Question: ARSUCHE APA-EEEE . . 1 Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph LLLLLCCCCCCCCCCC 13. A Mortgage Loan Manager at First Security Bank

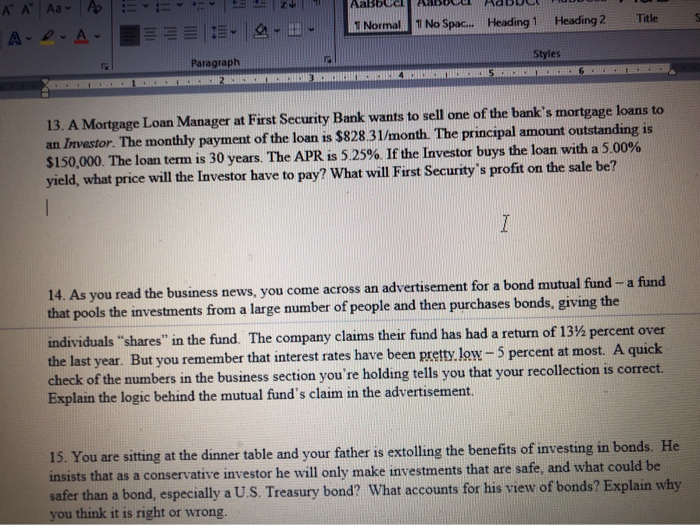

ARSUCHE APA-EEEE . . 1 Normal 1 No Spac... Heading 1 Heading 2 Title Paragraph LLLLLCCCCCCCCCCC 13. A Mortgage Loan Manager at First Security Bank wants to sell one of the bank's mortgage loans to an Investor. The monthly payment of the loan is $828 31/month. The principal amount outstanding is $150,000. The loan term is 30 years. The APR is 5.25%. If the Investor buys the loan with a 5.00% yield, what price will the Investor have to pay? What will First Security's profit on the sale be? 14. As you read the business news, you come across an advertisement for a bond mutual fund - a fund that pools the investments from a large number of people and then purchases bonds, giving the individuals "shares" in the fund. The company claims their fund has had a return of 13% percent over the last year. But you remember that interest rates have been prettylow-5 percent at most. A quick check of the numbers in the business section you're holding tells you that your recollection is correct. Explain the logic behind the mutual fund's claim in the advertisement. 15. You are sitting at the dinner table and your father is extolling the benefits of investing in bonds. He insists that as a conservative investor he will only make investments that are safe, and what could be safer than a bond, especially a U.S. Treasury bond? What accounts for his view of bonds? Explain why you think it is right or wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts