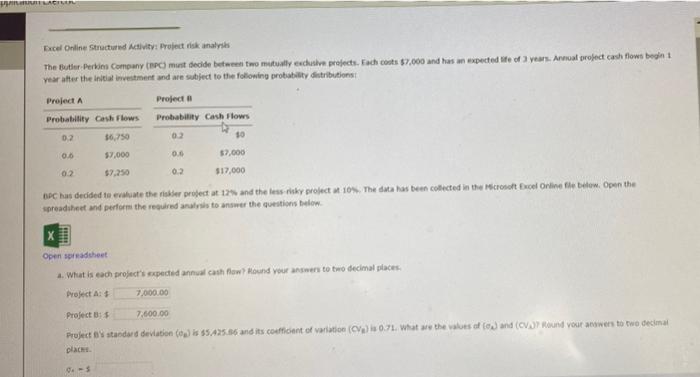

Question: ARTLAR Excel Online Structured Activity: Project risk analysis The Butler Perion Company (PCmust decide between two mutually exclusive projects. Each cots $7.000 and has an

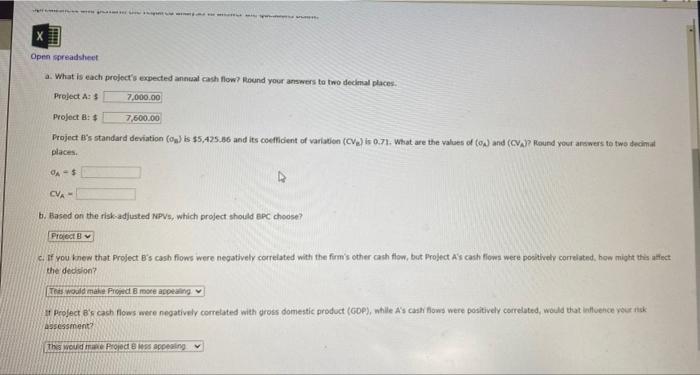

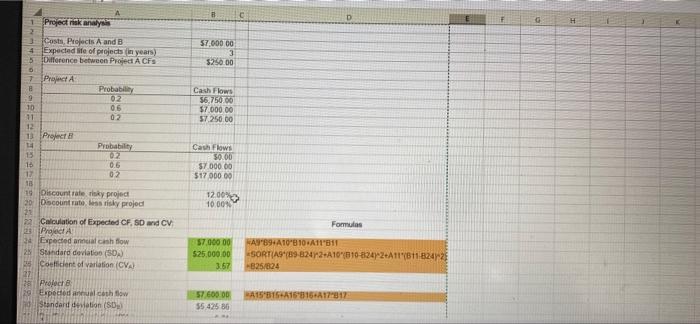

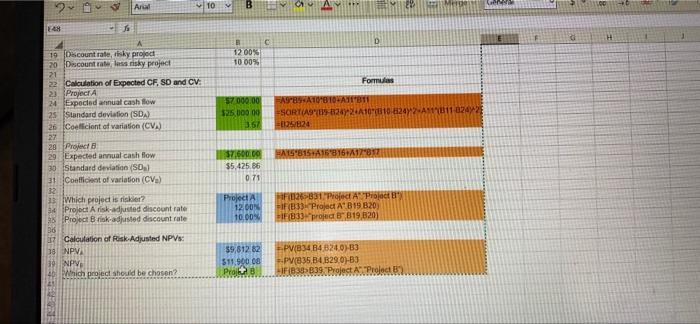

ARTLAR Excel Online Structured Activity: Project risk analysis The Butler Perion Company (PCmust decide between two mutually exclusive projects. Each cots $7.000 and has an expected life of years. Annual project cash flows bent year after the initial investment and are subject to the following probability distributions Project Project Probability Cash Flows 02 30 Probability Cash Flows 02 36.750 06 $9.000 02 $7.250 57.000 02 $17,000 BPC has decided to evaluate the risker probertat 12 and the less risky project 10. The data has been collected in the crosoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below TH Open spreadsheet 1. Wat is each project's expected annual cash flow Round your answer to two decimal places Project: 7,000.00 Project: 7.600.00 Projectes standard deviation () is $5.AS.86 and its coeficient of variation (CV) 07. What are the values of Coand ( Cound your answers to two decimal placht 0.5 Open spreadsheet a. What is each project's expected annual cash flow? Round your answers to two decimal places Project A: $ 7,000.00 Project B:$ 7,600.00 Projectes standard deviation (0) $5,425.86 and its coeffident of variation (CV) is 0.71. What are the values of (a) and (v.)? Round your answers to two decima places A- CVA- b. Based on the risk-adjusted NPVs, which project should BPC choose? Project e. If you knew that Project B's cash flows were negatively correlated with the firm's other cash flow, but Project A's cash flows were positively correlated, how might this affect the dedision? This would make Projed more appealing It Project B's cash flows were negatively correlated with gross domestic product (GDP), whille A's cash flows were positively corelated, would that influence your risk assessment This would make Projedes appealing B C Project risk analys D F G H 57,000.00 3 $250 00 Cash Flows 56.75000 $7.000.00 57.250.00 CostsProjects A and B 4. Expected life of projects in years) 5 Difference between Projed A CFs 0 7 Project B Probably 9 02 10 06 11 02 12 1 Project Probability 15 02 18 0.6 12 02 15 19 Discount ratesy projed 20 Oscount rate is risky project 23 22 Calculation of Expected CF, SD and CV Project 4 Expected and cash flow 2 Standard deviation (SD) 35 Coeficient of variation (CVA Cash Flows 50.00 $7 000.00 $1700000 1200 10.00 Fomulas 57.00000 525,000.00 3.67 WAY'89A10'810ATIT SORTIAP (89-82472+A109810-8247-2+A117811 8242 825/824 281 Project 19 Expected annualcosh flow Standard deviation (SD 57.600 5542586 MAIS BISA1164417317 Ara Mere TO 90 8 E H D C 1200% 1000% 57000.00 325 000 0 361 Formulas FAS'HA1B10 ATBT SORTASYUS 2421107010 H2472-A11011 0242 5824 HAL'8151861417872 19 Discount rate, ky project 20 Discount rate, risky project 21 22 Calculation of Expected CF, SD and CV: 23 Project 24 Expected annual cash flow 25 Standard deviation (SDA) 26 Coeficient of variation (CV) 27 28 Project 29 Expected annual cash flow 30 Standard deviation (SO) 31 Coetliceat of variation (CV) 32 13 Which project is riskier? 3 Project A risk-adjusted discount rate Project Brisk-adjusted discount rate 30 Calculation of Risk Adjusted NPVS: 18 NPV 19 NPV 4 which project should be chosen? 7.600.00 $5.425.86 0 71 Project 12. OON 10.00 F026-31 Pro A Project FIF(3) Project A B19 320) IF(8,33 proje 819,820) 59,81282 $11.900 Prots PV/834 84 3240 B3 --PV(835,14 1290)-B3 IFBB39. Project A Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts