Question: As a treasury analyst you are trying to value a potential target company X Co The capital structure ratio, market value of debt to value

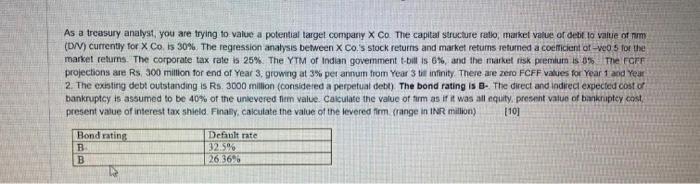

As a treasury analyst you are trying to value a potential target company X Co The capital structure ratio, market value of debt to value of nom (D/) currently for X Co is 30% The regression analysis between X Co.'s stock returns and market returns returned a coefficient of wes for the market returns. The corporate tax rate is 25%. The YTM of Indian government t-bill is 6%, and the market risk premium is 3% The FCEF projections are Rs 300 million for end of Year 3, growing at 3% per annum from Year 3 till infinity. There are zero FCFF values for Year 1 and Year 2. The existing debt outstanding is Rs. 3000 million considered a perpetual debt). The bond rating is - The direct and indirect expected cost of bankruptcy is assumed to be 40% of the unlevered the value. Calculate the value of form as if it was all equity, present value of bankruptcy cost present value of interest tax shield. Finally, calculate the value of the levered firm (range in INR million) [10] Bond rating B B Default rate 32.5% 26.366

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts