Question: Asking the arbitrage opportunity...question is clear Let someone else answer then.....it doesnt need more info Problem 3.1. A European call option on a stock with

Asking the arbitrage opportunity...question is clear

Let someone else answer then.....it doesnt need more info

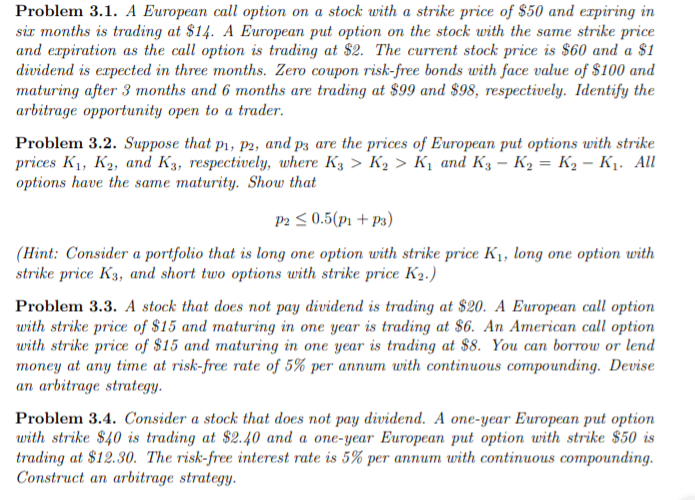

Problem 3.1. A European call option on a stock with a strike price of $50 and expiring in six months is trading at $14. A European put option on the stock with the same strike price and expiration as the call option is trading at $2. The current stock price is $60 and a $1 dividend is expected in three months. Zero coupon risk-free bonds with face value of $100 and maturing after 3 months and 6 months are trading at $99 and $98, respectively. Identify the arbitrage opportunity open to a trader. Problem 3.2. Suppose that p1, P2, and p3 are the prices of European put options with strike prices K1, K2, and K3, respectively, where Kg > K2 > K and K3 - K2 = K2 - K1. All options have the same maturity. Show that P2 K2 > K and K3 - K2 = K2 - K1. All options have the same maturity. Show that P2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts