Question: ASAP please explane the equation as given (figuers title given on answer sheet) answer provide by chegg expert has been shared as photo and i

Selecting a mortgage

Selecting a mortgage

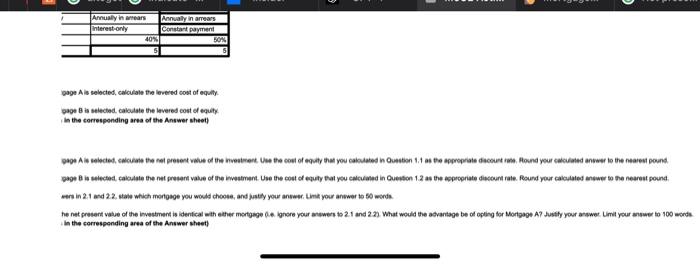

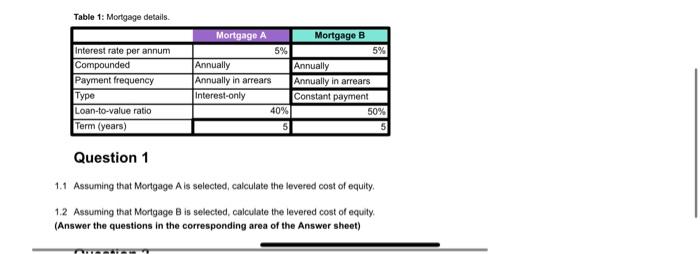

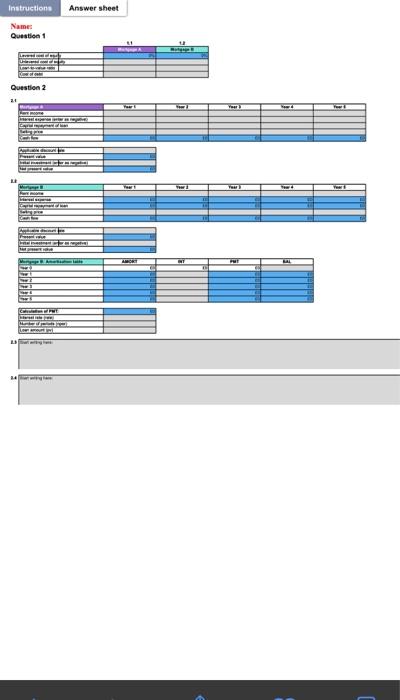

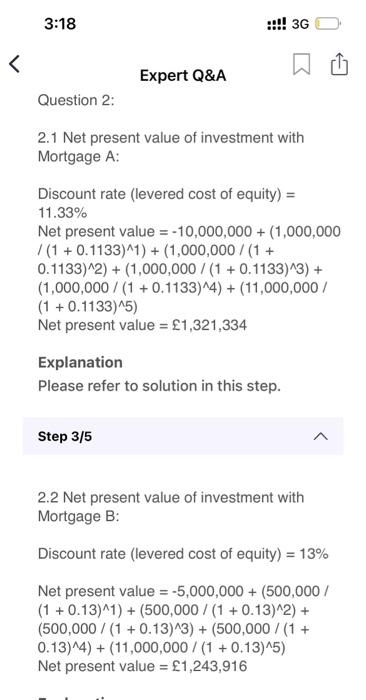

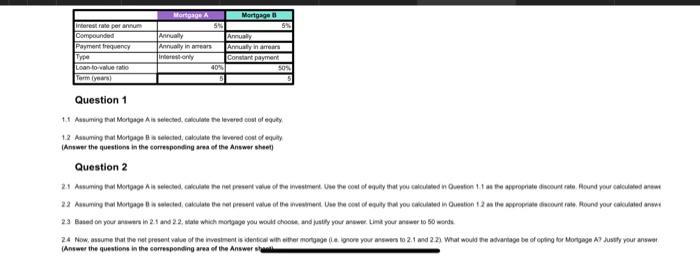

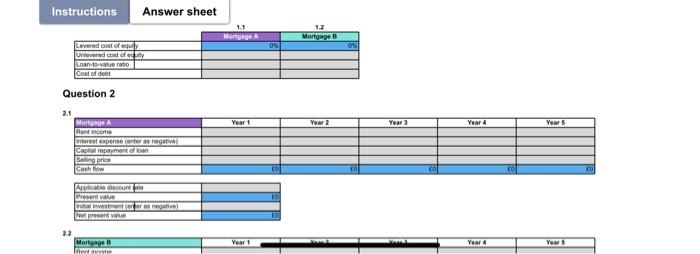

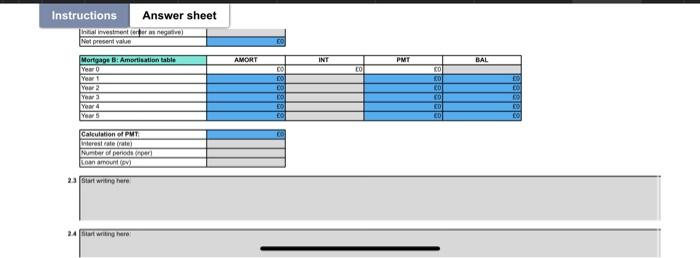

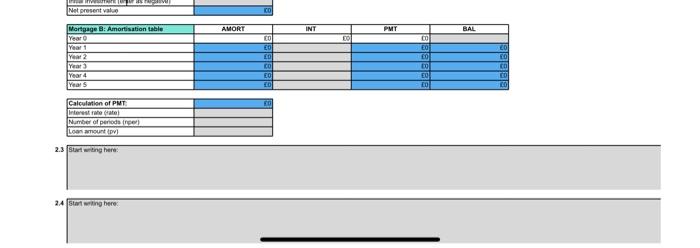

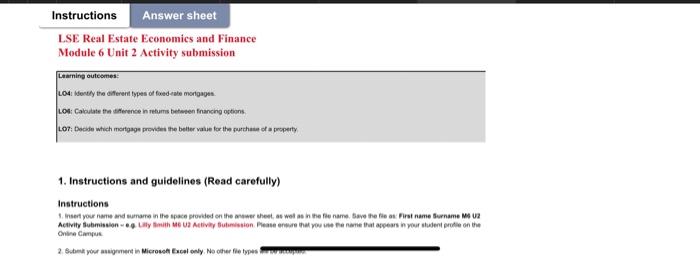

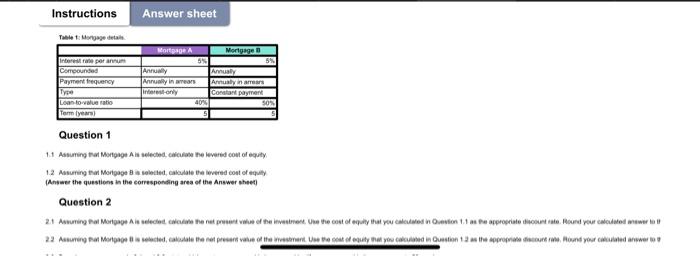

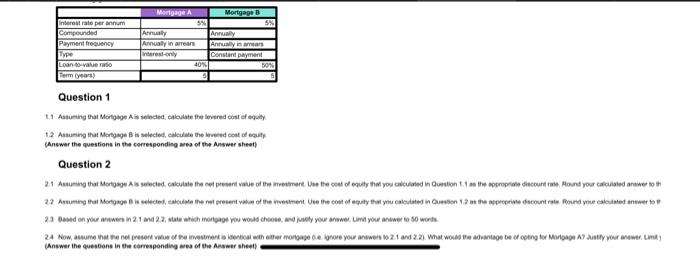

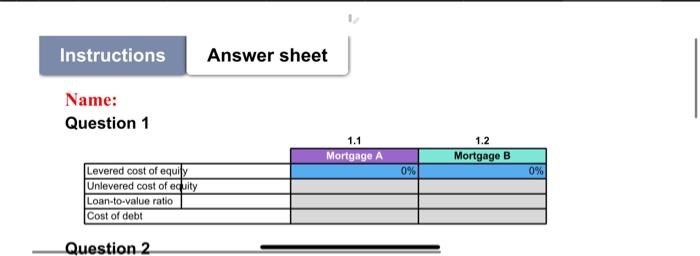

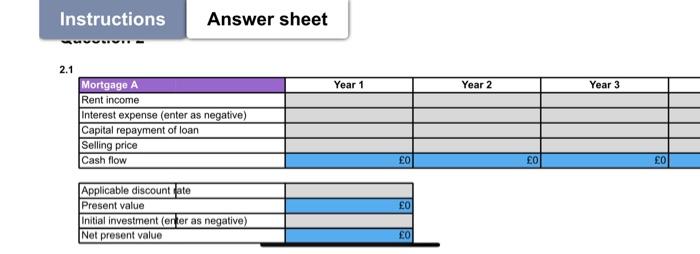

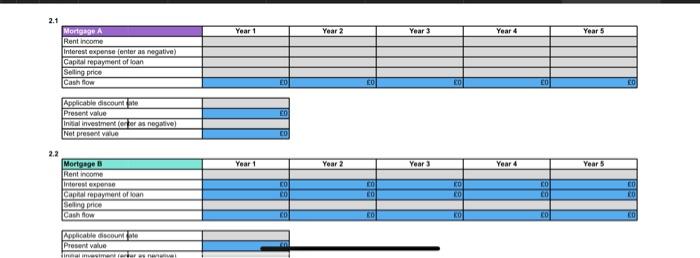

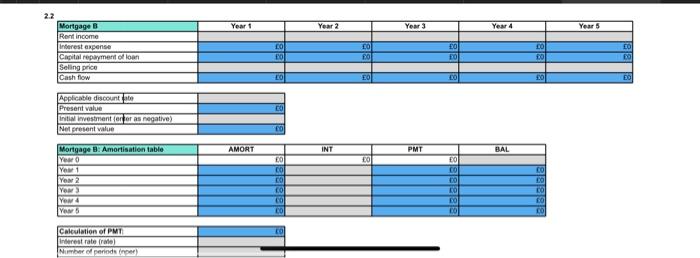

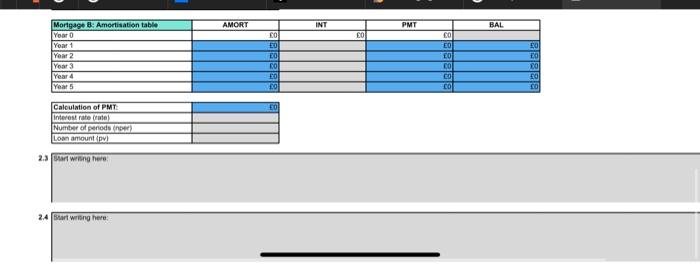

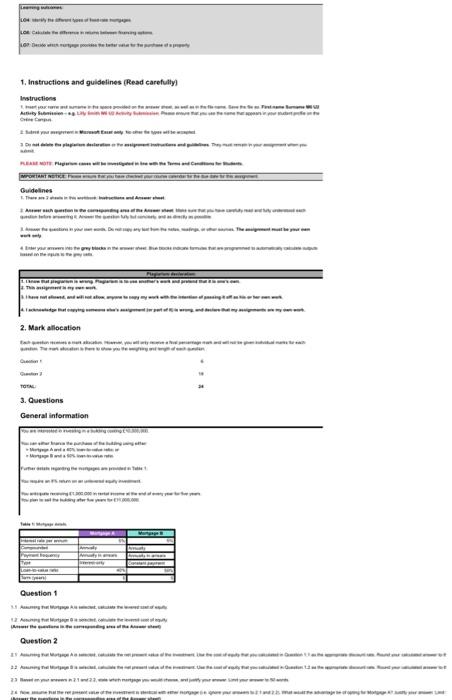

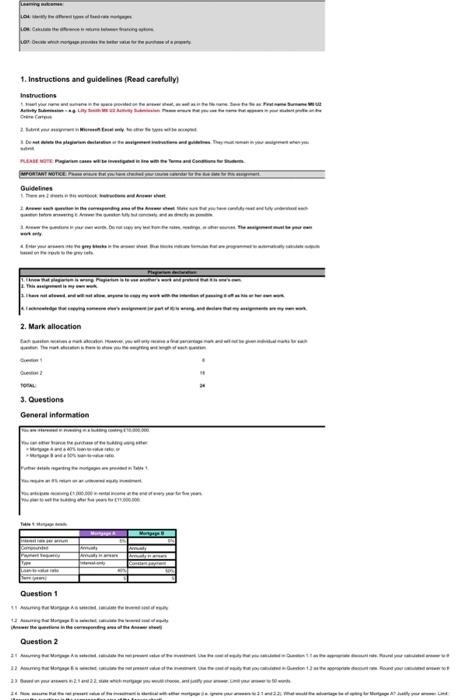

gage A is sebcted, calculate the levered cost of equly. paoe B is selecied. caboutate the levered cost of equity. in the correspending aree of the Answer sheot) in the correspending area of the Answer sheet) Table 1: Mortgage details. Question 1 1.1 Assuming that Mortgage A is selected, calculate the levered cost of equity. 1.2 Assuming that Mortgage B is selected, calculate the levered cost of equity. (Answer the questions in the corresponding area of the Answer sheet) Questiea 1 Question 2 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. 2.2 Net present value of investment with Mortgage B: Discount rate (levered cost of equity) =13% Net present value =5,000,000+(500,000/ (1+0.13)1)+(500,000/(1+0.13)2)+ (500,000/(1+0.13)3)+(500,000/(1+ 0.13)4)+(11,000,000/(1+0.13)5) Net present value =1,243,916 Question 1 I. f Assuming Bat Morlosot A is selected, calcuime the ievered cust of equly 1.2. Aasuming tat Morigage A a sebcied, cakoulate the ievetred onat of equity (Answer the questions in the sorresponing area ef the Answer sheed Question 2 2.3 Blased on your abwers in 2.1 and 2.2. stabe which molgage you woulf cheote and justly your asower. Lima your amdwer to 50 wards. (Answer the questions in the somesponsing area ef the Answer sheotm Question 2 23 Start witmonerie: 24 hiar witng haro: 23 Start witmonerie: 24 hiar witng haro: 2.3 Start wing here: LSE Real Estate Economics and Finance Module 6 Unit 2 Activity submission Leatning outesmes: Lo4: lifertly the diferent fypes of ficedenes morigaget. Los: Calbutate tha diference in refurns betioten francing ostions L.D7; Decide which mertgagn providei the belter value for the purchaide of a poperty 1. Instructions and guidelines (Read carefully) Instructions Cibre tamput. You are interested in investing is a bulding costing fta.000.000. Vos can ether Enance the pucchase of the bellding uating echer: * Morigape A and a doks loan-so-vabue taboc or * Mortgage f and a soins loar-to-value ratio. Furthar detals regarding the mongages are provided in Tabile 1. You fesoure an 3 Whatim on an unievered equify imestmant. You articipate reseiving E. 1,000.000 in rental noone at the end of every year for five years. vou plow to seil the toulding aher five years for E44,000.000 Talie ti Loroese detah. Question 1 1.t Assumeng fiat Mortgage A it selected, caiculabe the leverbed coit of equity. 1.2 Msuming thal Morigage B a selecied, cabedaie the levered bost of acuity (Ansaer the questions in the corresponsing area of the Answer sheed) Question 2 12 Assuming that Mortgage B is selecied, caleulete the kevered coat of equity. (Answer the questions in the corresponding ares of the Answer shett) Question 2 (Answer the euesbens in the carresponding ares of the Acswer she+t) Name: Question 1 Answer sheet 2.1 \begin{tabular}{|l|r|r|r|r|} \hline Mortgage A & Year 1 & Year 2 & & \\ \hline Rent income & & & & \\ \hline Interest expense (enter as negative) & & & \\ \hline Capital repayment of loan & & & \\ \hline Selling price & & & \\ \hline Cash flow & & & \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Applicable discount fate & \\ \hline Present value & \\ \hline Initial investment (enter as negative) & \\ \hline Net present value & \\ \hline \end{tabular} 2.2 \begin{tabular}{|l|l|} \hline Acplicable discount fate & \\ \hline Present value & \\ \hline intial ievestment ier for as negative) & \\ \hline Net present value & \\ \hline \end{tabular} 2.3 Crart wenng hers: 2.4 Bhart wring here: 1. Instructiens and guldelines (Read carefulty) lesiructions Cisinelines in inen mets 2. Mark aflocation 3. Questions General information Question 1 Question? 1. Instructions and guidelines (Resd carefully] instructions Srite Fierinet Butrint Cusintines 2. Mark allocation 3. Questions General intormation Question 1 Question 2 gage A is sebcted, calculate the levered cost of equly. paoe B is selecied. caboutate the levered cost of equity. in the correspending aree of the Answer sheot) in the correspending area of the Answer sheet) Table 1: Mortgage details. Question 1 1.1 Assuming that Mortgage A is selected, calculate the levered cost of equity. 1.2 Assuming that Mortgage B is selected, calculate the levered cost of equity. (Answer the questions in the corresponding area of the Answer sheet) Questiea 1 Question 2 2.1 Net present value of investment with Mortgage A: Discount rate (levered cost of equity) = 11.33% Net present value =10,000,000+(1,000,000 /(1+0.1133)1)+(1,000,000/(1+ 0.1133)2)+(1,000,000/(1+0.1133)3)+ (1,000,000/(1+0.1133)4)+(11,000,000/ (1+0.1133)5) Net present value =1,321,334 Explanation Please refer to solution in this step. 2.2 Net present value of investment with Mortgage B: Discount rate (levered cost of equity) =13% Net present value =5,000,000+(500,000/ (1+0.13)1)+(500,000/(1+0.13)2)+ (500,000/(1+0.13)3)+(500,000/(1+ 0.13)4)+(11,000,000/(1+0.13)5) Net present value =1,243,916 Question 1 I. f Assuming Bat Morlosot A is selected, calcuime the ievered cust of equly 1.2. Aasuming tat Morigage A a sebcied, cakoulate the ievetred onat of equity (Answer the questions in the sorresponing area ef the Answer sheed Question 2 2.3 Blased on your abwers in 2.1 and 2.2. stabe which molgage you woulf cheote and justly your asower. Lima your amdwer to 50 wards. (Answer the questions in the somesponsing area ef the Answer sheotm Question 2 23 Start witmonerie: 24 hiar witng haro: 23 Start witmonerie: 24 hiar witng haro: 2.3 Start wing here: LSE Real Estate Economics and Finance Module 6 Unit 2 Activity submission Leatning outesmes: Lo4: lifertly the diferent fypes of ficedenes morigaget. Los: Calbutate tha diference in refurns betioten francing ostions L.D7; Decide which mertgagn providei the belter value for the purchaide of a poperty 1. Instructions and guidelines (Read carefully) Instructions Cibre tamput. You are interested in investing is a bulding costing fta.000.000. Vos can ether Enance the pucchase of the bellding uating echer: * Morigape A and a doks loan-so-vabue taboc or * Mortgage f and a soins loar-to-value ratio. Furthar detals regarding the mongages are provided in Tabile 1. You fesoure an 3 Whatim on an unievered equify imestmant. You articipate reseiving E. 1,000.000 in rental noone at the end of every year for five years. vou plow to seil the toulding aher five years for E44,000.000 Talie ti Loroese detah. Question 1 1.t Assumeng fiat Mortgage A it selected, caiculabe the leverbed coit of equity. 1.2 Msuming thal Morigage B a selecied, cabedaie the levered bost of acuity (Ansaer the questions in the corresponsing area of the Answer sheed) Question 2 12 Assuming that Mortgage B is selecied, caleulete the kevered coat of equity. (Answer the questions in the corresponding ares of the Answer shett) Question 2 (Answer the euesbens in the carresponding ares of the Acswer she+t) Name: Question 1 Answer sheet 2.1 \begin{tabular}{|l|r|r|r|r|} \hline Mortgage A & Year 1 & Year 2 & & \\ \hline Rent income & & & & \\ \hline Interest expense (enter as negative) & & & \\ \hline Capital repayment of loan & & & \\ \hline Selling price & & & \\ \hline Cash flow & & & \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Applicable discount fate & \\ \hline Present value & \\ \hline Initial investment (enter as negative) & \\ \hline Net present value & \\ \hline \end{tabular} 2.2 \begin{tabular}{|l|l|} \hline Acplicable discount fate & \\ \hline Present value & \\ \hline intial ievestment ier for as negative) & \\ \hline Net present value & \\ \hline \end{tabular} 2.3 Crart wenng hers: 2.4 Bhart wring here: 1. Instructiens and guldelines (Read carefulty) lesiructions Cisinelines in inen mets 2. Mark aflocation 3. Questions General information Question 1 Question? 1. Instructions and guidelines (Resd carefully] instructions Srite Fierinet Butrint Cusintines 2. Mark allocation 3. Questions General intormation Question 1 Question 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts