Question: As for the code you can only answer 1 question, so please answer question 2. PROBLEM B: Alpha is deciding whether to invest $1,000 in

As for the code you can only answer 1 question, so please answer question 2.

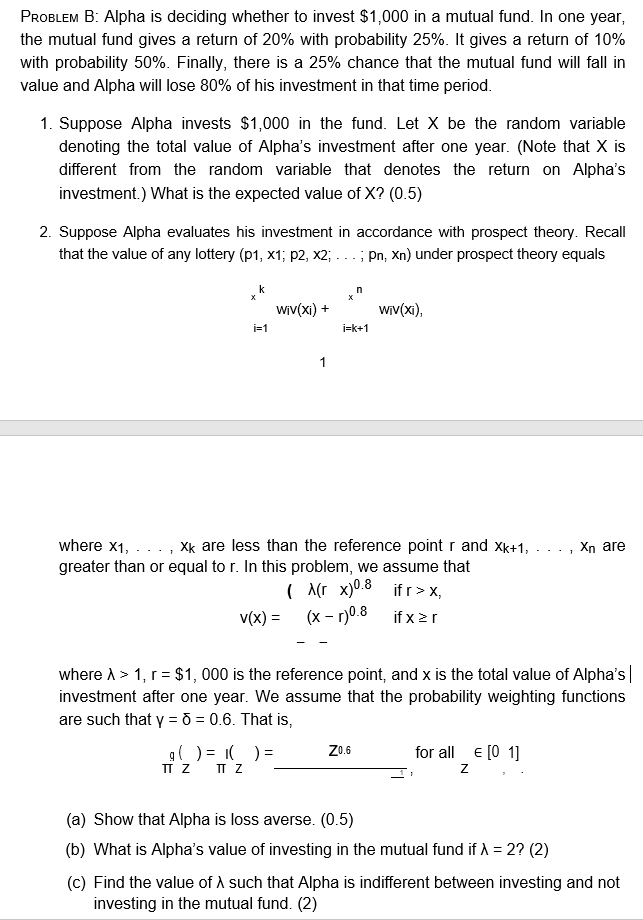

PROBLEM B: Alpha is deciding whether to invest $1,000 in a mutual fund. In one year, the mutual fund gives a return of 20% with probability 25%. It gives a return of 10% with probability 50%. Finally, there is a 25% chance that the mutual fund will fall in value and Alpha will lose 80% of his investment in that time period. 1. Suppose Alpha invests $1,000 in the fund. Let X be the random variable denoting the total value of Alpha's investment after one year. (Note that X is different from the random variable that denotes the return on Alpha's investment.) What is the expected value of X? (0.5) 2. Suppose Alpha evaluates his investment in accordance with prospect theory. Recall that the value of any lottery (P1, x1; P2, X2; ...; Pn, xn) under prospect theory equals n wiv(xi) + wiv(xi), Xn are where x1, ..., xk are less than the reference point r and Xk+1, greater than or equal to r. In this problem, we assume that ( A, x0.8 if> x, v(x) = (x - 1)0.8 if x2r where 1 > 1, r = $1,000 is the reference point, and x is the total value of Alpha's investment after one year. We assume that the probability weighting functions are such that y = 0 = 0.6. That is, g() = ( 20.6 for all E [O 1] TT Z TT Z Z (a) Show that Alpha is loss averse. (0.5) (b) What is Alpha's value of investing in the mutual fund if I = 2? (2) (c) Find the value of such that Alpha is indifferent between investing and not investing in the mutual fund. (2) PROBLEM B: Alpha is deciding whether to invest $1,000 in a mutual fund. In one year, the mutual fund gives a return of 20% with probability 25%. It gives a return of 10% with probability 50%. Finally, there is a 25% chance that the mutual fund will fall in value and Alpha will lose 80% of his investment in that time period. 1. Suppose Alpha invests $1,000 in the fund. Let X be the random variable denoting the total value of Alpha's investment after one year. (Note that X is different from the random variable that denotes the return on Alpha's investment.) What is the expected value of X? (0.5) 2. Suppose Alpha evaluates his investment in accordance with prospect theory. Recall that the value of any lottery (P1, x1; P2, X2; ...; Pn, xn) under prospect theory equals n wiv(xi) + wiv(xi), Xn are where x1, ..., xk are less than the reference point r and Xk+1, greater than or equal to r. In this problem, we assume that ( A, x0.8 if> x, v(x) = (x - 1)0.8 if x2r where 1 > 1, r = $1,000 is the reference point, and x is the total value of Alpha's investment after one year. We assume that the probability weighting functions are such that y = 0 = 0.6. That is, g() = ( 20.6 for all E [O 1] TT Z TT Z Z (a) Show that Alpha is loss averse. (0.5) (b) What is Alpha's value of investing in the mutual fund if I = 2? (2) (c) Find the value of such that Alpha is indifferent between investing and not investing in the mutual fund. (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts