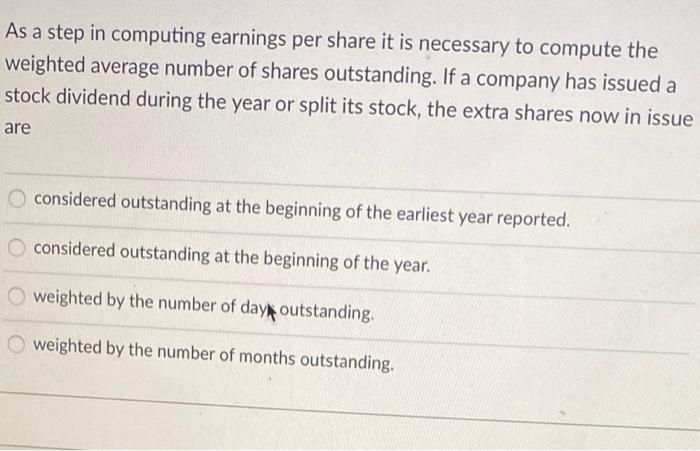

Question: As a step in computing earnings per share it is necessary to compute the weighted average number of shares outstanding. If a company has issued

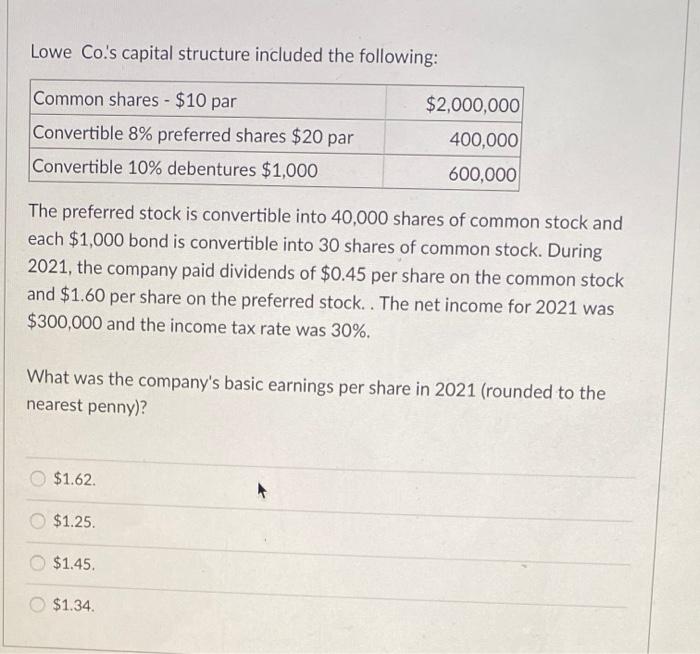

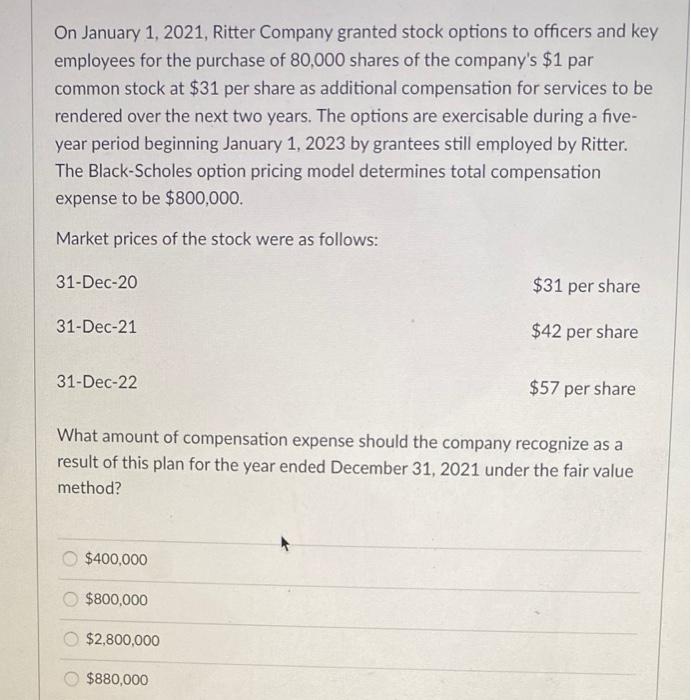

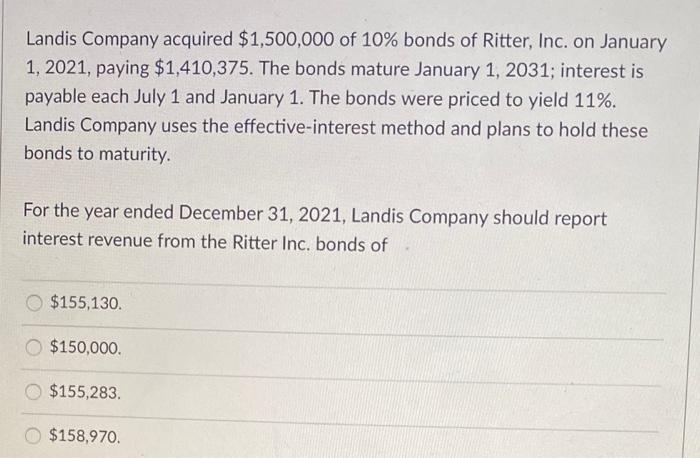

As a step in computing earnings per share it is necessary to compute the weighted average number of shares outstanding. If a company has issued a stock dividend during the year or split its stock, the extra shares now in issue are considered outstanding at the beginning of the earliest year reported. considered outstanding at the beginning of the year. weighted by the number of day outstanding, weighted by the number of months outstanding, Lowe Co.'s capital structure included the following: $2,000,000 Common shares - $10 par Convertible 8% preferred shares $20 par Convertible 10% debentures $1,000 400,000 600,000 The preferred stock is convertible into 40,000 shares of common stock and each $1,000 bond is convertible into 30 shares of common stock. During 2021, the company paid dividends of $0.45 per share on the common stock and $1.60 per share on the preferred stock. The net income for 2021 was $300,000 and the income tax rate was 30%. What was the company's basic earnings per share in 2021 (rounded to the nearest penny)? $1.62 $1.25. $1.45. $1.34. On January 1, 2021, Ritter Company granted stock options to officers and key employees for the purchase of 80,000 shares of the company's $1 par common stock at $31 per share as additional compensation for services to be rendered over the next two years. The options are exercisable during a five- year period beginning January 1, 2023 by grantees still employed by Ritter. The Black-Scholes option pricing model determines total compensation expense to be $800,000. Market prices of the stock were as follows: 31-Dec-20 $31 per share 31-Dec-21 $42 per share 31-Dec-22 $57 per share What amount of compensation expense should the company recognize as a result of this plan for the year ended December 31, 2021 under the fair value method? $400,000 $800,000 $2,800,000 $880,000 Landis Company acquired $1,500,000 of 10% bonds of Ritter, Inc. on January 1, 2021, paying $1,410,375. The bonds mature January 1, 2031; interest is payable each July 1 and January 1. The bonds were priced to yield 11%. Landis Company uses the effective interest method and plans to hold these bonds to maturity. For the year ended December 31, 2021, Landis Company should report interest revenue from the Ritter Inc. bonds of $155,130. $150,000. $155,283 $158,970

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts