Question: asap please Timing Differences The Ewert Exploration Company is considering two mutually exclusiv plans for extracting oil on property for which it has mineral rights.

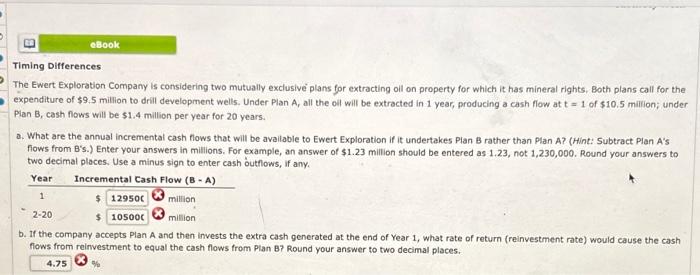

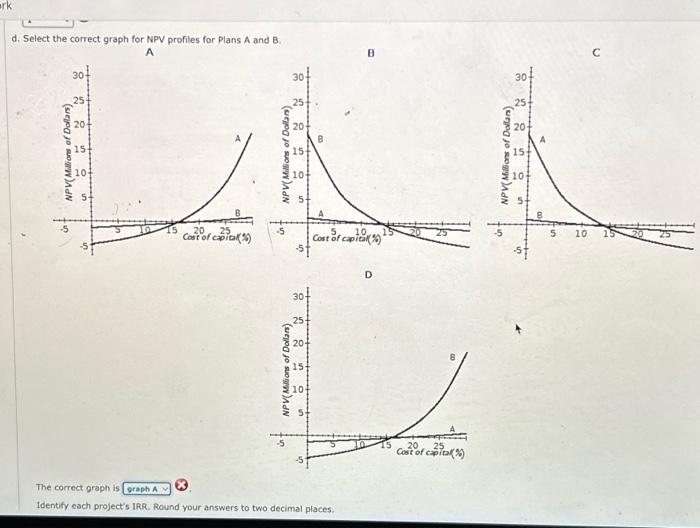

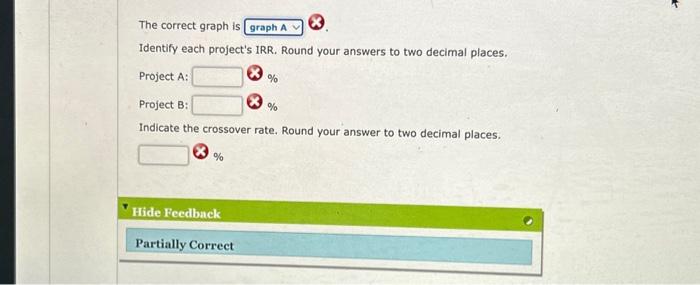

Timing Differences The Ewert Exploration Company is considering two mutually exclusiv plans for extracting oil on property for which it has mineral rights. Both plans call for the expenditure of $9.5 million to drill development wells. Under Plan A, all the oil will be extracted in 1 year, producing a cash flow at t=1 of $10.5 million; under Plan B, cash flows will be $1.4 million per year for 20 years. a. What are the annual incremental cash flows that will be available to Ewert Exploration if it undertakes Plan B rather than Plan A? (Hint: Subtract Plan A's fiows from B's.) Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23 , not 1,230,000. Round your answers to two decimal places. Use a minus sign to enter cash outflows, if any. b. If the company accepts Plan A and then invests the extra cash generated at the end of Year 1 , what rate of return (reinvestment rate) would cause the cash flows from relinvestment to equal the cash flows from Plan B? Round your answer to two decimal places. 8% d. Select the correct graph for NPV profiles for Plans A and B. A The correct graph is Identify each project's IRR. Round your answers to two decimal places. The correct graph is Identify each project's IRR. Round your answers to two decimal places. Project A: % Project B: % Indicate the crossover rate. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts