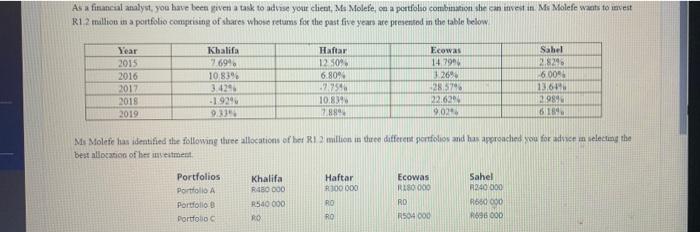

Question: As a financial analyst, you have been even a task to advise your chest, Ms Molefe, on a portfolio combination she can invest in Ms

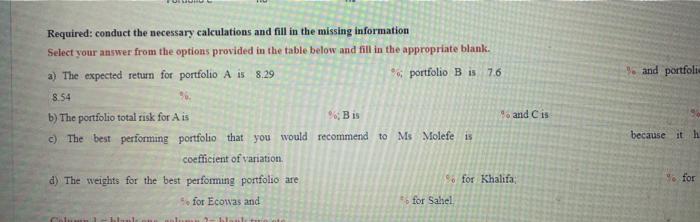

As a financial analyst, you have been even a task to advise your chest, Ms Molefe, on a portfolio combination she can invest in Ms Molefe wants to invest R1.2 million in a portfolio comprising of shares whose retums for the past five years are presented in the table below Year 2015 Khalifa 7.699 108399 2016 2017 2018 2019 Haftar 12.50 6.80 254 10.8398 2889 Ecowas 147994 1269 28.5796 22629 902 Sabel 2829 6009 13,6198 2.989 61895 9.39 Ms Molefe has identified the following three allocations of her R2 million in three different portfolios and has approached you for a selecting the best location of her sestment Portfolios Khalifa R450 000 Haftar R100 000 Ecowas R80 000 Sahel R240 000 Portfolio A R540000 RO RD Portfolio Portfoto R60 000 R696 000 RO RO R504000 Required: conduct the necessary calculations and fill in the missing information Select your answer from the options provided in the table below and fill in the appropriate blank. a) The expected return for portfolio A is 8.29 * portfolio B is 76 % and portfolio 8.54 6. and C is b) The portfolio total risk for Ais %, Bis c) The best performing portfolio that you would recommend to Ms Molefe is because it coefficient of variation d) The weights for the best performing portfolio are 96 for Khalifa Yo for 5. for Ecowas and for Sahel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts