Question: ASAP please Thank you :) Ehrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's

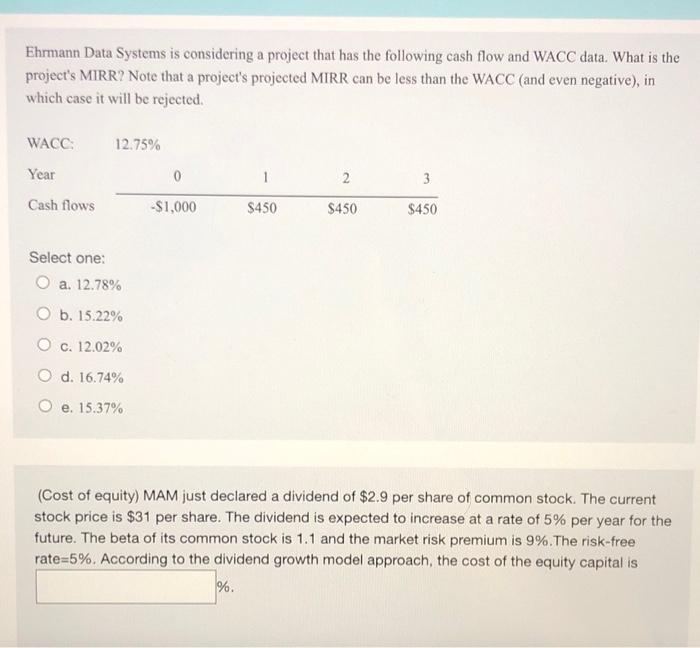

Ehrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. WACC: 12.75% Year 0 1 2 3 Cash flows -$1,000 $450 $450 $450 Select one: O a. 12.78% O b. 15.22% O c. 12.02% O d. 16.74% O e. 15.37% (Cost of equity) MAM just declared a dividend of $2.9 per share of common stock. The current stock price is $31 per share. The dividend is expected to increase at a rate of 5% per year for the future. The beta of its common stock is 1.1 and the market risk premium is 9%. The risk-free rate=5%. According to the dividend growth model approach, the cost of the equity capital is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts