Question: As a treasury analyst, you are trying to value a potential target company X Co. The capital structure ratio (D/E) currently for X Co. ist.

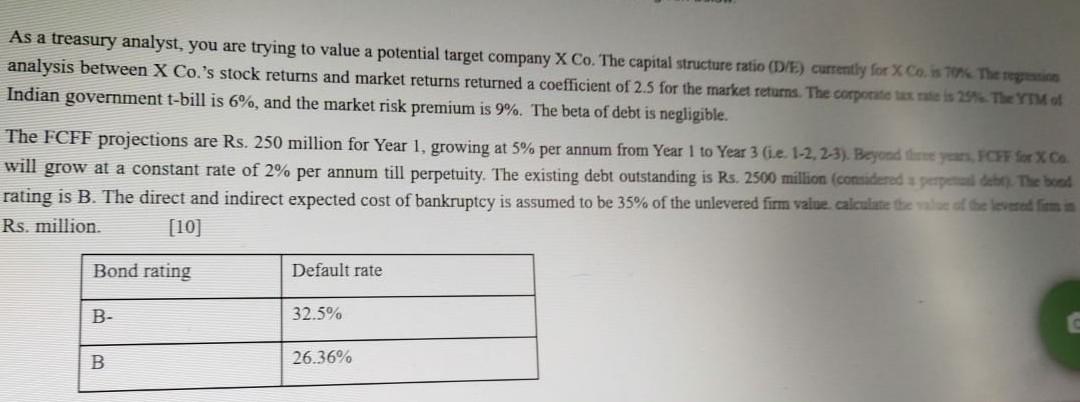

As a treasury analyst, you are trying to value a potential target company X Co. The capital structure ratio (D/E) currently for X Co. ist. The regis analysis between X Co.'s stock returns and market returns returned a coefficient of 2.5 for the market returns. The corporate at tale is 25. TheYTM of Indian government t-bill is 6%, and the market risk premium is 9%. The beta of debt is negligible. The FCFF projections are Rs. 250 million for Year 1, growing at 5% per annum from Year 1 to Year 3 (.e. 1-2, 2-3). Beyond the FOHF fox XC will grow at a constant rate of 2% per annum till perpetuity. The existing debt outstanding is Rs. 2500 million (considered speed. The be rating is B. The direct and indirect expected cost of bankruptcy is assumed to be 35% of the unlevered firm value. calculate the value of the lead in Rs. million [10] Bond rating Default rate B- 32.5% B 26.36%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts