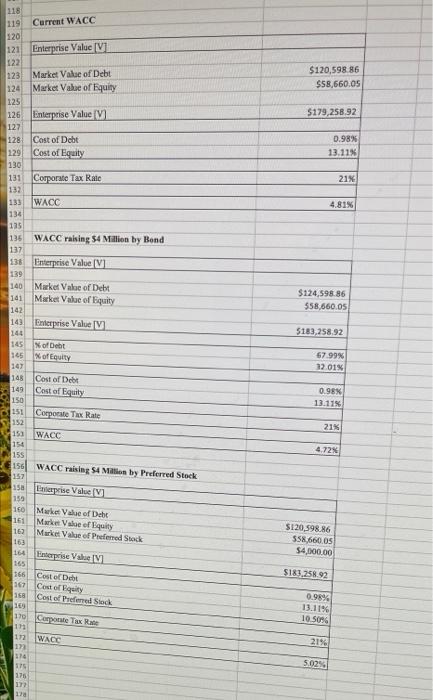

Question: are the three calculations correct? 4.81%, 4.72% & 5.02% ? $120,598.86 $58,660.05 $179,258.92 0.98% 13.11% 129 21% 4.81% 118 119 Current WACC 120 121 Enterprise

$120,598.86 $58,660.05 $179,258.92 0.98% 13.11% 129 21% 4.81% 118 119 Current WACC 120 121 Enterprise Value TV1 122 2.23 Market Value of Debt 124Market Value of Equity 125 126 Enterprise Value 127 128 Cost of Debt Cost of Equity 130 131 Corporate Tax Rate 132 133 WACC 134 125 135 WACC raising S4 Million by Bond 137 Enterprise Value [V 139 140 Market Value of Debt 141 Market Value of Equity 142 143 Deterprise Value 144 145 N of Debt 145 X of Equity 147 148 Cost of Debt 149 150 151 Corporate Tax Rate 152 153 WACC $124,598.86 558,660.05 5183,258.92 67.99% 12.01% Cost of Equity 0.98% 13.11% 21% 15 4.72% 155 156 WACC raising S4 Million by Preferred Stock 157 $120.598.86 558,660.05 $4.500.00 $183,258.92 15 Enterprise Value 159 160 Mare Value of Debt 151 Market Value of Equity 162 Macket Vake of Peemed Stock 163 164 Enterprise Value 165 166 Cost of Debt 107 Cost of Equity 18 Costel Pened Stock 109 110 Capacate Tax Rate 1 172 WACC 12 116 175 275 177 120 0.98% 13.11% 10.50 2196 5029 $120,598.86 $58,660.05 $179,258.92 0.98% 13.11% 129 21% 4.81% 118 119 Current WACC 120 121 Enterprise Value TV1 122 2.23 Market Value of Debt 124Market Value of Equity 125 126 Enterprise Value 127 128 Cost of Debt Cost of Equity 130 131 Corporate Tax Rate 132 133 WACC 134 125 135 WACC raising S4 Million by Bond 137 Enterprise Value [V 139 140 Market Value of Debt 141 Market Value of Equity 142 143 Deterprise Value 144 145 N of Debt 145 X of Equity 147 148 Cost of Debt 149 150 151 Corporate Tax Rate 152 153 WACC $124,598.86 558,660.05 5183,258.92 67.99% 12.01% Cost of Equity 0.98% 13.11% 21% 15 4.72% 155 156 WACC raising S4 Million by Preferred Stock 157 $120.598.86 558,660.05 $4.500.00 $183,258.92 15 Enterprise Value 159 160 Mare Value of Debt 151 Market Value of Equity 162 Macket Vake of Peemed Stock 163 164 Enterprise Value 165 166 Cost of Debt 107 Cost of Equity 18 Costel Pened Stock 109 110 Capacate Tax Rate 1 172 WACC 12 116 175 275 177 120 0.98% 13.11% 10.50 2196 5029

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts