Question: ASAP ASAP ASAP I NEED HELP AS FAST AS POSSIBLE I ONLY NEED LETTER (C) AND (D) ANSWERED PLEASE HURRY! Rate of return, standard deviation,

ASAP ASAP ASAP I NEED HELP AS FAST AS POSSIBLE I ONLY NEED LETTER (C) AND (D) ANSWERED PLEASE HURRY!

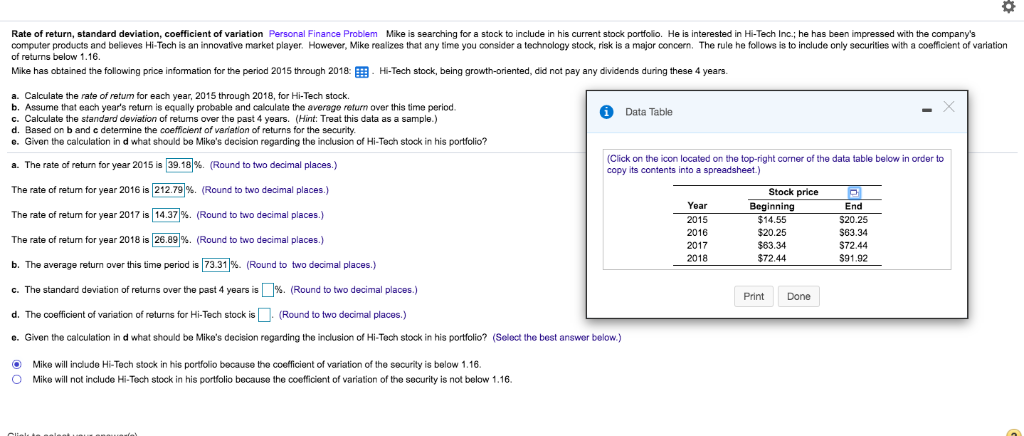

Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company's computer products and believes Hi-Tech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.16. Mike has obtained the following p ce information for the period 2015 through 2018 Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. Calculate the rate of retum for each year, 2015 through 2018, for Hi-Tech stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. c. Calculate the standard deiation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation of returns for the security e. Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his portfolio? Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a s a. The rate of return for year 2015 is 39.18%. (Round to two decimal places.) The rate of return for year 2016 is | 212.79%. (Round to two decimal places.) The rate of return for year 2017 is | 14.37%. (Round to two decimal places.) The rate of return for year 2018 is 26.89%. (Round to two decimal places.) b. The average return over this time period is 73.31%. (Round to two decimal places.) c. The standard deviation of returns over the past 4 years is Stock price Year Beginning $14.55 $20.25 $63.34 $72.44 S20.25 S63.34 $72.44 $91.92 2016 2017 2018 (Round to two decimal places.) Print Done d. The coefficient of variation of returns for Hi-Tech stock is(Round to two decimal places.) Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his portfolio?Select the best answer below.) e. Mike will indlude Hi-Tech stock in his portfolio because the coefficient of variation of the security is below 1.16 O Mike will not include Hi-Tech stock in his portfolio because the coefficient of variation of the security is not below 1.16 Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company's computer products and believes Hi-Tech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.16. Mike has obtained the following p ce information for the period 2015 through 2018 Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. Calculate the rate of retum for each year, 2015 through 2018, for Hi-Tech stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. c. Calculate the standard deiation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation of returns for the security e. Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his portfolio? Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a s a. The rate of return for year 2015 is 39.18%. (Round to two decimal places.) The rate of return for year 2016 is | 212.79%. (Round to two decimal places.) The rate of return for year 2017 is | 14.37%. (Round to two decimal places.) The rate of return for year 2018 is 26.89%. (Round to two decimal places.) b. The average return over this time period is 73.31%. (Round to two decimal places.) c. The standard deviation of returns over the past 4 years is Stock price Year Beginning $14.55 $20.25 $63.34 $72.44 S20.25 S63.34 $72.44 $91.92 2016 2017 2018 (Round to two decimal places.) Print Done d. The coefficient of variation of returns for Hi-Tech stock is(Round to two decimal places.) Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his portfolio?Select the best answer below.) e. Mike will indlude Hi-Tech stock in his portfolio because the coefficient of variation of the security is below 1.16 O Mike will not include Hi-Tech stock in his portfolio because the coefficient of variation of the security is not below 1.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts