Question: Arroy Snackfoods is considering replacing a five-year-old machine that originally cost $50,000. It was being depreciated using straight-line to an expected salvage value of zero

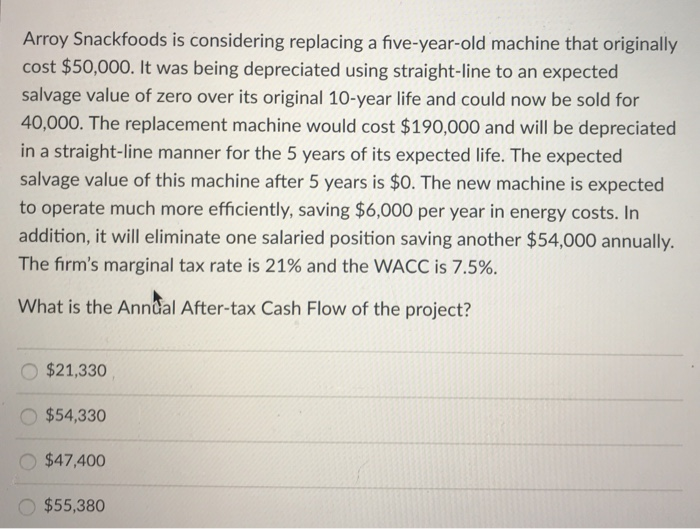

Arroy Snackfoods is considering replacing a five-year-old machine that originally cost $50,000. It was being depreciated using straight-line to an expected salvage value of zero over its original 10-year life and could now be sold for 40,000. The replacement machine would cost $190,000 and will be depreciated in a straight-line manner for the 5 years of its expected life. The expected salvage value of this machine after 5 years is $0. The new machine is expected to operate much more efficiently, saving $6,000 per year in energy costs. In addition, it will eliminate one salaried position saving another $54,000 annually. The firm's marginal tax rate is 21% and the WACC is 7.5%. What is the Annual After-tax Cash Flow of the project? O $21,330 O $54,330 O$47,400 $55,380

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts