Question: Read the Walt Disney Company 2020 case and analyze the case. You need to 1) Identify the problem Definition 2) Use business tools appropriate to

Read the Walt Disney Company 2020 case and analyze the case. You need to 1) Identify the problem Definition 2) Use business tools appropriate to the case ( use only those parts that are relevant to the case) Provide your own interpretation of the results of analysis from each tool. Can be SWOT PESTEL PORTERS 5 FORCES. PORTERS DIAMOND VRIO

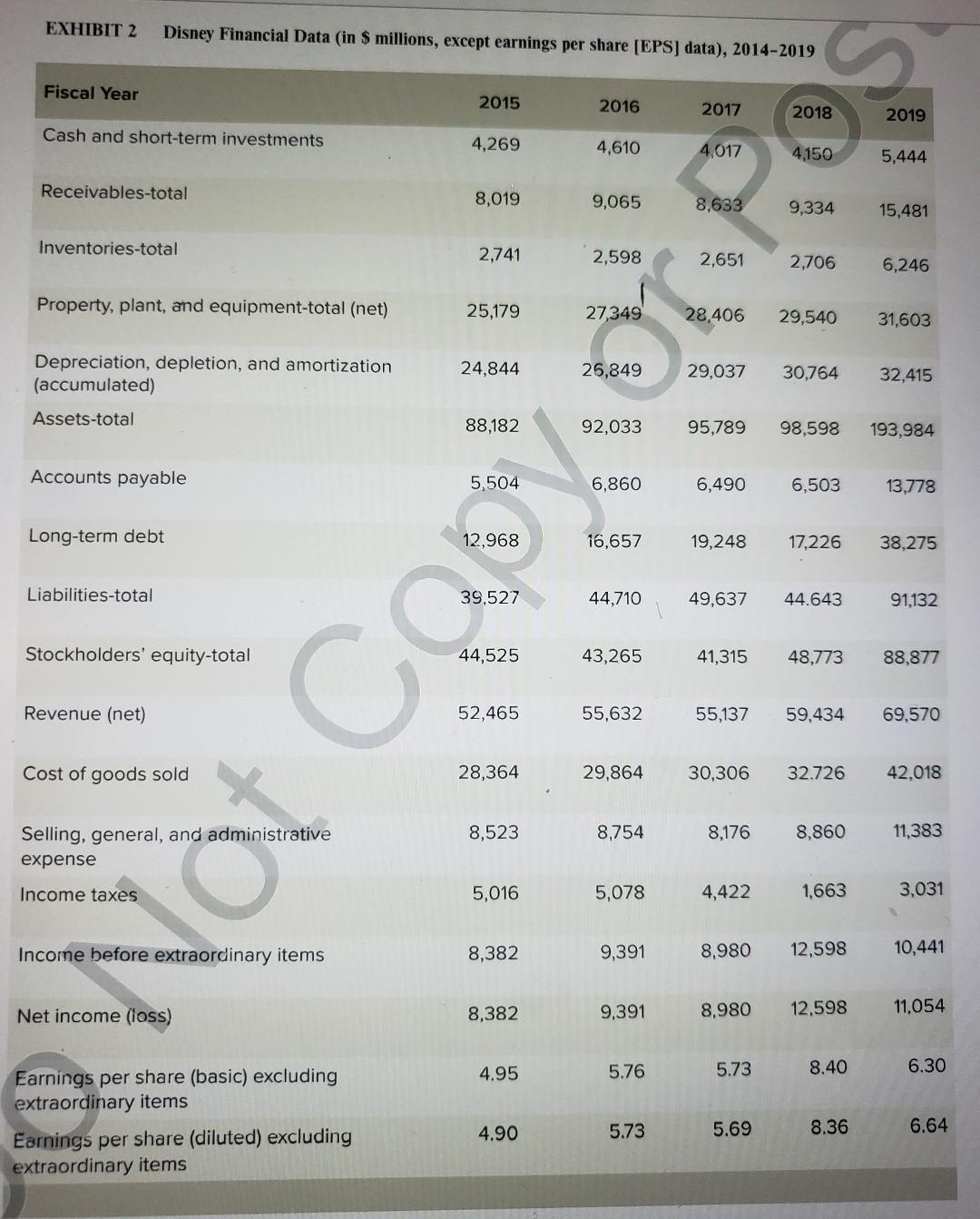

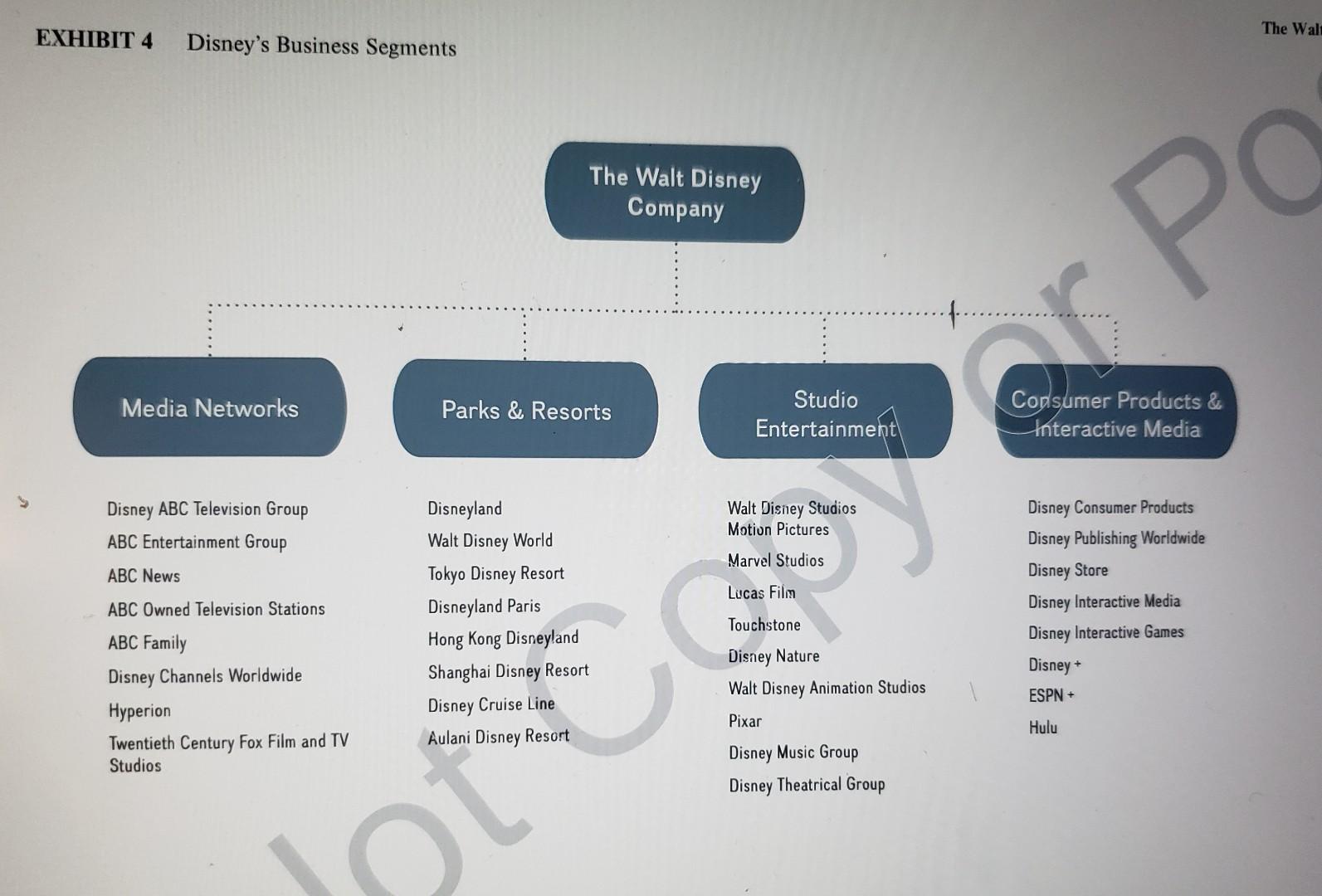

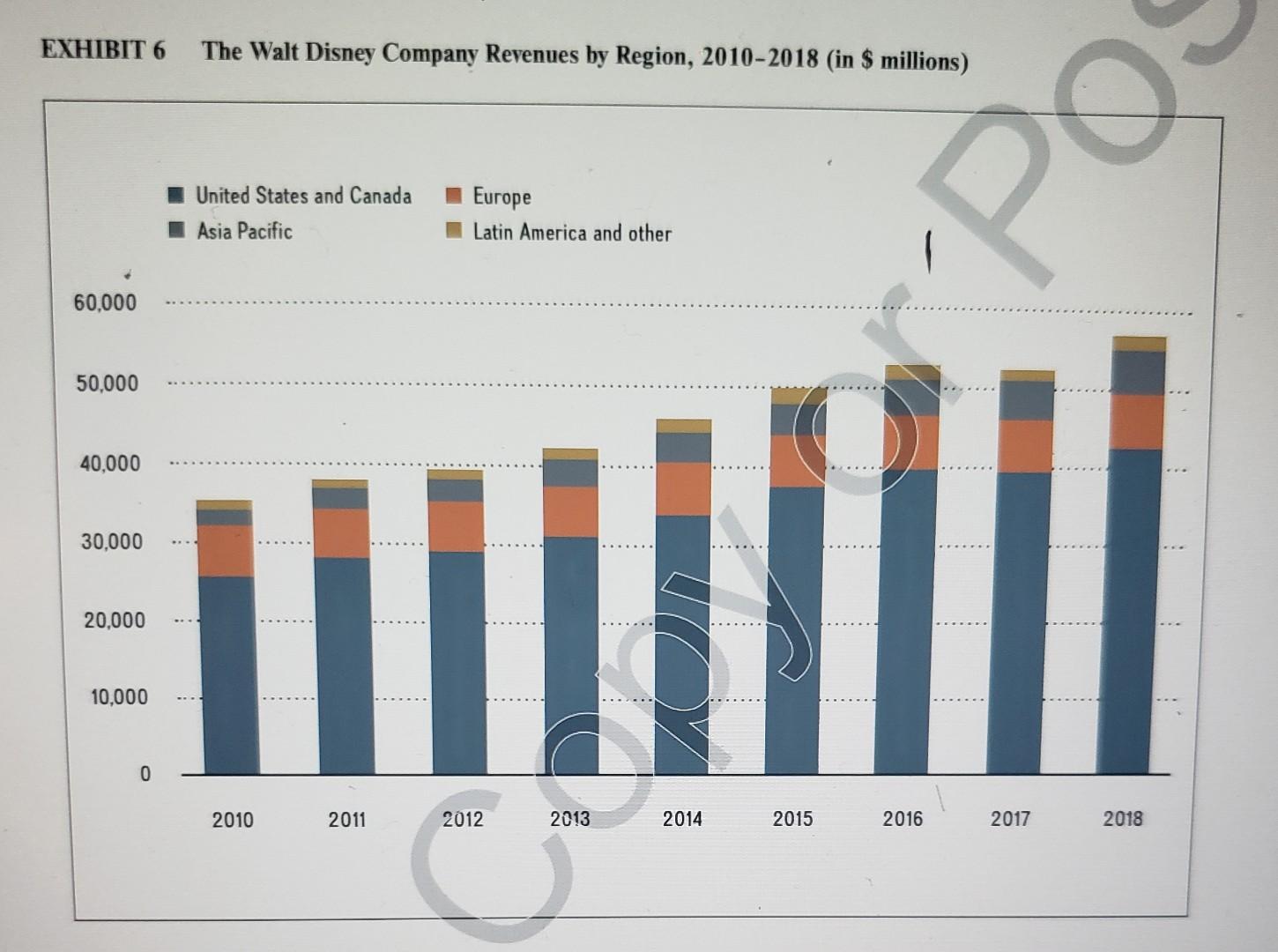

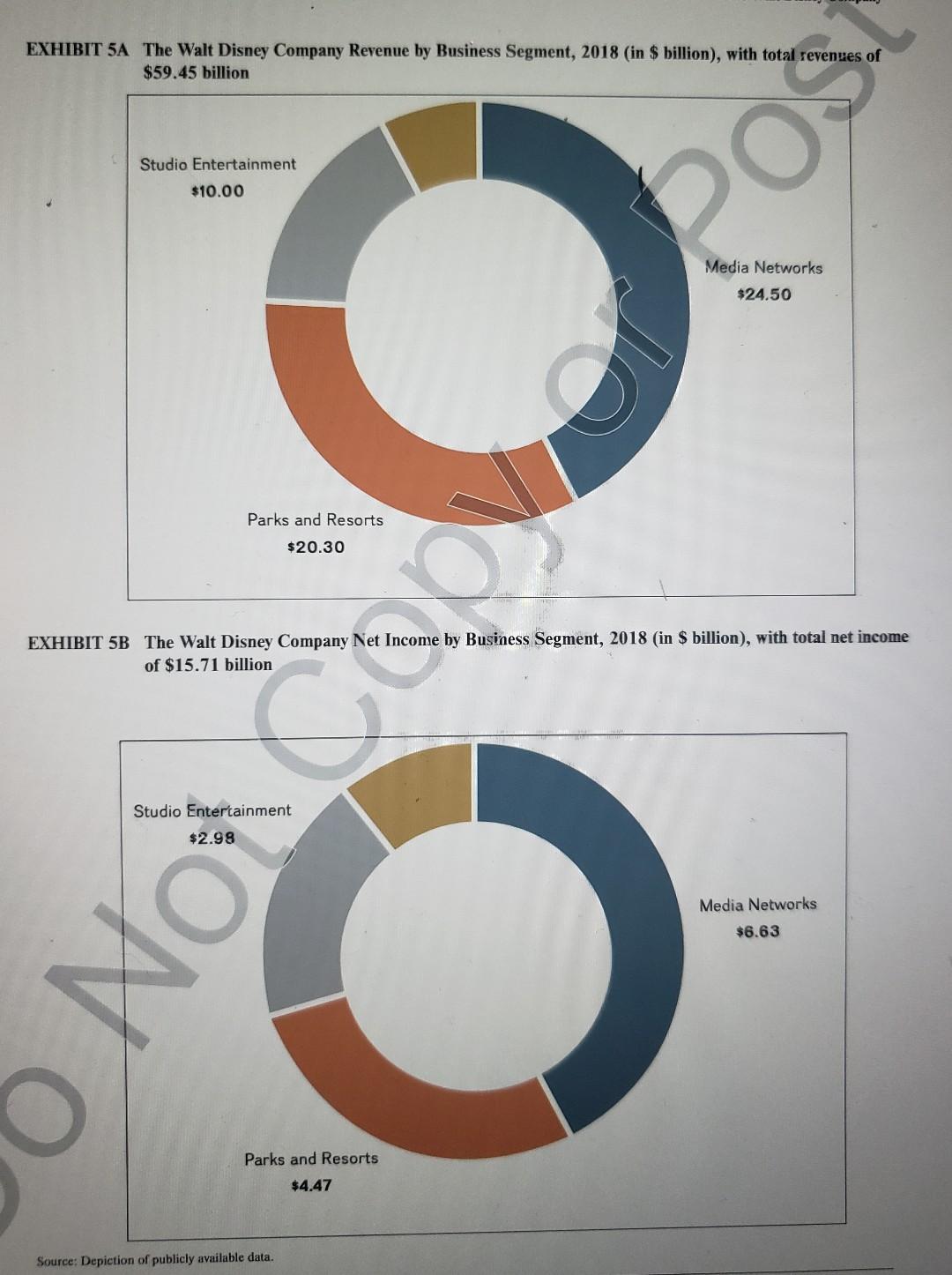

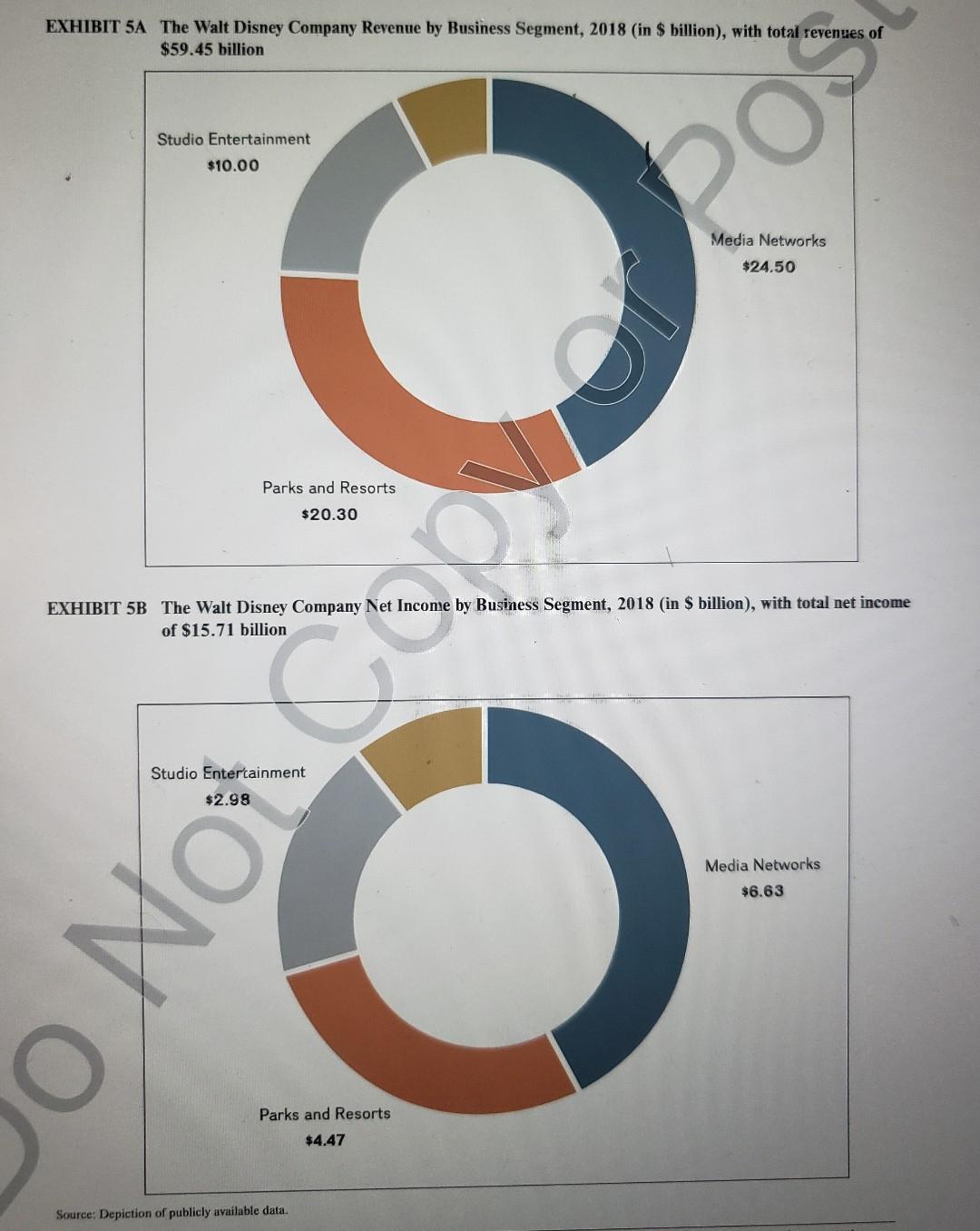

The Walt Disney Company It's kind of fun to do the impossible. - Walt Disney February 25, 2020, 4:15 am. Bob Chapek's alarm goes off and 10 minutes later he is riding on his Peloton bicycle, while watching a new 3D computer-animated video with virtual reality headsets. After a quick shower, Bob Chapek summons his white Tesla Model X with dark tinted windows from the garage to let the car drive him on his 30 -minute commute to Disney's Burbank, CA, office. While relaxing during the car ride, his thoughts turn to the big announcement later this afternoon, with him being named Disney's new CEO, effective immediately. Employees, investors, and all of the other Disey stakeholders will have a lot of questions about his future vision for Disney... With $60 billion in annual revenues in 2019 , The Walt Disney Company is one of the world's largest media companies. As a diversified media company, Disney is active in a wide array of business activities, from movies to amusement parks as well as cable and broadcast television networks (ABC, ESPN, and others), cruises, retailing, and streaming. 1 The New CEO will need to implement multiple strategic initiatives that were put in place by Bob Iger, his larger-than-life predecessor at Disney, who spent almost 50 years with the company, and thereof 15 years as CEO. Disney closed its $71.3 billion acquisition of 21 st Century Fox's entertainment assets, or its largest acquisition ever, in March 2019.2 As part of the Fox and other deals, Disney gained controlling ownership of Hulu, a streaming service. 3 Disney is also rolling out its own new streaming service called Disney+ in November 2019, thus moving into the direct-to-consumer space. In September 2019, Apple announced is new streaming services, Apple TV+. On the day of the Apple announcement, Iger resigned from Apple's board of directors due to a conflict of interests. 4 Iger also announced that Disney will pull most of its movies from Netflix by 2020.5 Another challenge is managing the growing portfolio in Disney's Studio Entertainment division, as it operates more than seven movie studios, including Walt Disney Pictures, Walt Disney Animation, Pixar, Marvel, Lucasfilm, 21 st Century Fox, Fox, and Blue Sky. As a result, Disney has outlined plans for roughly a dozen movies each year through 202266 During Iger's tenure as CEO, Disney has performed well in terms of stock price appreciation and financials (Exhibit 1 and Exhibit 2). Yet, Iger has delayed his retirement from Disney five times. Each time he has leveraged delaying retirement into higher pay, which in 2018 was $65 million; 7 making Iger one of the highest paid CEOs in corporate America. What surprised many, including Disney employees is that Iger's announcement to indeed step down as CEO happened with no prior notice, and was made effective immediately. The new CEO, Bob Chapek, has big shoes to fill. Strategic Leadership The phenomenal success of Disney is partly attributed to the leadership of three distinguished individuals: Walt Disney, Michael Eisner, and Robert Iger. The saga of 411 three leaders is akin to Disney's epic movies featuring unsurmountable challenges, adventure, and fleeting victories. Each leader is recognized for providing a strong vision and strategic direction that enabled the company to adapt to unprecedented changes in the media and entertainment indusiry and grow into the colossus company it is today. WaLT DISNEY Walt Disney, the entrepreneur, animator, and film producer, is viewed by many as the "icon of American ingenuity"8 who had the corporate vision, values, and perseverance that led to the company's success as a media and entertainment provider. In 1923 , Walt moved to Los Angeles to work as a film director and was unable to find a job. Thus, he joined forces with his brother Roy, and they founded Disney Brothers Cartoon Studios. The new entrant produced Alice in Wonderland and a series of Alice comedies that lost popularity by 1927 . Walt worked with his old friend Ubbe Iwerks to create a new character Mortimer Mouse, later renained Mickey Mouse, which revolutionized the cartoon industry. In 1928, Mickey made his screen debut in Steamboat Willie. 9 In 1937, another major turning point for the Disney Company came with the release of the world's first full-length animated cartoon in Technicolor called Snow White and the Seven Dwarfs. This film made $8 million ( $150 million in today's inflation-adjusted dollars), and it won eight Oscars. Over the course of Walt's life, the company continued to produce successful full-length animated films such as: Pinocchio (1940), Fantasia (1940), Dumbo (1941), Bambi (1942), Cinderella (1950), Alice in Wonderland (1951), Peter Pan (1953), Sleeping Beauty (1959), 101 Dalmatians (1961), and Mary Poppins (1964). As the head of the company, Walt was an influential leader with a strong work ethic and lofty values. He ran the company as a flat, nonhierarchical meritocracy. He held employees to high professional standards emphasizing creativity, quality, teamwork, communication, and cooperation. Even when facing financial pressure, Walt refused to compromise on quality and worked to constantly reinvent his company. 10 One such reinvention was his idea of building an entertainment theme park, a testament to his commitment to having fun, and what appeared to his investors and his brother Roy as a cockamamie "project that would not bring in revenue." 11 Walt forged ahead and purchased 160 acres of land in Anaheim, California and $17 million dollars later, opened Disneyland on Sunday July 17 , 1955. Walt designed and built Disneyland under WED enterprises independent from Disney Productions, to allow his "imagineer" employees to design the park free from the demands of a publicly traded company. Disneyland was built according to Walt's exacting standards with technically advanced attractions for the entire family. Disneyland was well received by the public and quickly became an American landmark. More importantly, Disneyland's success resulted in financial stability for the company., 12 By 1957 , the company was diversified and "Walt Disney himself produced the strategic vision that enables Disney to sustain its competitive advantage and growth up to this day."13 His vision is embodied in Exhibit 3 demonstrating how each of the different businesses were leveraged to create synergies. The map shows how Disney's different business lines, TV, music, studio, merchandise licensing, publications, comic strips, magazines, art corner shops, and Disneyland create synergies by leveraging intellectual property (IP) across complementary business segments. The map provided "a conceptual filter that can be repeatedly used to select, and assemble cornplementary bundles of assets, activities and resources to navigate the surrounding terrain oyer an extended period."14 The image appears to be a prelude to the model of building successful framchises for which the company attributes its success and long-term viability. In 1965, Walt purchased over 27,000 acres of land in Orlando, Florida to create another Disney park that would be "an experimental prototype community of tomorrow, or EPCOT, planned as a living showcase for the creativity of American industry." 15 However, in 1966, Walt Disney died of lung cancer and was succeed by his brother Roy as the CEO of the company. Roy realized his brother's dream, and opened Disney World in Orlando in 1971. Disney World became the top selling park in the world, with 11 million visitors and revenues of $139 million in its first year of operation ( $900 million in today's inflation-adjusted dollars). Michael Eisner In 1984, Michael Eisner was appointed CEO of Disney. He continued Walt Disney's emphasis on creativity, branding, and synergies achieved strong results for the company during his 20 -yeat tenure as CEO (1984-2005). The media conglomerate's revenues increased from less than $2 billion to more than $25 billion, 16 and its market value from $1.8 billion to a high of $80 billion. 17 Eisner started his career in 1964 working for NBC as a Federal Communications Commission logging clerk, and then worked for CBS where he placed commercials during shows. Eisner moved to ABC in 1966 and fast-tracked to an executive position developing prime-time shows, moving ABC from third-place ratings to the fjrst-place position. In 1976, a struggling Paramount Pictures hired Eisner as president and CEO. Again, Eisner took the film studio from last place to the top and developed "a reputation as a creative genius, an idea man." 18 Eisner believed creativity was the result of creative conflict out of which the best ideas would emerge. He also focused on strengthening the Disney brand through synergies across business units. In 1987 , he established a centralized corporate marketng function to oversee corporate-wide marketing and branding activities. Eisner started by revitalizing Disney's television programming and animated films. In TV, Disney produced popular new shows and movies for the Disney channel, ABC, NBC, and created syndication operations to sell Disney programming to independent TV stations, 19 In the film studio business, Eisner raised Disney's share at the box office from 4 percent in 1984 to 19 percent by 1988 , with the release of many profitable movies, making Disney the Hollywood market leader. 20 He also invested $30 million in computer-animated production systems (CAPS) technology that digitized the animation process reducing the time for producing animated films. Soon thereafter, Disney released successful movies such as Roger Rabbit (1988), The Little Mermaid (1989), Beauty and the Beast (1991), and Aladdin (1992). In the 1990s, however, Disney's animation studio also released a number of movies that flopped at the box office, including Hercules, Lilo \& Stitch, and Brother Bear. Disney's biggest successes during this time came from its alliance with Pixar, a computer-animation movie studio, producing mov- ies such as Toy Story and The Incredibles. Yet, Steve Jobs disdained Michael Eisner, and Jobs ended the Pixar-Disney alliance in 2004. In parks and resorts, Eisner expanded and improved Disney theme parks to increase profitability, growth, and synergies with other business lines. He opened new attractions such as Captain EO (1986) and Disney MGM Film Studio (1989). In 1992, Disney also opened a new theme park outside of Paris, France-Euro Disney. Disney had 49 percent ownership stake and received 10 percent from ticket sales and 5 percent from merchandise sales. In 1999, Disney formed a partnership with Hong Kong's government to build a theme park that was opened in 2005 . Disney held a 43 percent ownership stake and the Hong Kong government held the remaining 57 percent, which could later be increased to 73 percent by converting subordinate shares. 21 In consumer products, Eisner's strategy of "retail as entertainment" doubled the average rateof retail sales per square foot in 1992. A myriad of businesses comprised this area such as Disney stores, Disney Press and Hyperion Books, Hollywood Records, and catalog marketing. Disney also entered the home-video industry by establishing Buena Vista Home Video where Aladdin, in 1993 , became the best-selling video of all time with over 30 miilion copies sold. 22 In 1995, Disney spent $19 billion to acquire CapCities ABC, making it the second biggest acquisition in U.S. history. ABC included TV networks and stations, radio networks and stations, cable including sports channel ESPN, in addition to newspapers and other periodicals. The deal made Disney the biggest media entertainment company in the United States and provided world-wide distribution outlets. 23 However, by the late 1990s, Disney financials deteriorated, and this was partly attributed to Eisner's heavy-handed management style, and strategic imperatives of creativity, branding, and synergy. The increasingly combative culture led to politicking and high turnover of executives. The intense focus on branding also caused displeasure among Disney fans who felt that branding is what you do when you lack original, high-quality content. 24 In this vein, Eisner's push for synergies through cross-selling appeared excessive, robbing Disney of its magic. 25 By 2005, a confluence of events led to Eisner's departure. First, a shareholder revolt to remove Eisner was led by Roy Disney, the same person who initially requested Eisner to join the company. Second, Pixar had ended its relationship with Eisner in a public manner that was not flattering for Disney. Third, Comcast made a surprise $66 billion hostile bid to take over Disney. 26 ROBERT IGER Robert Iger was appointed The Walt Disney Company's CEO in 2005, after previously having served as Chief Operating Officer. As CEO, Iger established a new vision and strategic direction for Disney; he articulated three pillars of strategy that he felt were aligned with Walt Disney's original intent, that is invest in: 1) creative content, 2) technology innovation, and 3) international expansion. 27 Taken together, Iger envisioned a Disney that uses advanced technology to produce creative content with global reach. To implement his strategic pillars, Iger proceeded to make some major changes in the company beginning with reconciliation with board members who had led the shareholder revolt against his predecessor, and to end other conflicts. Next, Iger worked to change the perception within Disney of technology as a threat, to viewing it as an opportunity. 28 Iger also decentralized decision making by empowering individual business, while reducing the role of Disney's central strategic planning. 29 Instead of micromanaging, he took a hands-off approach and was effective in delegating. This change in structure restored the eroded trust among upper management and made each business unit accountable to be as ereative as possible while optimizing results. Trust and accountability were cascaded through all levels of management and frontline workers. Iger articulated a corporate strategy to pursue billion-dollar franchises, which generally begin with a big movie hit and are followed up with derivative TV shows, theme park rides, video games, toys, clothing such as T-shirts and PJs, among many other spin-offs. qather than churning out some 30 movies per year as it did prior to Iger, Disney now produces about 10 movies per year, focusing on box office hits. Iger implemented his strategic vision to build billion-dollar franchises by making a number of highprofile acquisitions, including Pixar (2006), Marvel (2009), Lucasfilm (2012), and 21 st Century Fox (2019). In particular, former CEO Robert Iger led a group of about 20 executives whose sole responsibility is to hunt for the next billion-dollar franchise. This group of senior leaders decides top-down which projects are a go and which are not. They also allocate resources to particular projects. Disney even organized its employees in the consumer products group around franchises such as Frozen, Toy Story, Star Wars, and other cash cows. Disney's annual movie lineup is now dominated by such franchises as Stars Wars and Marvel superhero movies and also live-action versions of animated classics such as Aladdin, Cinderella, and Beauty and the Beast. Some of biggest Disney franchises that started with a movie hit include the Pirates of Caribbean (grossing more than $4 billion). Toy Story (over $2 billion), Monsters, Inc. (close to $2 billion), Cars (over $1 billion), and Frozen (over $1.5 billion). In 2018, Disney released the Black Panther superhero movie based on the Marvel Comics character. The movie was a smashing success at the box office, grossing $1.5 billion on a budget of $200 million. The Black Panther sequel is scheduled to be released in the spring of 2022 . The success of the initial movie is the starting point for another billion-dollar franchise. In 2019, Disney's Marvel franchise released Avengers: Endgame, which was a smash hit in the box office. It surpassed $2 billion in sales in record time and is currently the second highest grossing movie of all time. It is the last installment in a series of 22films, which has grossed over $8 billion in the domestic box office and is the highest grossing franchise series in the United States. And the billion-dollar franchises machine keeps churning out more successes: by summer 2019 , Disney had the highest-grossing year in Hollywood history (close to $8 billion on movies alone), thanks to Captain Marvel, Avengers: Endgame, and The Lion King (remake). Coming out in November, Frozen II may help to take the top-line revenue figure above $10 billion-which is staggering sum for big screen movies alone. Taken together, the corporate strategy around building billion-dollar franchises is certainly paying off: Disney has seen a steady growth to its topline, earned some $14 billion in profits (in 2019), up from a mere $3 billion a decade earlier. During Robert Iger's long tenure as CEO, Disney has performed well in terms of stock price appreciation and financials (Exhibits 1 and 2). At the same time, Iger delayed his retirement from Disney five times. Each time he leveraged delaying retirement into higher pay that in 2018 was $65 million; 30 making Iger one of the highest paid CEOs in corporate America. This attracted criticism, including from Abigail Disney 31 because Iger's compensation is over 1,000 times the median salary of Disney employees. 32 ROBERT CHAPEK Despite the fact that Iger's contract runs until December 2021, Robert "Bob" Chapek, Disney's new CEO was put in place on February 25, 2020, with immedate effect. In contrast to Bob Iger, who was charismatic and cosmopolitan and enjoyed the glamor of Hollywood, Bob Chapek is known o be a no-nonsense executive with a strength in execution and implementation. Chapek is viewed as lacking Iger's creative spark and insight, but being much stronger in running an effective operation. Chapek spent 27 years at Disney, most recently heading the parks and resgrts division, and achieving double-digit growht in all but one year the he was on the helm. 33 Strategic Business Units The Walt Disney Company is a diversified worldwide entertainment company with operations in four strategic business units (SBUs): Media Networks, Parks and Resorts, Studio Entertainment, Consumer Products \& Interactive (Exhibit 4). Exhibit 5 shows the revenue share of each segment in 2018. Recently, the company combined former Consumer Products and Interactive into a single segment. Across all its four strategic business units, the company engages in a variety of corporate strategy arrangements including full ownership, joint ventures, alliances, and long-term contracts. The following is a brief description of each SBU. Media NETWORKS Disney's largest segment by revenues earned $24.5 billion in 2018 from cable networks, broadcasting, radio businesses, original programming, and equity investments in other entities that operate programming, distribution, and content management services. 34 Revenues in this segment are from cable, satellite, and telecom service providers (Multi-channel Video Programming Distributors "MVPD"), broadband service providers (digital MVPDs) and affiliate fees from other TV stations delivering Disney programs, advertisements sales, and program sales for the right to use Disney programming. The cable network includes ESPN, the Disney Channels and Freeform, which produce their own programs, and derive revenues from affiliate fees and ad sales (ESPN and Freeform). Broadcast businesses include the A BC TV Network, eight owned television stations, television production and distribution. The majority of the revenues come from ad sales and some from affiliate fees. Radio businesses consist of the ESPN Radio Network, which includes four ESPN radio stations and the Radio Disney network. Disney produces and distributes live action and animated television programming which may be sold in network, first-run syndication and other television markets, to subscription services and formats such as DVD, Blu-Ray, and iTunes. Disney has equity investments in external media businesses including A\&E Television Network LLC, BAMTech LLC, and CTV Specialty Television Inc. In 2019. Disney's acquisition of 21 st Century Fox also included several television networks, including mega movie hits (Titanic, Avatar) and TV series (The Simpsons), plus some of its key networks (FX, Hulu, National Geographic Channel). PARKS AND RESORTS This is Disney's next largest business segment with $20.3 billion in revenue with 10 percent of growth from 2017.35 The company owns and operates Disneyland in California, Disney World in Florida, Aulani Disney Resort \& Spa in Hawaii, Disney Cruise Line, Adventures by Disney, and the Disney Vacation Club. Internationally, the company owns 47 percent of Hong Kong Disneyland Resort and 43 percent of the Shanghai Disney that opened in 2016 . In 2015 , the company also completed a $1 billion recapitalization of Disneyland Paris, increasing its shares from 51 percent to 81 percent. The company charges royalties, licensing, and consulting fees to Disneyland Tokyo. The Walt Disney Imagineering business designs and develops resort properties and theme park attractions. Revenues are generated from a variety of sources including admissions to theme parks, food, merchandise, hotel room nights, cruise and vacation packages, rentals of vacation properties, and royalties. 36 In 2018 , Disney introduced variable ticket prices that increased for higher demand time periods ("dynamic pricing"). 37 In 2019, a Disney park excutive Catherine Powell departed following concerns about Disneyland attendance with the roll out of its new Galaxy Edge attraction based on Star Wars. 38 STUDIOS ENTERTAINMENT This segment generated $10 billion and 19 percent growth over the prior year in 2018 , which, in part, reflects contributions from acquisitions. The oldest business segment in The Walt Disney Company, this segment produces and acquires live-action and animated movies, in addition to musical recordings, and live stage plays. The company distributes films under the Walt Disney Pictures, Pixar, Marvel, Lucasfilm, and Touchstone banners. In 2016, Disney ended the 2009 agreement with DreamWorks to distribute its live-action motion pictures and acquired all rights titles and interests to 13 Dream Works films. The studio entertainment distributes its creations in the theatrical market in the United States and internationally, it aiso serves the home entertainment market by selling DVDs online, and it distributes to the television market. The Disney Music Group, which includes Walt Disney Records, Hollywood Records, Disney Music Publishing, and Buena Vista Concerts, develops and distributes recorded music in the United States and manages the licensing of the Disney song catalogue. It also produces live musical concerts through the Buena Vista Concerts. The Disney Theatrical Group develops and licenses live entertainment events on Broadway and around the world. Revenues are primarily derived from distribution of films to theatre, home entertainment and television markets, as well as stage play tickets, distribution of music, and licensing of intellectual property. In 2009, Disney acquired Marvel Entertainment for $4 billion added Spiderman, Iron Man, The Incredible Hulk, and Captain America to its lineup of characters. A successful investment by any measure-Marvel's superhero movies have grossed over $18 billion at the box office. 39 In 2012 , Disney acquired Lucasflim for just over $4 billion from Star Wars creator George Lucas, adding Darth Vader, Obi-Wan Kenobi, Princess Leia, Luke Skywalker, and other characters to Disney, and by 2018 associated revenues surpassed 4.8 billion. 40 In 2019, Disney also completed its largest acquisition ever with the takeover of 21 st Century Fox, adding the Simpsons, Deadpool, and the Fox-owned Marvel characters such as X-Men and the Fantastic Four to its line-up of characters, as well as control of Hulu. 41 However, expectations of 21 st Century Fox employees were grim as they braced for lay-offs, 42 suggesting Disney may lose important creative talent. With the addition of 20 th Century Fox and Blue Sky, Disney now has seven movie studios with plans to release roughly a dozen movies a year. 43 DISNEY CONSUMER PRODUCTS \& INTERACTIVE MEDIA This business segment had $4.65 billion in revenue in 2018 a 4 percent decline from 2017.44 This segment generates revenues through licensing Disney's characters to third parties for use in con- sumer merchandises, published materials, and in multi-platform games. Revenues are also obtained from selling merchandise, games, children's books, English language learning centers in China, and advertising. The segment operations include retail, online, and wholesale distribution through the Disney Store, DisneyStore.com and MarvelStore.com, and direct to retailers. For example, Disney is partnering with Target to create stores within stores. 45 This division also licenses its trade name, characters, and properties to manufacturers, game developers, publishers, and retailers throughout the world. 46 This division is also home to one of Disney's new strategic initiatives into consumer streaming with Disney+, ESPN+, and Hulu. In 2018, Disney launched ESPN+, a sports streaming service that already has over 2 million subscribers in less than a year. In November 2019 , Disney will launch Disney+ at half the price of Netflix's monthly subscription fee, and Apple+ streaming is launching at the same time with an even lower price. 47 Disney+ a direct-to-consumer streaming service is built around some of its most popular franchises from Star Wars to High School Musical. Disney will also bundle Disney+, ESPN + and Hulu for $12.99 a month, making this content similar in cost to Netflix. Technological change is continuing to reshape the media industry. Consumers are switching from watching cable TV to viewing content online via streaming services such as Netflix, and other interactive media. For example, the Disney Channel and Disney's ESPN have declining viewership. 48 In 2018, ESPN-the most expensive channel in any cable TV subscription-lost 2 million subscribers. 49 However, Disney also added 2 million subscribers to ESPN+, its new streaming services dedicated to sports coverage, events, and original sports programming. Yet, Disney continues to lose money on its streaming services as it attempts to grow its subscriber base. 50 Competition Disney's traditional rivals include Comcast, AT\&T (Time Warner and HBO+), National Amusements (CBS and Viacom) and Sony, but this list is growing to include Amazon, Apple, and Netflix. Relative to its traditional competitors, Disney has a large market capitalization (over 230 billion). However, new competitors are larger in terms of market capitalization (Amazon $850 billion and Apple $1 trillion), and Apple has over $210 billion in cash on hand. To complicate matters, Disney's new stream services, Disney+, relies on Amazon Web Services for cloud services. Disney's Media Network segment competes for viewers, sale of advertising time, and acquisitions of sports and other programming. Its primary competitors for an audience are other television and cable networks, TV stations, DVD and Blu-ray formats, and the Internet. For advertisers, competition is from TV networks. radio and TV stations, MVPDs, advertising media such as newspapers, magazines, billboards, and the Internet. Competition for acquisition of sports and other programming is intense, especially for Disney's ESPN which faces increasing competition from the sports channels of 21 st Century Fox, CBS, and Comcast's NBC Universal segment. 51 The Parks and Resorts segment competes for consumers' leisure time. Primary competitors include other forms of entertainment, lodging, tourism, and recreational activities. Specific competitors for theme parks and resorts include Six Flags Entertainment, Comcast, Cedar Fair, SeaWorld Entertainment, and Universal Studios. 52 The Studios Entertainment segment competes with all forms of entertainment including companies that provide films, home entertainment products, pay TV, music, and live theatre. There is also com- Innovation and Technology Soon after Iger took office, he firmly believed that media companies like Disney needed to start thinking more like technology companies. For example, he made a deliberate decision not to have a corporate-level CTO and assigned this position to himself, and appointed a CTO for each of the four segments. Iger also included more technology expertise on Disney's board of directors. He invited Twitter and Square co-founder Jack Dorsey, BlackBerry CEO John Chen, Facebook COO Sheryl Sandberg, and Steve Jobs who joined the board when Disney acquired Pixar in 2005, and became Disney's largest shareholder. 57 In 2016 , Iger made another bold technology move by acquiring 33 percent interest for $1.1 billion in Bam Tech, a platform that allowed Major League Baseball to stream content to consumers directly via the Internet. In particular, BamTech is a content management and distribution business with a streaming platform that allows for direct-to-consumer programming. In 2017, Disney agreed to invest $1.58 billion for an additional 42 percent share in Bam Tech bringing its ownership stake up to 75 percent. The relatively small acquisition for Disney allowed Iger to build its in-house streaming services, Disney+ and ESPN+, and thus to compete directly with other streaming content distributors such as Netflix and Amazon Prime Video. With it, Disney is a fully vertically integrated media company that produces and distributes its own content, in addition, to using content selective licensing deals. International Expansion Disney's global presence in the form of products, services, and brand recognition was another priority for Iger. Walt Disney International is responsible for Disney's businesses outside the United States. Disney International has over 13,500 employees with operations in 45 countries throughout the world. The company has a substantial global footprint across six regions (Asia, Australia and New Zealand, EMEA [Europe, Middle East, Africa], India, Latin America, and Russia). Yet, Disney remains dependent on North America for most of its revenues (Exhibit 6). Since its opening on April 1992, Disneyland Paris has struggled with socio-cultural differences and barriers that limited profitability. The dismal performance was partly attributed to resistance by the French to what they considered "American cultural imperialism" and stated publicly they hoped the Disney Park wouid be a failure. In 2017 , Disney bought out other investors to make Euro Disney (the French parent company) a wholly owned subsidiary. 58 During Iger's reign. Walt Disney International has implemented integrated structures in foreign markets that have "greatly accelerated revenue in China, produced growth across Japan and Europe and provided unparalleled access to emerging markets throughout Latin America and South East Asia." 59 Mao and Mickey - Disney in China CEO Robert Iger expended significant effort in the past ten years to establish Shanghai Disney Resort in China. Iger related the importance of China for Disney's international expansion efforts. Well, the negotiations and the process to put a shovel in the ground of Shanghai Disneyland was more than a decade long. It redefines the word "patience" in many respects. But the reason we were so patient, or tenacious, or intent on getting something done, is that we believe this is a fantastic opportunity-perhaps the company's biggest in the long term. 60 petition for performing talent, advertisers, and broadcast rights. Primary competitors in this area include AT\&T (Time Warner), Sony, and Viacom. 53 The Consumer Products \& Interactive Media businesses compete with other licensors, retailers and publishers of character, brand, and. celebrity names. Competition also arises from licensors, publishers and developers of game software, online video content, and websites. 54 The success of this segment is highly correlated to the Studio business and Disney's ability to protect and increase the popularity of its characters and brands. STREAMING WARS Increasing disruption and convergence in the media and entertainment industry is producing a whole new set of competitors for Disney. Entry into streaming service s generating cutthroat competition with established players such as Netflix and Hula (now fully controlled by Disney), but also new entrants such as Apple TV+, AT\&T's HBO MAX, NBC Universal's Peacock (owned by Comcast), YouTube Premium, as well as Disney's new streaming services Disney+ and ESPN+. Each of these companies are developing their own original programming to act as an advertisement for their streaming services to obtain subscriptions. Shows such as Netflix's 13 Reason's Why, Amazon's Transparent, and Hulu's Difficult People have gained considerable popularity. In 2019 , the clear market leader in streaming services is Netflix with over 150 million subscribers worldwide, thereof, 61 million in the United States. The revenues for the media services provider in 2019 were $16 billion, and its market cap stood at $150 billion. Over the past decade, Netflix's stock appreciated by some 2,600 percent, while the tech-heavy NASDAQ-100 index grew by "only" 310 percent in the same period. Yet, Netflix subscriber growth in the United States has been slowing, and new entrants such as Apple TV+ are pricing their services aggressively (\$4.99 a month vs. $12.99 a month for basic Netflix subscription). Amazon offers its Instant Video service to its estimated 100 million Prime subscribers (\$119 a year or roughly $10 a month), with selected titles free. In addition, Prime members receive free twoday shipping on Amazon purchases (with one-day shipping announced in 2019). Hulu Plus (\$7.99 a month), a video-on-demand service, has some 25 million subscribers. One advantage Hulu Plus has over Netflix and Amazon is that it typically makes the latest episodes of popular TV shows available the day following the broadcast; the shows are often delayed by several months before being offered by Netflix or Amazon. A joint venture of Disney (67 percent ownership, but 100 percent voting rights) and NBCUniversal (33 percent), Hulu Plus uses advertisements along with its subscription fees as revenue sources. Google's YouTube with its more than 1 billion users is evolving into a TV ecosystem, benefiting not only from free content uploaded by its users but also creating original programming. Google offers its ad-free service YouTube Premium for $12 per month, which allows users to download content such as videos and music for later, off-line use (e.g., while traveling in an airplane). And Apple has over 1 billion devices worldwide such as iPhones and iPads as an installed base where users can enjoy its services such as Apple TV+ and Apple Music. GER'S StRATEGIC Vision Iger's strategic vision was based on billion-dollar franchises, which generally begin with a big novie hit followed by derivative TV shows, theme park rides, video games, toys, clothing, among nany other possible spin-offs. As a result, Iger focused Disney on his three pillars of strategy: 1) generate the best creative content possible, 2) foster innovation and utilize the latest technologies, and 3) expand into new markets around the globe. 55 Creative Content When Iger took the helm in 2005, Disney was experiencing abysmal performance with its own releases attributed to lackluster creative content and earlier cost-cutting efforts. At this time, Disney was in a strategic alliance with Pixar led by Steve Jobs. Disney's distribution network and stellar reputation in animated movies were critical complementary assets that Pixar needed to commercialize its newly created computer-animated movies. In turn, Disney was able to rejuvenate its floundering product lineup, retaining the rights to the newly created Pixar characters and sequels. Pixar became successful beyond imagination as it rolled out one blockbuster after another. Toy Story ( 1 , 2, and 3), A Bug's Life, Monsters, Inc., Finding Nemo, The Incredibles, and Cars, grossing several billion dollars. In 2004, renegotiations of the Pixar-Disney alliance broke down attributed to conflicts between Steve Jobs and then-Disney Chairman and CEO Eisner. In 2005, Iger reinitiated negotiations with Pixar and developed a long-standing friendship with Steve Jobs. In 2006, Disney acquired Pixar and gained access to blockbuster hits and turned some into billion dollars franchises such as Toy Story (over $2 billion), Monsters, Inc. (close to $2 billion), Cars (over $1 billion), and Frozen ( $1.5 Billion). Frozen is the most successful animated movie ever and has a sequel scheduled for release in late 2019. In 2009, Disney acquired Marvel Entertainment adding a lineup of superhero characters. Marvel superheroes movies grossed a cumulative $15 billion at the box office, with The Avengers bringing in some $2 billion. In 2012, Disney acquired Lucasfilm. The Star Wars franchise has become the crown jewel in Disney's line-up of billion-dollar franchises. The 2015 Star Wars sequel, The Force Awakens, grossed over $2 billion at the box office on a budget of $260 million, making it the third best-selling movie after Avatar and Titanic. More importantly, the Star Wars franchise with add-on revenues from such areas as streaming, merchandise, books, gaming, and TV shows is estimated to be worth over $10 billion. 56 In 2014, Disney acquired Maker Studios, a YouTube-based multichannel network, for $675 million. Under Disney, Maker Studios no longer provides some 60,000 YouTube creators with support by promoting their channels and selling ads. Instead, Maker focuses on no more than the top 250 YouTube content creators with a large following in order to build billion-dollar franchises in the new on-demand TV space. One Maker Studios' early success story was YouTube megastar PewDiePie, who with 100 million subscribers has the largest following. In 2017 , however, Disney cut ties with PewDiePie following his publication of videos in which he made inflammatory remarks that were not in line with Disney's values. In 2019 , Disney made by far the largest acquisition in its history in its purchase of 21 st Century Fox for $71 billion, adding movies studios, characters, and network assets, as well as control of Hulu. Fox's large library of entertainment hits combined with Disney's should provide synergies, but it is yet to be seen if this forward integration strategy will pay off in the long term. For example, it has real costs from investing in new resources, as well as lost revenue from Netflix licensing fees, cable fees, and possibly even movie tickets, as it seven studios cannibalize each other's sales. In the process of building Shanghai Disney, Iger stressed how important it was to adjust to local culture tastes and preferences, "pride in local culture, particularly in a place like China, has never been greater...that needs to be reflected at Shanghai Disneyland."61 As a result, the Park was built with unique rides and features that incorporated Chinese elements such as the "Tron" light cycle roller coaster, vast central garden for older visitors, and the Wandering Moon Teahouse. Shanghai Park opened in the summer of 2016 to great fanfare. Iger hoped that Shanghai Disneyland will create an ecosystem of demand in China for movies, merchandise, apps, and video games. In its most optimistic expectations. However, Disney lowered ticket pricel in 2018 to boost park attendance. 62 Competition in the Chinese market for entertainment parks is also heating up as Comcast's Universal Studios is building a theme park in Beijing, and Dreamworks Animation is opening a film studio and entertainment complex in Shanghai. In addition, there are local competitors such as Songcheng Park in Hangzhou and Chimelong Ocean Kingdom in Hengqin. Moreover, Disney-as a quintessential American company-may also be negatively affected by the larger U.S.-China trade war. Challenges Many of Disney's greatest franchises, such as Pixar, Marvel and Star Wars, were external acquisitions. However, an acquisition-led growth strategy may not be sustainable. This is because of the limited number of media companies that Disney can acquire, as well as increased conflicts across business units and divisions. An increased reliance on billion-dollar franchises also reduces originality. For example, Disney relies on a formulaic recipe of success: a blockbuster hit followed by derivative shows, merchandise, and other spin-offs. While nearly half of Disney profits come from its TV networks ESPN, ABC, and others, 63 the media industry is being disrupted, as consumer preferences to streaming content via over-the-top services such YouTube, Netflix, Apple TV+, Sling TV, and other services. 64 While ESPN continues to do well, the cost of rights to show the big sporting events live has scalated dramatically in recent years. As a consequence, ESPS is losing subscribers as many consumers "cut the cord" (that is cancel their cable subscription), or never subscribe to cable in the first place. This trend also affects Disney's other TV properties, including ABC. Although, Disney is in the process of launching its own streaming services, Disney+ and ESPN+, there appears to be room for only a few, if not just one or two winners in a competitive landscape where Apple, Netfiix, Comcast, AT\&T, and Amazon are all chasing after the same costumer. The question is for how many different services will the average consumer in the United States and elsewhere pay for? Chapek's Tesla Model X stopped gently in front of the elevator banks in the parking garage of Disney's Burbank headquarters. Chapek hopped out the car, and let the Tesla park itself. As he pushed the elevator button, he thought to himself "I sure hope that the force is with me, and I can create some more magic for Disney going forward. .." The Walt Disney Co Price \% Change Dow Jones Industrial Average Level \% Change EXHIBIT 2 Disney Financial Data (in \$ millions, except earnings per share [EPS] data), 2014-2019 EXHIBIT 3 Creating Synergies across Disney's Business Lines Source: Based on Core Competency "Creative Talent" as envisioned by Walt Disney in 1957 (simplified depiction). EXHIBIT 4 Disney's Business Segments The Wal EXHIBIT 6 The Walt Disney Company Revenues by Region, 2010-2018 (in \$ millions) UnitedStatesandCanadaAsiaPacificEuropeLatinAmericaandother 60,000 50,000 40,00030,000 20,000 10,000 0 2010 2011 2012 2013 2014 20152016 2017 2018 EXHIBIT 5A The Walt Disney Company Revenue by Business Segment, 2018 (in \$ billion), with total revenues of $59.45 billion EXHIBIT 5B The Walt Disney Company Net Income by Business Segment, 2018 (in $ billion), with total net income of $15.71 billion Source: Depiction of publicly available data. EXHIBIT 5A The Walt Disney Company Revenue by Business Segment, 2018 (in \$ billion), with total revenues of $59.45 billion EXHIBIT 5B The Walt Disney Company Net Income by Business Segment, 2018 (in \$ billion), with total net income of $15.71 billion Source: Depiction of publicly available data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts