Question: ASAP please 2 A security analyst specializes in studying stocks A and B and is considering whether to combine them in one portfolio. His estimate

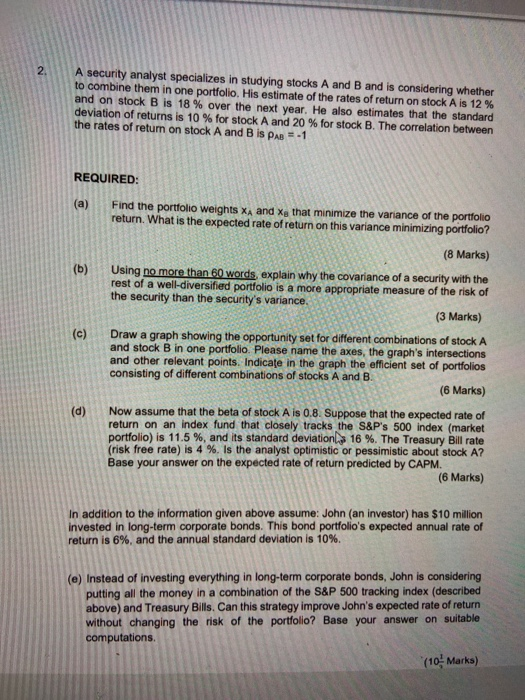

2 A security analyst specializes in studying stocks A and B and is considering whether to combine them in one portfolio. His estimate of the rates of return on stock A is 12 % and on stock B is 18 % over the next year. He also estimates that the standard deviation of returns is 10% for stock A and 20 % for stock B. The correlation between the rates of return on stock A and B is DAB = -1 REQUIRED: (a) (b) Find the portfolio weights XA and Xe that minimize the variance of the portfolio return. What is the expected rate of return on this variance minimizing portfolio? (8 Marks) Using no more than 60 words, explain why the covariance of a security with the rest of a well-diversified portfolio is a more appropriate measure of the risk of the security than the security's variance. (3 Marks) Draw a graph showing the opportunity set for different combinations of stock A and stock B in one portfolio. Please name the axes, the graph's intersections and other relevant points. Indicate in the graph the efficient set of portfolios consisting of different combinations of stocks A and B. (6 Marks) (c) (d) Now assume that the beta of stock A is 0.8. Suppose that the expected rate of return on an index fund that closely tracks the S&P's 500 index (market portfolio) is 11.5%, and its standard deviation 16 %. The Treasury Bill rate (risk free rate) is 4 %. Is the analyst optimistic or pessimistic about stock A? Base your answer on the expected rate of return predicted by CAPM. (6 Marks) In addition to the information given above assume: John (an investor) has $10 million invested in long-term corporate bonds. This bond portfolio's expected annual rate of return is 6%, and the annual standard deviation is 10%. (e) Instead of investing everything in long-term corporate bonds, John is considering putting all the money in a combination of the S&P 500 tracking index (described above) and Treasury Bills. Can this strategy improve John's expected rate of return without changing the risk of the portfolio? Base your answer on suitable computations. (10 Marks) 2 A security analyst specializes in studying stocks A and B and is considering whether to combine them in one portfolio. His estimate of the rates of return on stock A is 12 % and on stock B is 18 % over the next year. He also estimates that the standard deviation of returns is 10% for stock A and 20 % for stock B. The correlation between the rates of return on stock A and B is DAB = -1 REQUIRED: (a) (b) Find the portfolio weights XA and Xe that minimize the variance of the portfolio return. What is the expected rate of return on this variance minimizing portfolio? (8 Marks) Using no more than 60 words, explain why the covariance of a security with the rest of a well-diversified portfolio is a more appropriate measure of the risk of the security than the security's variance. (3 Marks) Draw a graph showing the opportunity set for different combinations of stock A and stock B in one portfolio. Please name the axes, the graph's intersections and other relevant points. Indicate in the graph the efficient set of portfolios consisting of different combinations of stocks A and B. (6 Marks) (c) (d) Now assume that the beta of stock A is 0.8. Suppose that the expected rate of return on an index fund that closely tracks the S&P's 500 index (market portfolio) is 11.5%, and its standard deviation 16 %. The Treasury Bill rate (risk free rate) is 4 %. Is the analyst optimistic or pessimistic about stock A? Base your answer on the expected rate of return predicted by CAPM. (6 Marks) In addition to the information given above assume: John (an investor) has $10 million invested in long-term corporate bonds. This bond portfolio's expected annual rate of return is 6%, and the annual standard deviation is 10%. (e) Instead of investing everything in long-term corporate bonds, John is considering putting all the money in a combination of the S&P 500 tracking index (described above) and Treasury Bills. Can this strategy improve John's expected rate of return without changing the risk of the portfolio? Base your answer on suitable computations. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts