Question: Ask for extra questions if required. a) PTL Bhd has issued 5 million ordinary shares, with a market price of RM9 each. The company has

Ask for extra questions if required.

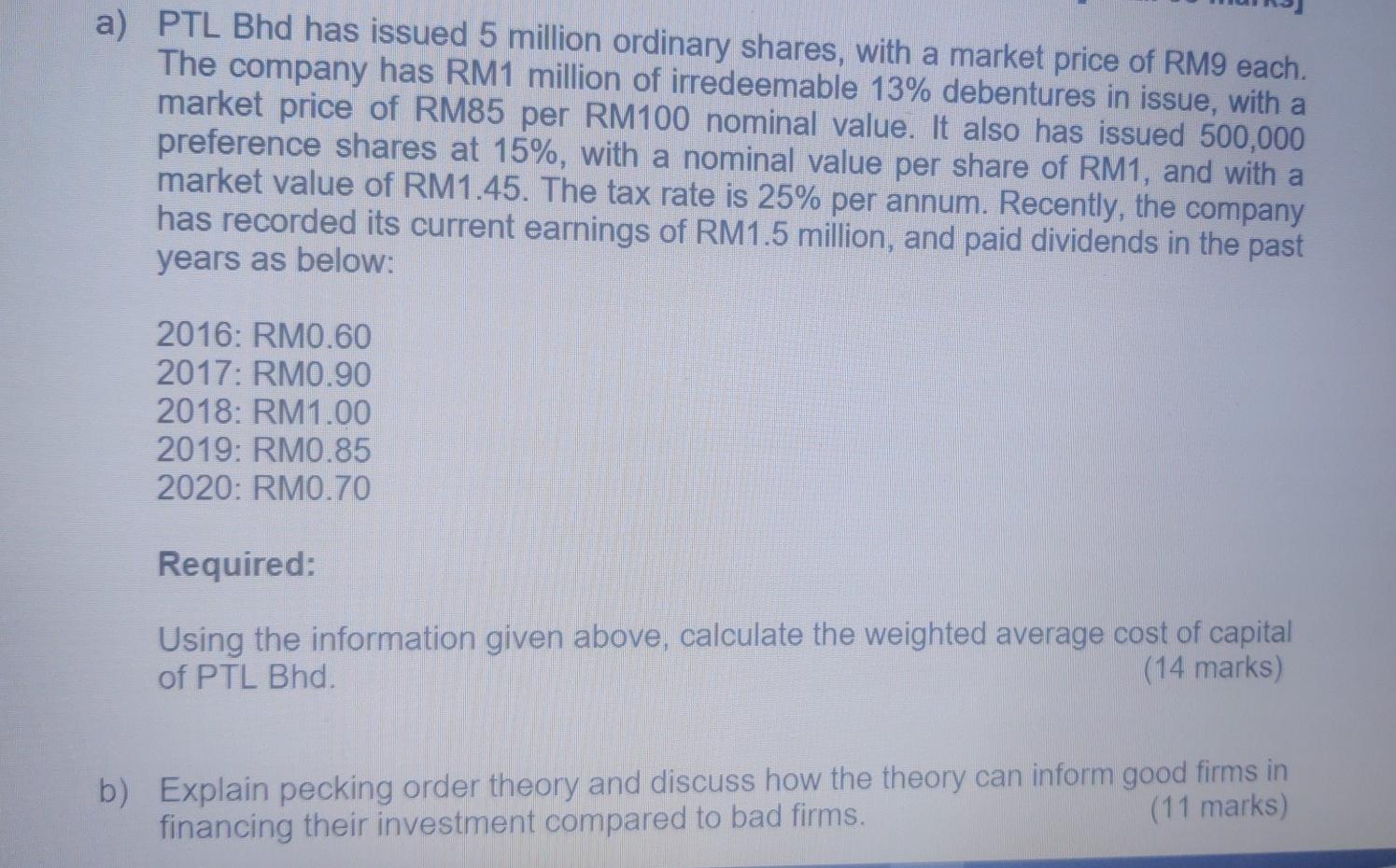

a) PTL Bhd has issued 5 million ordinary shares, with a market price of RM9 each. The company has RM1 million of irredeemable 13% debentures in issue, with a market price of RM85 per RM100 nominal value. It also has issued 500,000 preference shares at 15%, with a nominal value per share of RM1, and with a market value of RM1.45. The tax rate is 25% per annum. Recently, the company has recorded its current earnings of RM1.5 million, and paid dividends in the past years as below: 2016: RM0.60 2017: RM0.90 2018: RM1.00 2019: RM0.85 2020: RM0.70 Required: Using the information given above, calculate the weighted average cost of capital of PTL Bhd. (14 marks) b) Explain pecking order theory and discuss how the theory can inform good firms in financing their investment compared to bad firms. (11 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts