Question: As a consultant for this case you are to write a 1-2 page recommendation report to the store including the following: 1. Create ONE comparison

As a consultant for this case you are to write a 1-2 page recommendation report to the store including the following:

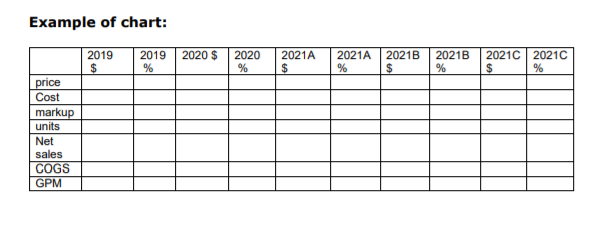

1. Create ONE comparison chart with an analysis with 3 potential retail prices (2021A, 2021B, 2021C), sales dollars and units, and mark ups, gross margin, and percentages example of chart provided below:

2. Which price would result in the highest gross profit and why?

3. What other factors should RITZY consider? Remember, that unforeseen circumstances arise (example: a pandemic), competition changes, taste changes, demand changes, etc.

4. What price would you recommend to charge, and how many units would you recommend to order? Explain your reasoning.

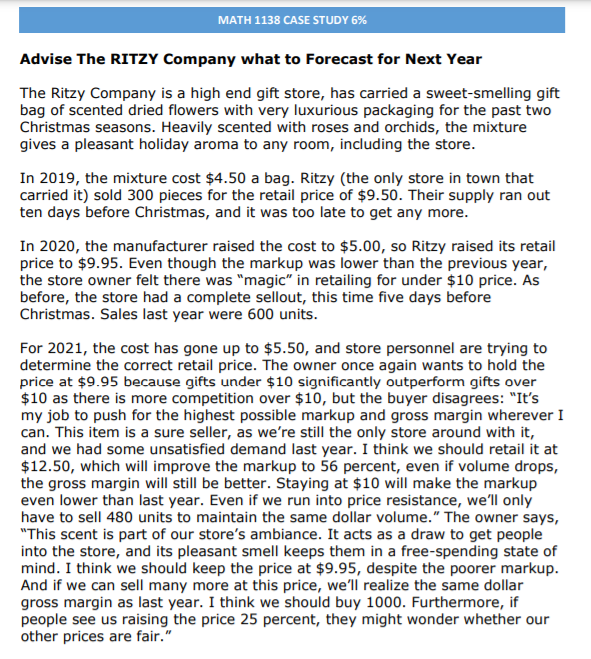

MATH 1138 CASE STUDY 6% Advise The RITZY Company what to Forecast for Next Year The Ritzy Company is a high end gift store, has carried a sweet-smelling gift bag of scented dried flowers with very luxurious packaging for the past two Christmas seasons. Heavily scented with roses and orchids, the mixture gives a pleasant holiday aroma to any room, including the store. In 2019, the mixture cost $4.50 a bag. Ritzy (the only store in town that carried it) sold 300 pieces for the retail price of $9.50. Their supply ran out ten days before Christmas, and it was too late to get any more. In 2020, the manufacturer raised the cost to $5.00, so Ritzy raised its retail price to $9.95. Even though the markup was lower than the previous year, the store owner felt there was "magic" in retailing for under $10 price. As before, the store had a complete sellout, this time five days before Christmas. Sales last year were 600 units. For 2021, the cost has gone up to $5.50, and store personnel are trying to determine the correct retail price. The owner once again wants to hold the price at $9.95 because gifts under $10 significantly outperform gifts over $10 as there is more competition over $10, but the buyer disagrees: "It's my job to push for the highest possible markup and gross margin wherever I can. This item is a sure seller, as we're still the only store around with it, and we had some unsatisfied demand last year. I think we should retail it at $12.50, which will improve the markup to 56 percent, even if volume drops, the gross margin will still be better. Staying at $10 will make the markup even lower than last year. Even if we run into price resistance, we'll only have to sell 480 units to maintain the same dollar volume." The owner says, "This scent is part of our store's ambiance. It acts as a draw to get people into the store, and its pleasant smell keeps them in a free-spending state of mind. I think we should keep the price at $9.95, despite the poorer markup. And if we can sell many more at this price, we'll realize the same dollar gross margin as last year. I think we should buy 1000. Furthermore, if people see us raising the price 25 percent, they might wonder whether our other prices are fair." Example of chart: 2020 $ 2019 $ 2019 % 2020 % 2021A $ 2021A % 2021B $ 2021B % 2021C 2021C $ % price Cost markup units Net sales COGS GPM MATH 1138 CASE STUDY 6% Advise The RITZY Company what to Forecast for Next Year The Ritzy Company is a high end gift store, has carried a sweet-smelling gift bag of scented dried flowers with very luxurious packaging for the past two Christmas seasons. Heavily scented with roses and orchids, the mixture gives a pleasant holiday aroma to any room, including the store. In 2019, the mixture cost $4.50 a bag. Ritzy (the only store in town that carried it) sold 300 pieces for the retail price of $9.50. Their supply ran out ten days before Christmas, and it was too late to get any more. In 2020, the manufacturer raised the cost to $5.00, so Ritzy raised its retail price to $9.95. Even though the markup was lower than the previous year, the store owner felt there was "magic" in retailing for under $10 price. As before, the store had a complete sellout, this time five days before Christmas. Sales last year were 600 units. For 2021, the cost has gone up to $5.50, and store personnel are trying to determine the correct retail price. The owner once again wants to hold the price at $9.95 because gifts under $10 significantly outperform gifts over $10 as there is more competition over $10, but the buyer disagrees: "It's my job to push for the highest possible markup and gross margin wherever I can. This item is a sure seller, as we're still the only store around with it, and we had some unsatisfied demand last year. I think we should retail it at $12.50, which will improve the markup to 56 percent, even if volume drops, the gross margin will still be better. Staying at $10 will make the markup even lower than last year. Even if we run into price resistance, we'll only have to sell 480 units to maintain the same dollar volume." The owner says, "This scent is part of our store's ambiance. It acts as a draw to get people into the store, and its pleasant smell keeps them in a free-spending state of mind. I think we should keep the price at $9.95, despite the poorer markup. And if we can sell many more at this price, we'll realize the same dollar gross margin as last year. I think we should buy 1000. Furthermore, if people see us raising the price 25 percent, they might wonder whether our other prices are fair." Example of chart: 2020 $ 2019 $ 2019 % 2020 % 2021A $ 2021A % 2021B $ 2021B % 2021C 2021C $ % price Cost markup units Net sales COGS GPMStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts