Question: CASE STUDY RESEARCH TOPIC SELECTED - INTERNATIONAL FINANCIAL CRISES I choose covid-19 for my international financial crises case study. please answer 1. Context background information,

CASE STUDY

RESEARCH TOPIC SELECTED - INTERNATIONAL FINANCIAL CRISES

I choose covid-19 for my international financial crises case study.

please answer

1. Context background information, business climate, concern and issues

2. Strategies described: Approacges taken by stakeholders, CEO, MARKETING and sales team involved P-R-O Model ( pessimistic/realistic/optimistic)

3. Challenges Concern that emerged, various perspectives

4. Outcomes Accomplishments, changes, lesson learned

5. Following harvard business school Case study Method format for write up.

The COVID-19 crisis has had a far-reaching negative impact around the world, affecting and worsening conditions in many economies, which may lead to a severe recession or even depression. The number of positive cases has increased significantly in recent months, and the number of deaths has also reached its highest point. The purpose of this study is to examine the impact of the global financial crisis and the COVID-19 pandemic on macroeconomic variables in the US economy. It also provides insight in descriptive format, analyzes and compares the global financial crisis and the COVID-19 pandemic in tabular and graphical format. Tables and averages were used for analytical purposes. Charts for the second half of 2008 and the beginning of the global financial crisis in 2009 are used for graphic formats. The first six months of the spread of the Covid-19 pandemic were also taken into account. The results confirm that the current COVID-19 pandemic presents a worse picture of economic activity than the global financial crisis. Moreover, the impact of the crisis on the probability of recession during the current pandemic is smaller than during the global financial crisis

Introduction

The novel coronavirus, or COVID-19, has a huge and disruptive impact on the global economy . Infectious diseases confine people to their homes, which in turn affects the daily working life of the population. Unlike other epidemics, its impact on labor and consumer markets is unprecedented. When Covid-19 was declared a pandemic after China and South Korea on March 12, 2020, the US market experienced a shock as the pandemic spread across the country and the oil market collapsed, impacting the economy into recession . The combination of COVID-19 and the oil market crisis is affecting the US economy, which is experiencing stock market volatility, unemployment, declining consumer confidence and spending, and declining industrial production. The impact and volatility of the economy and monetary policy are similar to or surpassing the impact of previous major crises in the United States, namely the 2008 Global Crisis, the 1978 Crash, and the 1929 Depression. In addition, the imposition of lockdowns to limit people's most serious health problems has resulted in the loss of jobs and livelihoods for millions of Americans. Also, the introduction of the lockdown in the United States completely affected the entire market, which is equivalent to a recession. Financial markets bounced from lows and highs 18 times over a 25-day period in March 2020, economists found, adding to the bad news in the market as the dollar fell sharply on top of a drop in US GDP and a rise in consumer goods. Expected performance of industrial production and services, low participation in the stock market . Moreover, unemployment has risen faster than the financial crisis due to economic losses. Unemployment, which reached 10% in the 2008 global crisis and could reach as high as 12.8% during the pandemic, is alarming and could seriously affect the labor market, Labor Market and Morgan Stanley predict. It also said 3.3 million workers filed their first insurance claims with the government in the second to last week of March, up from 200,000 the previous week. To add insult to injury, unemployment and consumer spending are at record lows, while most citizens and the unemployed are likely to lose health insurance. Also compared to the 2008 global financial crisis, the COVID-19 pandemic is worse than the GFC. While the 2008 global crisis demonstrated some structural problems in the US economy prior to the crisis, the 2020 pandemic proved to have a distinctive feature: a shock to the US economy and the rest of the world. Proliferation in countries that have led the US government to restrict and limit any activities and programs to stop proliferation. The pandemic-induced crisis in the United States is now known as the Black Swan or the Great Depression. Likewise, post-pandemic deglobalization has been widely observed. Countries close borders, people movement, airlines and other forms of travel. Many journalists, economists and writers have compared the crisis to a global war, as the global economy shrinks, including the G7 powers, which supply and satisfy almost all of the rest of the world's needs by supplying, exporting and importing goods that produce 70% of goods worldwide, restricting these services. which in turn has a huge impact on the stock market and job market. The pandemic has already started to show the effects that we are seeing in the world in general and in the US in particular, the COVID-19 has finally affected businesses at both the micro and macro level, i.e. production and delivery are physically disrupted, routes and air shipping and shipping to and from the United States. This leads to restrictions on people's work, which means unemployment. In addition, low production and high demand will raise product prices, leading to high inflation and recession. The US economic shutdown also affected the oil index, the Dow Jones and the major stock markets, with a large number of daily positives. Fiscal austerity is more related to fiscal deficits than other crises, and the outcome of the current crisis in 2020 is inherently uncertain as to when it will end and the economy will recover. Large countries such as the US, Germany, Canada, China and Europe maintain their economies using reserves, while smaller countries may not and will be in recession or even depression. The purpose of the study is to examine the impact of the new coronavirus on macroeconomic variables in the US economy. It also provides an understanding in a descriptive format, analyzes and compares the crises of the global financial crisis and the COVID-19 pandemic in a tabular and graphical format. Moreover, this study sheds light on the current situation and future financial performance in a sensible manner. The article also attempts to compare the GFC (Global Financial Crisis) with the current pandemic outbreak in the US. Because of the evolving pandemic model in the United States, the study did not quantify any specific variable or outcome. Research on the impact of the novel coronavirus pandemic on macroeconomic variables is important in several ways: First, the research results provide some useful insights that will help researchers better understand the current economic conditions. Along with the data, a macroeconomic impact perspective and broader view in tables and graphs will be presented to understand the short- and long-term impact of macroeconomic factors on the US economy. Second, descriptive research will also enable policy makers to mitigate .

Literature review

The literature on the impact of the COVID-19 pandemic on key macroeconomic variables is scant. Some studies have looked at COVID-19 from different directions examines the performance and volatility of European investment funds during the Covid-19 outbreak. Using six months of monthly data, the authors find that mutual funds show weekly results. Similarly looks at the performance of equity funds during Covid-19 and their relationship with human capital efficiency. The authors found that equity funds with higher HCE ratings outperformed their peers during the pandemic. investigates the solvency status of companies in all EU countries during Covid-19. The authors find that the solvency profile of all companies has deteriorated during the pandemic. examines the performance of European funds during the outbreak. The results of the study show that social entrepreneurship funds showed positive returns during the epidemic. ( examine the relationship between economically relevant variables, namely the spread of the recent infectious disease COVID-19, stock prices, oil prices and market volatility, geopolitical scenarios, and economic policy uncertainty in the United States. series analysis for a certain period of time. The authors apply velvet methods and Vellet Granger tests to daily data on COVID-19, geopolitical risk, stock market volatility, and oil shocks and prices The results showed that the impact of COVID-19 on geopolitical risks in the US went beyond the country's economic uncertainty. The pandemic crisis can be viewed differently at different times, which means that in the short term it can be seen as an economic crisis, while in the long term it appears to be a geopolitical risk to the country. Similarly, for US unemployment, Gangopadhyaya and Garrett (2020) observe unemployment compared to two crises: the global financial crisis and the recent COVID-19 crisis. They took data on a variety of health care and industry workers and looked at their unemployment and insurance losses. The study shows that during the GFC (Global Financial Crisis) in 2008, unemployment reached 10%, but during the pandemic it rose to 12%, still in crisis. They also found that 3.5 million workers had filed insurance claims with the US government in March. Based on consumer spending, the author examines consumer spending in different Chinese cities and examines the impact of COVID-19 on real consumer spending in China. Data on consumer spending is collected from China Daily in 214 cities. This study conducts a differential analysis of consumer and consumer offline consumption using UnionPay payments and QR code scanner transactions The author found that from February to March, consumer offline spending fell by 1% of GDP, which is estimated at about 1 trillion yuan . They also hinted that it will continue for the next two weeks. It may soon reach 6% of GDP. In addition, there are also documented studies of people's psychological problems during the pandemic. studied consumers and people experiencing stress and mental disorders due to the COVID-19 pandemic. The aim of the study is to protect people from mental illness and mental illness during the pandemic. The data comes from the Pew Research Center in the United States, which surveyed 9,678 people and was converted into a survey-based questionnaire. Use multiple linear regression models to find actual scores for anxiety, stress, mental states, and mental disorders. The author found that 3% of people are depressed and try to use social media and other platforms on the Internet to learn about the coronavirus. The US leisure and tourism industry has also been hit hard. explores the fact that the charity and entertainment industries are among the hardest hit sectors of the US economy. They analyzed data from 26 states that filed unemployment claims and used a statistical method model, a peak modeling approach. The study found large differences in unemployment before and after the pandemic. The authors also point to the enormous losses faced by all industrial, entertainment, and charitable sectors in the United States. They also compared the industry's low and high unemployment rates based on business and media reports. It explains the coronavirus and its impact on the world in general and the G7 economy in particular. In his technological study, he analyzed that many countries are heading for recession and some for depression. He also laid out the macroeconomic variables that the 2020 outbreak will affect and believes the outbreak is still ongoing. Therefore, the need to analyze and integrate the variables that actually affect the US economy was recognized. The authors further analyze how the pandemic affected supply and demand channels, investment and trade, financial markets, international cooperation, economic and financial stability, and political and economic growth (Su et al., 2020a). The authors aim to provide a comprehensive overview of the state of the US economy from a macro variable perspective. The study presents each variable in tables, graphs and maps to advise policymakers on how the 2020 pandemic will affect national economies. (Wenzhi et al., 2020) investigated strong immunity and strong crisis response to the COVID 19 pandemic. Businesses are the backbone of a country's economy and the largest source of economic finance. The authors surveyed 6,000 companies in 56 economies around the world. This study assesses company characteristics and stock price response to the events of the Covid-19 pandemic. The study concluded that the companies most affected by the pandemic have strong supply chains, stable customer pipelines and management teams that are less affected by the pandemic crisis. The authors also found that firms with large exposures to corporate hedge fund derivatives were larger than larger firms that did not participate in corporate hedge funds or did not hedge most of their exposure through derivatives. To examine whether daily cases of COVID-19 affect stock prices in the US market (Alfaro et al., 2020), we examined the impact of epidemic trajectories on the daily return of human epidemic stocks. The authors estimate that dichotomous disease trajectories affect stock prices between 4% and 11% over bullish or bearish time periods. After the study, it was found that if the path of infection is not more severe than before, the bursa will recover even if the bursa increases. The study also found that the environment is closely related to pollution and that companies vulnerable to pollution have a significant impact on business value and employment and vice versa. In addition, the course of the pandemic will affect companies with a lot of debt. (Baker et al., 2020) Measuring economic uncertainty and prosperity with market policy. The study evaluated more than 12,000 newspaper articles about major events such as World War I and World War II, the bankruptcy of Lehman Brothers, the global financial crisis and the US presidential election. The study found that economic policy uncertainty is mainly driven by stock price volatility, declining foreign and domestic direct investment, and unemployment in sectors most sensitive to economic policy, such as defense, health, finance and infrastructure construction. Formation of economic policy. Macroeconomic policy uncertainty can affect policy innovation that affects investment, output, and employment in the United States. As far as developing countries are concerned, Pakistan is also one of the most affected countries. (Ahmad et al., 2020) studied the impact of COVID-19 on Pakistan's stock market and its volatility. The authors used data on daily positive COVID-19 cases, deaths and recoveries for the first 25 days of March, as well as Pakistan's stock index. The authors found that recovery was positively correlated with stock price indices, while mortality was negatively correlated with stock prices (Su et al., 2021c). In general, many studies have been conducted to examine the impact of COVID-19 on various aspects of the economy. However, no studies have compared the impact of COVID-19 with previous global financial crises. Therefore, this study examines the impact of the novel coronavirus on macroeconomic variables in the US economy and compares two crises, the global financial crisis and the COVID-19 pandemic, to add to the existing literature. This report is also the first to assess the current situation and the impact of COVID-19 on future financial results. The research findings have important management and policy implications. One of the inspirations for this study was to assess the impact of COVID-19 on key macroeconomic variables such as industrial production, real private consumption expenditures, recession potential, total business capital, and the unemployment rate (Su et al., 2020b). Most importantly, it reduces the chances of a US recession during the two major crises: the global financial crisis and COVID-19. The first is to identify the possibility of a recession in the US market. Depending on the average probability of a recession and the management of the situation, governments can take the necessary measures. Governments can also ensure public safety and save businesses a return to normal economic levels over time. It is therefore important to assess the response of key macroeconomic variables during the pandemic and their relative performance compared to the global financial crisis. The next section examines the potential impact of COVID-19 and the global financial crisis on key macroeconomic variables. Additional research will be conducted to describe and map variables related to the US economy. This section focuses on conclusions and discussion, section 4 concludes and section 5 concludes with policy recommendations.

Discussion on different Macroeconomics

The main purpose of this study is to show the impact of the Covid 19 pandemic crisis on macroeconomic variables. It also compares the COVID-19 pandemic and the global financial crisis to show how each will affect the US economy. It is clear that the current crisis is developing in nature and it is impossible to obtain such quantitative results, but in order to understand the relationship between the two major crises that occurred in the last decade, a descriptive study in tabular form must be organized and documented.. and graphical comparison. It is important to remember that current data evolves and changes asymmetrically every day. Table 1 shows the descriptive statistics of the key macroeconomic variables used in the study. The data covers the period from October 1, 2007 to October 1, 2020. A large standard deviation of a variable indicates high volatility of any macroeconomic variable. Variables are also skewed. A significant value for the Jarque-Bera statistic indicates that the data are not normally distributed. Therefore, it can be said that the global financial crisis and the COVID-19 pandemic have had a significant impact on the trends of major macroeconomic variables.

Overview of the US economy

The COVID-19 pandemic is having a huge impact on the United States. Covid-19 has brought many operations and economic sectors to a standstill in the United States, raising doubts about growth prospects and putting the country on the brink of a deep recession. The infection turned out to have caused the biggest shock to the national economy since the Great Depression. The annual rate of GDP fell 32.9%, the highest rate since the Great Depression. Unemployment has also taken a huge hit, with 30.2 million workers collecting unemployment benefits at the end of July. Moreover, industrial production has suffered a massive setback and the country's growth has been destroyed, so the growth of the past five years has come to an end. which accounts for more than two-thirds of the US economy, is down 34.6% this year. Investment in oil exploration and non-residential use fell 34.9%, while total business investment fell 27% this year. Investments in infrastructure fell by 38.7%. The descriptive study critically documents charts and graphs with graphs to clarify the impact of COVID-19 on the macro variables of the US economy, namely industrial production, real personal consumption spending, the probability of a recession, total company inventories and the unemployment rate. However, the study also attempts to compare the current contagion crisis with the global financial crisis. The data for these variables are adjusted monthly and quarterly. Table 2 provides a detailed overview of US industrial production. The latest economic shock from the pandemic was critical and impacted the US economy. Close borders, prohibit transport routes, restrict the movement of people and reduce international trade flows. The industrial production index in Table 2 fell from 109.2 in the first month of January 2020 to 98.9 in July 2020, a steeper decline and an even larger average decline than during the global financial crisis. In Figure 1, the industrial production index fell to 91.1 from 100.8 in August 2008, an average decline of 95.8, less than during the recent COVID-19 pandemic crisis. It should be noted that financial vulnerabilities during the 2008 global financial crisis were structural, artificial and well contained at the time. Moreover, it should be noted that this epidemic has affected all areas of resources, be it labor, imports and exports, or the production of raw materials. Another similarity is that in the GFC banks are drying up, liquidity is shrinking and the economy is recovering two years later due to the endogenous nature of the crisis, while during the recent pandemic everything is normal, banks are full of exogenous resources and industrial production is suffering. it was more serious than during the global financial crisis.

Figure 1. Comparison of Industrial Production During GFC and COVID-19.

Conclusions and policy implications

This article examines the role of COVID-19 and its impact on macroeconomic variables in the US economy in comparison to the global financial crisis. We show the variables for the six months when the natural crisis peaked in both tabular and graphical format. We also explain each variable and paint the financial picture in descriptive format. Understandably, the current crisis, due to its evolving nature, may not have emerged empirically and quantitatively. Furthermore, to our knowledge, there is no detailed study comparing the GFC (Global Financial Crisis and the COVID-19) pandemic. Therefore, this study attempts to thoroughly explain the impact of the global financial crisis and COVID 19 on the macroeconomic variables of the US economy. For the analysis of the study, data was first collected from various reliable sources from the US Department of Economic Research and the US Federal Reserve Bank. The study analyzed each variable where the mean change and mean value of each variable were calculated and then plotted in a graphical format to examine the impact of the crisis. Compared to the global financial crisis, the impact of the current pandemic crisis on industrial production, consumer spending, total business inventories and unemployment is more severe. Moreover, the possibility of a smooth recession is high in the global financial crisis caused by financial tightening and the draining of banks and investment firms. Finally, we find that it is not uncommon for economies not to fall into recession during times of crisis. This crisis has had a severe impact on inventory levels and international trade, resulting in a decline in industrial production and employment. Unemployment creates additional space for low consumption. To prevent political consequences such as exogenous crises, countries, especially the United States, should focus on e-commerce and advanced technologies. In the event of such a pandemic, the US government should actively focus on developing innovative policies to prevent the coming pandemic. The country should end the lockdown and introduce smart lockdown in areas with high daily positive cases. Industry and financial markets must fully implement standard operating procedures and activate the engine of the economy. In addition, the US government should implement online training and other similar innovations without shutting down economic activity. But waiting for the pandemic to end could plunge the country into depression. Unlike the global financial crisis, this study is limited to the role of COVID-19 and its impact on macroeconomic variables in the US economy. Further research may be conducted to examine the performance and volatility of US equity funds during the development of Covid-19. Furthermore, further research is needed to highlight the impact of this contagious Covid-19 on businesses across the country.

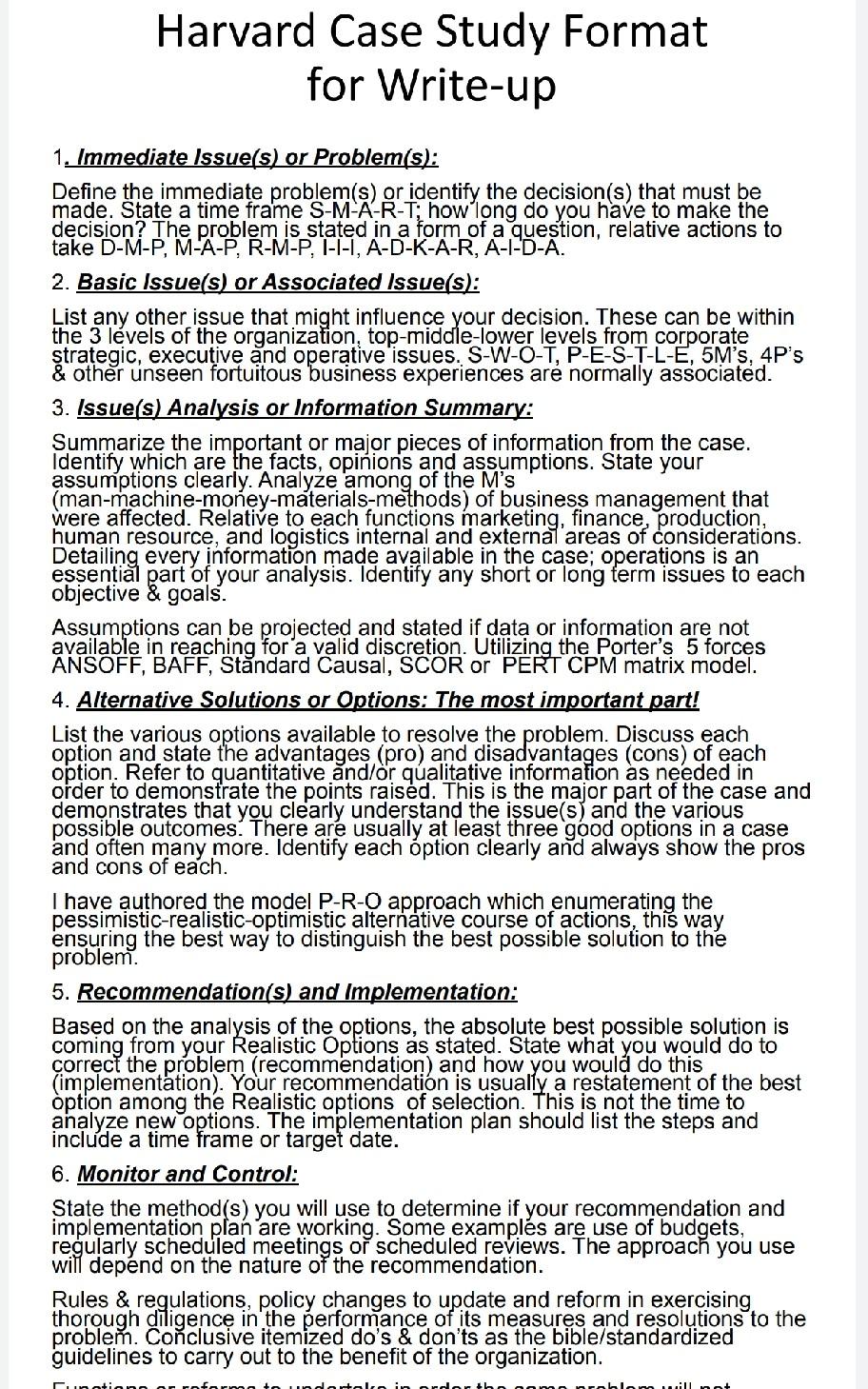

Harvard Case Study Format for Write-up 1. Immediate Issue(s) or Problem(s): Define the immediate problem(s) or identify the decision(s) that must be made. State a time frame S-M-A-R-T; how long do you have to make the decision? The problem is stated in a form of a question, relative actions to take D-M-P, M-A-P, R-M-P, I-I-I, A-D-K-A-R, A-I-D-A. 2. Basic Issue(s) or Associated Issue(s): List any other issue that might influence your decision. These can be within the 3 levels of the organization, top-middle-lower levels from corporate strategic, executive and operative issues. S-W-O-T, P-E-S-T-L-E, 5M's, 4P's \& other unseen fortuitous business experiences are normally associated. 3. Issue(s) Analysis or Information Summary: Summarize the important or major pieces of information from the case. Identify which are the facts, opinions and assumptions. State your assumptions clearly. Analyze among of the M's (man-machine-money-materials-methods) of business management that were affected. Relative to each functions marketing, finance, production, human resource, and logistics internal and externai areas of considerations. Detailing every information made available in the case; operations is an essential part of your analysis. Identify any short or long term issues to each objective \& goals. Assumptions can be projected and stated if data or information are not available in reaching for a valid discretion. Utilizing the Porter's 5 forces ANSOFF, BAFF, Standard Causal, SCOR or PERT CPM matrix model. 4. Alternative Solutions or Options: The most important part! List the various options available to resolve the problem. Discuss each option and state the advantages (pro) and disadvantages (cons) of each option. Refer to quantitative and/or qualitative information as needed in order to demonstrate the points raised. This is the major part of the case and demonstrates that you clearly understand the issue(s) and the various possible outcomes. There are usually at least three good options in a case and often many more. Identify each option clearly and always show the pros and cons of each. I have authored the model P-R-O approach which enumerating the pessimistic-realistic-optimistic alternative course of actions, this way ensuring the best way to distinguish the best possible solution to the problem. 5. Recommendation(s) and Implementation: Based on the analysis of the options, the absolute best possible solution is coming from your Realistic Options as stated. State what you would do to correct the problem (recommendation) and how you would do this (implementation). Your recommendation is usually a restatement of the best option among the Realistic options of selection. This is not the time to analyze new options. The implementation plan should list the steps and include a time frame or target date. 6. Monitor and Control: State the method(s) you will use to determine if your recommendation and implementation plan are working. Some examples are use of budgets, regularly scheduled meetings or scheduled reviews. The approach you use will depend on the nature of the recommendation. Rules \& regulations, policy changes to update and reform in exercising thorough diligence in the performance of its measures and resolutions to the problem. Conclusive itemized do's \& don'ts as the bible/standardized guidelines to carry out to the benefit of the organization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts