Question: Problem 1 (25%) PT Singkong Emas (PTSE) had a sheet metal cutter that cost Rp. 96,000,000 on January 2, 2006. This old cutter had an

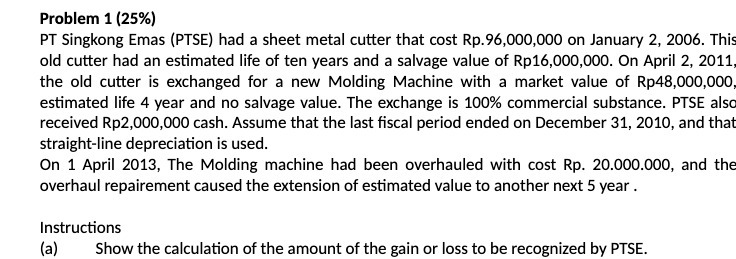

Problem 1 (25%) PT Singkong Emas (PTSE) had a sheet metal cutter that cost Rp. 96,000,000 on January 2, 2006. This old cutter had an estimated life of ten years and a salvage value of Rp16,000,000. On April 2, 2011, the old cutter is exchanged for a new Molding Machine with a market value of Rp48,000,000, estimated life 4 year and no salvage value. The exchange is 100% commercial substance. PTSE also received Rp2,000,000 cash. Assume that the last fiscal period ended on December 31, 2010, and that straight-line depreciation is used. On 1 April 2013, The Molding machine had been overhauled with cost Rp. 20.000.000, and the overhaul repairement caused the extension of estimated value to another next 5 year . Instructions (a) Show the calculation of the amount of the gain or loss to be recognized by PTSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts