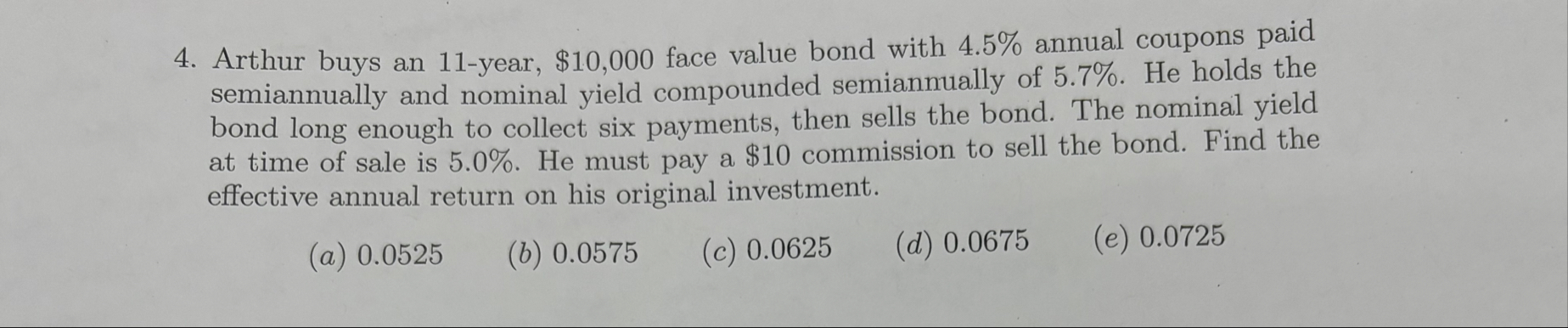

Question: Arthur buys an 1 1 - year, $ 1 0 , 0 0 0 face value bond with 4 . 5 % annual coupons paid

Arthur buys an year, $ face value bond with annual coupons paid semiannually and nominal yield compounded semiannually of He holds the bond long enough to collect six payments, then sells the bond. The nominal yield at time of sale is He must pay a $ commission to sell the bond. Find the effective annual return on his original investment.

a

b

c

d

e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock