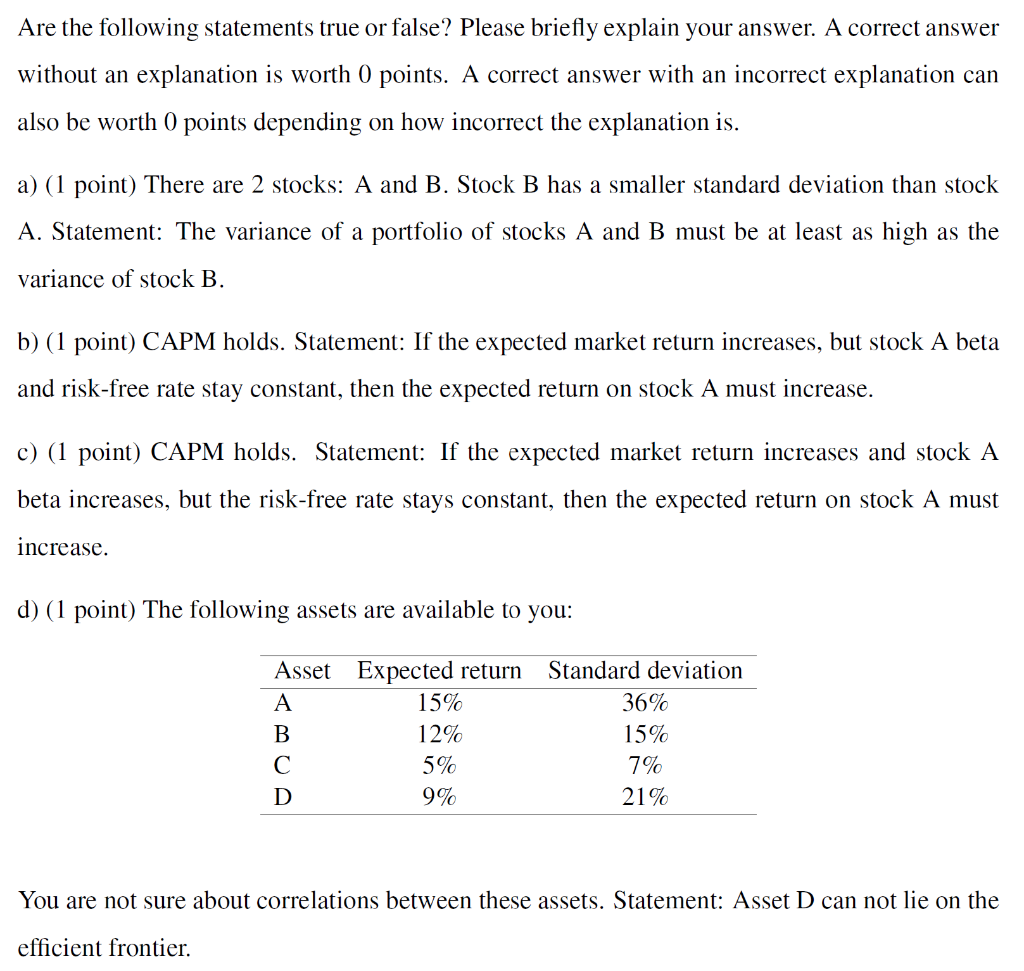

Are the following statements true or false? Please briefly explain your answer. A correct answer without an explanation is worth 0 points. A correct answer with an incorrect explanation can also be worth ( points depending on how incorrect the explanation is. a) (1 point) There are 2 stocks: A and B. Stock B has a smaller standard deviation than stock A. Statement: The variance of a portfolio of stocks A and B must be at least as high as the variance of stock B. b) (1 point) CAPM holds. Statement: If the expected market return increases, but stock A beta and risk-free rate stay constant, then the expected return on stock A must increase. c) (1 point) CAPM holds. Statement: If the expected market return increases and stock A beta increases, but the risk-free rate stays constant, then the expected return on stock A must increase. d) (1 point) The following assets are available to you: Asset Expected return A 15% B 12% 5% D 9% Standard deviation 36% 15% 7% 21% You are not sure about correlations between these assets. Statement: Asset D can not lie on the efficient frontier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts