Question: as soon as possible Consider the below data. All monetary values are in CAD. SHOW ALL YOUR STEPS. Current Plan: Assets: CAD 5 million Debt:

as soon as possible

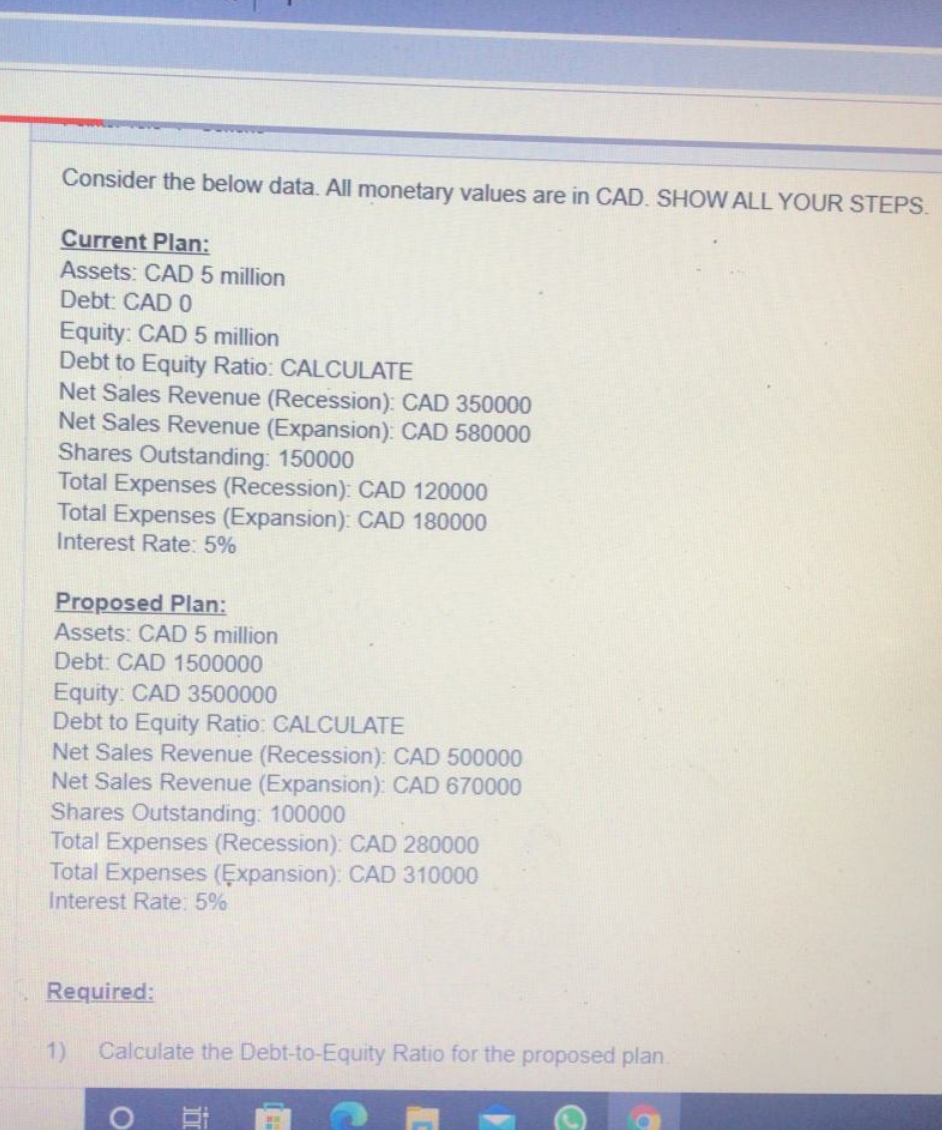

Consider the below data. All monetary values are in CAD. SHOW ALL YOUR STEPS. Current Plan: Assets: CAD 5 million Debt: CAD 0 Equity: CAD 5 million Debt to Equity Ratio: CALCULATE Net Sales Revenue (Recession): CAD 350000 Net Sales Revenue (Expansion): CAD 580000 Shares Outstanding: 150000 Total Expenses (Recession): CAD 120000 Total Expenses (Expansion): CAD 180000 Interest Rate: 5% Proposed Plan: Assets: CAD 5 million Debt: CAD 1500000 Equity: CAD 3500000 Debt to Equity Ratio: CALCULATE Net Sales Revenue (Recession): CAD 500000 Net Sales Revenue (Expansion): CAD 670000 Shares Outstanding: 100000 Total Expenses (Recession): CAD 280000 Total Expenses (Expansion): CAD 310000 Interest Rate: 5% Required: 1) Calculate the Debt-to-Equity Ratio for the proposed plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts