Question: Are these correct? If not can you help me solve them? Required information Problem 15-40 Target Costing (LO 15-3, 15-5, 15-6, 15-8) [The following information

Are these correct? If not can you help me solve them?

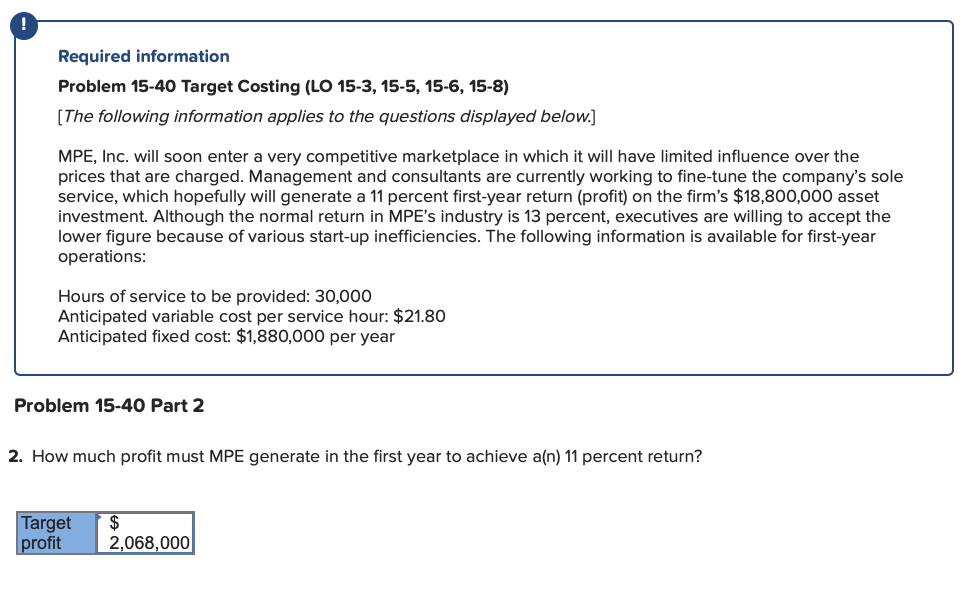

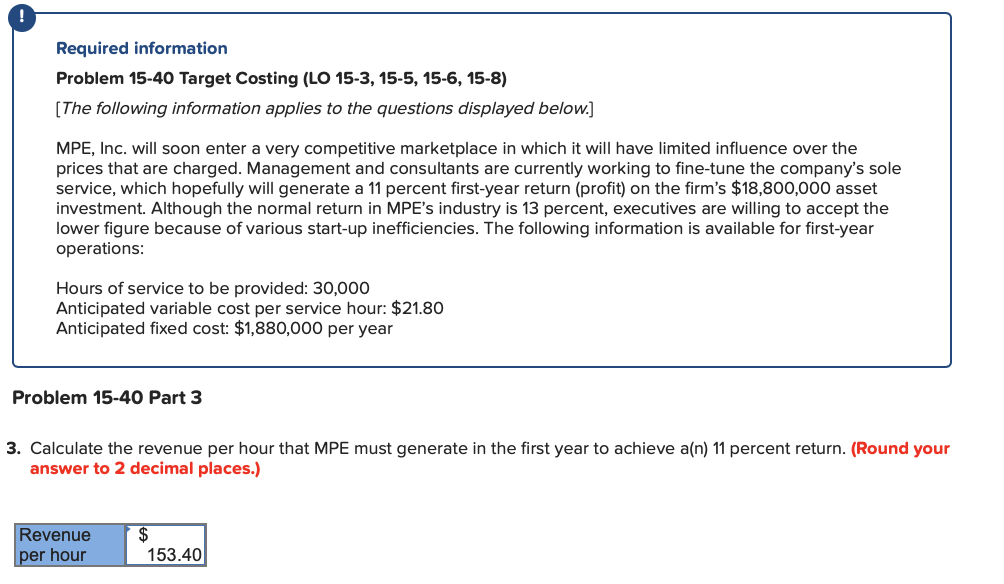

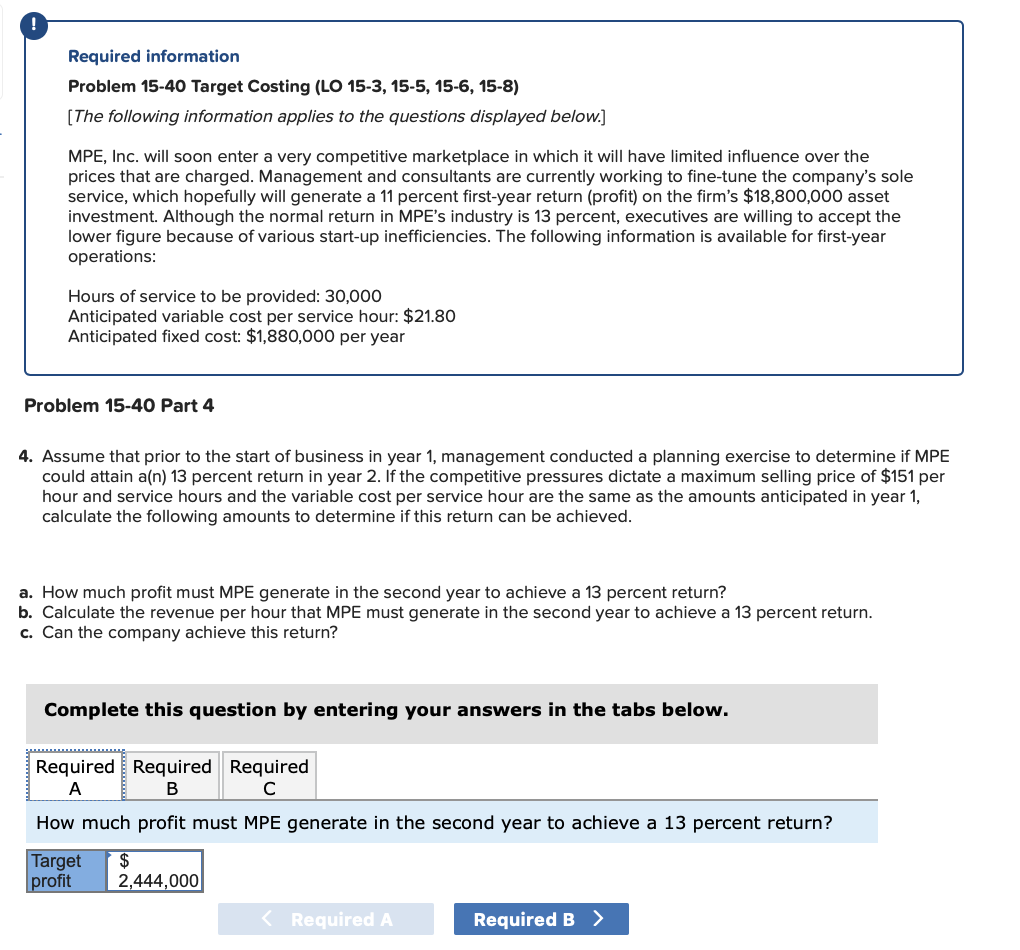

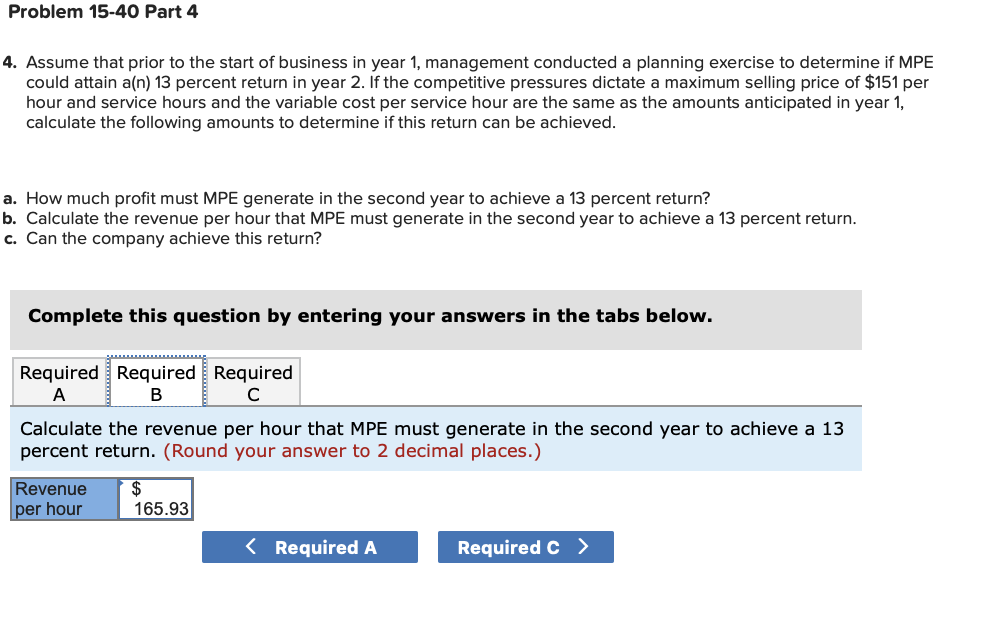

Required information Problem 15-40 Target Costing (LO 15-3, 15-5, 15-6, 15-8) [The following information applies to the questions displayed below.) MPE, Inc. will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company's sole service, which hopefully will generate a 11 percent first-year return (profit) on the firm's $18,800,000 asset investment. Although the normal return in MPE's industry is 13 percent, executives are willing to accept the lower figure because of various start-up inefficiencies. The following information is available for first-year operations: Hours of service to be provided: 30,000 Anticipated variable cost per service hour: $21.80 Anticipated fixed cost: $1,880,000 per year Problem 15-40 Part 2 2. How much profit must MPE generate in the first year to achieve a(n) 11 percent return? Target profit $ 2,068,000 Required information Problem 15-40 Target Costing (LO 15-3, 15-5, 15-6, 15-8) [The following information applies to the questions displayed below.] MPE, Inc. will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company's sole service, which hopefully will generate a 11 percent first-year return (profit) on the firm's $18,800,000 asset investment. Although the normal return in MPE's industry is 13 percent, executives are willing to accept the lower figure because of various start-up inefficiencies. The following information is available for first-year operations: Hours of service to be provided: 30,000 Anticipated variable cost per service hour: $21.80 Anticipated fixed cost: $1,880,000 per year Problem 15-40 Part 3 3. Calculate the revenue per hour that MPE must generate in the first year to achieve a(n) 11 percent return. (Round your answer to 2 decimal places.) Revenue per hour $ 153.40 Required information Problem 15-40 Target Costing (LO 15-3, 15-5, 15-6, 15-8) [The following information applies to the questions displayed below.] MPE, Inc. will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company's sole service, which hopefully will generate a 11 percent first-year return (profit) on the firm's $18,800,000 asset investment. Although the normal return in MPE's industry is 13 percent, executives are willing to accept the lower figure because of various start-up inefficiencies. The following information is available for first-year operations: Hours of service to be provided: 30,000 Anticipated variable cost per service hour: $21.80 Anticipated fixed cost: $1,880,000 per year Problem 15-40 Part 4 4. Assume that prior to the start of business in year 1, management conducted a planning exercise to determine if MPE could attain a(n) 13 percent return in year 2. If the competitive pressures dictate a maximum selling price of $151 per hour and service hours and the variable cost per service hour are the same as the amounts anticipated in year 1, calculate the following amounts to determine if this return can be achieved. a. How much profit must MPE generate in the second year to achieve a 13 percent return? b. Calculate the revenue per hour that MPE must generate in the second year to achieve a 13 percent return. c. Can the company achieve this return? Complete this question by entering your answers in the tabs below. Required Required Required How much profit must MPE generate in the second year to achieve a 13 percent return? Target profit $ 2,444,000 - Required A Required B. Problem 15-40 Part 4 4. Assume that prior to the start of business in year 1, management conducted a planning exercise to determine if MPE could attain a(n) 13 percent return in year 2. If the competitive pressures dictate a maximum selling price of $151 per hour and service hours and the variable cost per service hour are the same as the amounts anticipated in year 1, calculate the following amounts to determine if this return can be achieved. a. How much profit must MPE generate in the second year to achieve a 13 percent return? b. Calculate the revenue per hour that MPE must generate in the second year to achieve a 13 percent return. c. Can the company achieve this return? Complete this question by entering your answers in the tabs below. Required Required Required A B C Calculate the revenue per hour that MPE must generate in the second year to achieve a 13 percent return. (Round your answer to 2 decimal places.) Revenue per hour 165.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts