Question: ASAP Please CASE 2: Below is the data extracted from an oil and gas company that is currently experiencing explosion in revenues from its downstream

ASAP Please

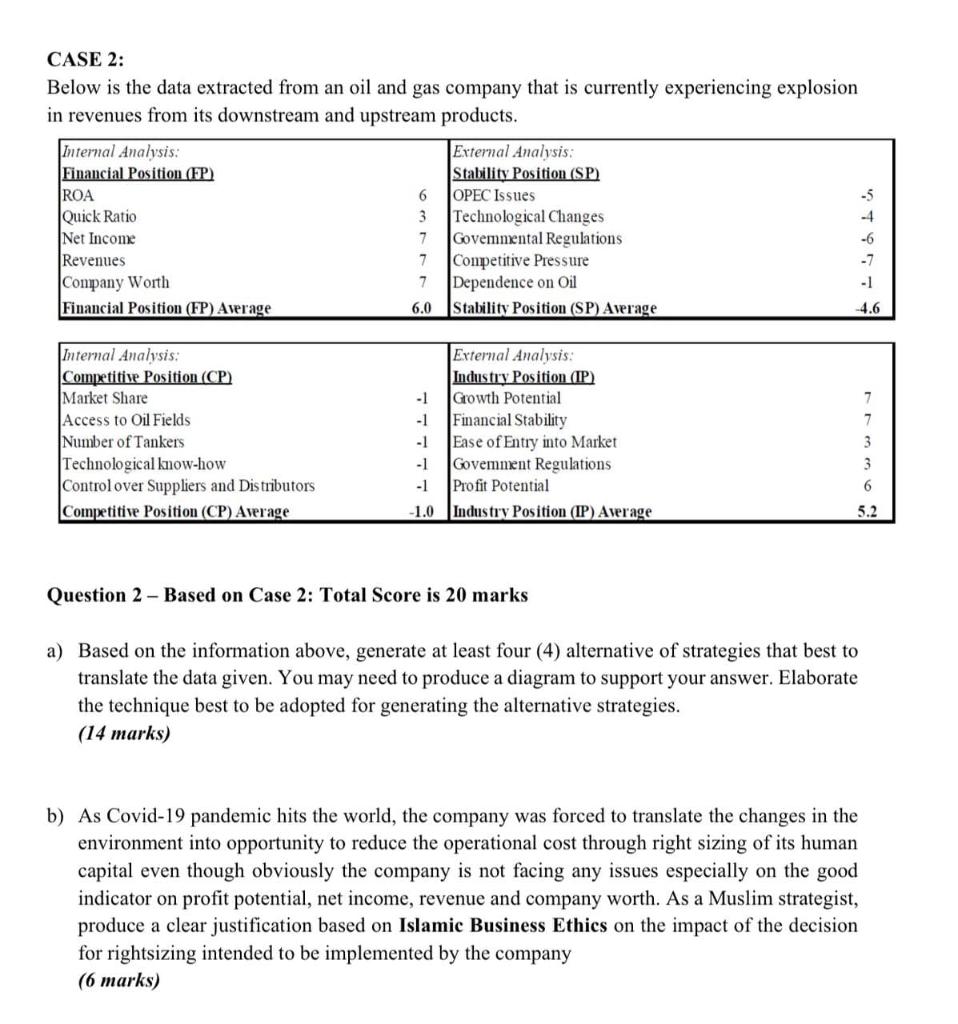

CASE 2: Below is the data extracted from an oil and gas company that is currently experiencing explosion in revenues from its downstream and upstream products. Internal Analysis: External Analysis: Financial Position (FP) Stability Position (SP) ROA 6 OPEC Issues -5 Quick Ratio 3 Technological Changes -4 Net Income 7 Govemmental Regulations -6 Revenues 7 Competitive Pressure -7 Company Worth 7 Dependence on Oil Financial Position (FP) Average 6.0 Stability Position (SP) Average -4.6 Internal Analysis: Competitive Position (CP) Market Share Access to Oil Fields Number of Tankers Technological know-how Control over Suppliers and Distributors Competitive Position (CP) Average External Analysis: Industry Position (IP) -1 Growth Potential -1 Financial Stability -1 Ease of Entry into Market -1 Govemment Regulations -1 Profit Potential -1.0 Industry Position (IP) Average 7 7 3 3 6 5.2 Question 2 - Based on Case 2: Total Score is 20 marks a) Based on the information above, generate at least four (4) alternative of strategies that best to translate the data given. You may need to produce a diagram to support your answer. Elaborate the technique best to be adopted for generating the alternative strategies. (14 marks) b) As Covid-19 pandemic hits the world, the company was forced to translate the changes in the environment into opportunity to reduce the operational cost through right sizing of its human capital even though obviously the company is not facing any issues especially on the good indicator on profit potential, net income, revenue and company worth. As a Muslim strategist, produce a clear justification based on Islamic Business Ethics on the impact of the decision for rightsizing intended to be implemented by the company (6 marks) CASE 2: Below is the data extracted from an oil and gas company that is currently experiencing explosion in revenues from its downstream and upstream products. Internal Analysis: External Analysis: Financial Position (FP) Stability Position (SP) ROA 6 OPEC Issues -5 Quick Ratio 3 Technological Changes -4 Net Income 7 Govemmental Regulations -6 Revenues 7 Competitive Pressure -7 Company Worth 7 Dependence on Oil Financial Position (FP) Average 6.0 Stability Position (SP) Average -4.6 Internal Analysis: Competitive Position (CP) Market Share Access to Oil Fields Number of Tankers Technological know-how Control over Suppliers and Distributors Competitive Position (CP) Average External Analysis: Industry Position (IP) -1 Growth Potential -1 Financial Stability -1 Ease of Entry into Market -1 Govemment Regulations -1 Profit Potential -1.0 Industry Position (IP) Average 7 7 3 3 6 5.2 Question 2 - Based on Case 2: Total Score is 20 marks a) Based on the information above, generate at least four (4) alternative of strategies that best to translate the data given. You may need to produce a diagram to support your answer. Elaborate the technique best to be adopted for generating the alternative strategies. (14 marks) b) As Covid-19 pandemic hits the world, the company was forced to translate the changes in the environment into opportunity to reduce the operational cost through right sizing of its human capital even though obviously the company is not facing any issues especially on the good indicator on profit potential, net income, revenue and company worth. As a Muslim strategist, produce a clear justification based on Islamic Business Ethics on the impact of the decision for rightsizing intended to be implemented by the company (6 marks)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock