Question: ash need a numer*ic response 9-4 Option Hedge On June 1, Wellmax Co. (a U.S.-based company) sold goods to a foreign customer for 1,040,000 pesos.

ash

need a numer*ic response

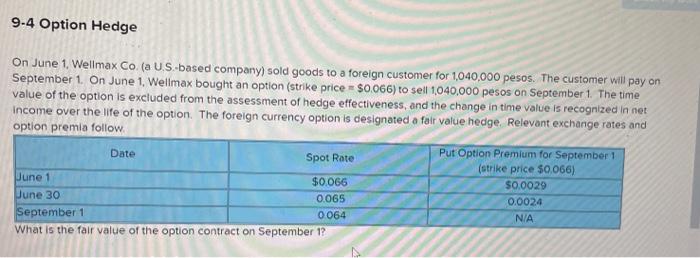

9-4 Option Hedge On June 1, Wellmax Co. (a U.S.-based company) sold goods to a foreign customer for 1,040,000 pesos. The customer will pay on September 1. On June 1, Wellmax bought an option (strike price = $0.066) to sell 1040,000 pesos on September 1. The time value of the option is excluded from the assessment of hedge effectiveness, and the change in time value is recognized In net income over the life of the option. The foreign currency option is designated a fair value hedge, Relevant exchange rates and option premia follow. Date Spot Rate Put Option Premium for September 1 (strike price $0,066) June 1 $0.066 50.0029 June 30 0.065 0.9024 September 1 0 064 NA What is the fair value of the option contract on September 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts