Question: are these correct? need help with both part a and part b Metlock Construction Company has entered into a contract beginning January 1, 2020, to

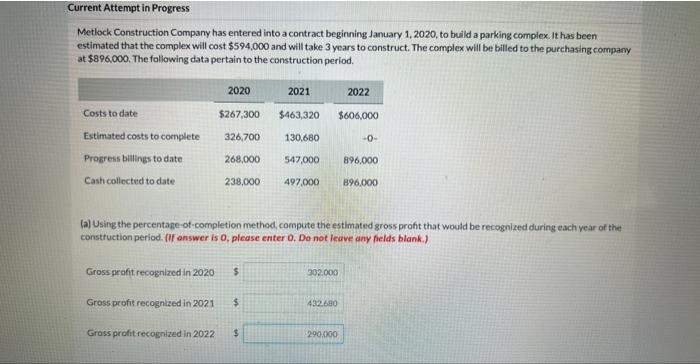

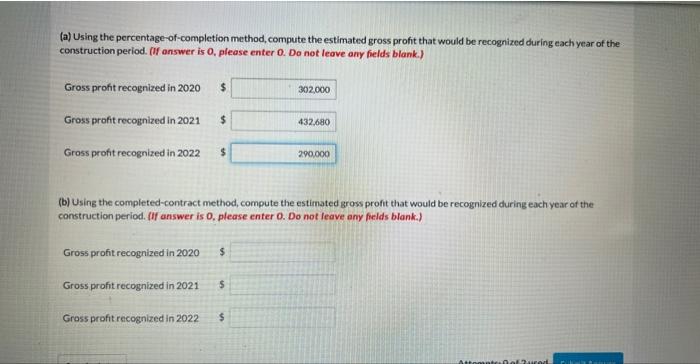

Metlock Construction Company has entered into a contract beginning January 1, 2020, to build a parking complex. it has been estimated that the complex will cost $594,000 and will take 3 years to construct. The complex will be billed to the purchasing company at $896,000. The foliowing data pertain to the construction period. (a) Using the percentage-of-completion method, compute the estimated gross proft that would be recognized during each year of the construction period. (If answer is 0 , please enter 0 . Do not leave any felds blank.) (a) Using the percentage-of-completion method, compute the estimated gross profit that would be recognized during each year of the construction period. (If answer is 0 , please enter 0 . Do not leave any fields blank.) Gross profit recognized in 2020 Gross proft recognized in 2021$ Gross profit recognized in 2022 (b) Using the completed-contract method, compute the estimated gross profit that would be recognized during each year of the construction period. (If answer is 0 , please enter 0 . Do not leave any fields blank.) Gross profit recognized in 2020$ Gross profit recognized in 2021 Gross profit recognized in 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts