Question: ASAP as soon as possible 0.6 1)) You are using the arbitrage pricing model to estimate the expected return on Bethlehem Stesland have derived the

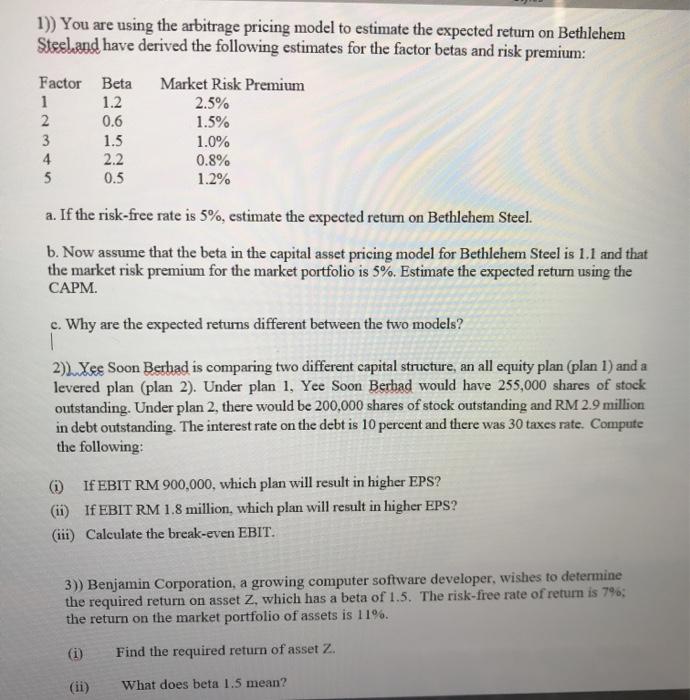

0.6 1)) You are using the arbitrage pricing model to estimate the expected return on Bethlehem Stesland have derived the following estimates for the factor betas and risk premium: Factor Beta Market Risk Premium 1 1.2 2.5% 2 1.5% 3 1.5 1.0% 4 0.8% 5 0.5 1.2% a. If the risk-free rate is 5%, estimate the expected retum on Bethlehem Steel. b. Now assume that the beta in the capital asset pricing model for Bethlehem Steel is 1.1 and that the market risk premium for the market portfolio is 5%. Estimate the expected return using the CAPM. 2.2 c. Why are the expected returns different between the two models? 1 2) Xee Soon Berhad is comparing two different capital structure, an all equity plan (plan 1) and a levered plan (plan 2). Under plan 1, Yee Soon Berhad would have 255,000 shares of stock outstanding. Under plan 2, there would be 200,000 shares of stock outstanding and RM 2.9 million in debt outstanding. The interest rate on the debt is 10 percent and there was 30 taxes rate. Compute the following: If EBIT RM 900,000, which plan will result in higher EPS? (ii) If EBIT RM 1.8 million, which plan will result in higher EPS? (iii) Calculate the break-even EBIT. 3)) Benjamin Corporation, a growing computer software developer, wishes to determine the required return on asset Z, which has a beta of 1.5. The risk-free rate of return is 7%; the return on the market portfolio of assets is 11%. (i) Find the required return of asset Z. What does beta 1.5 mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts