Question: please show work 13. APV Problem SAE Corp. a large cap tech firm, is evaluating the possible acquisition of the Benchmark Company, an electronic manufacturer.

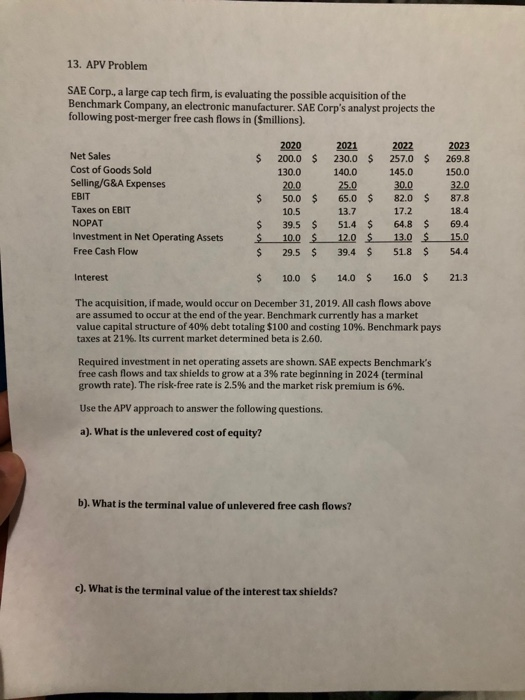

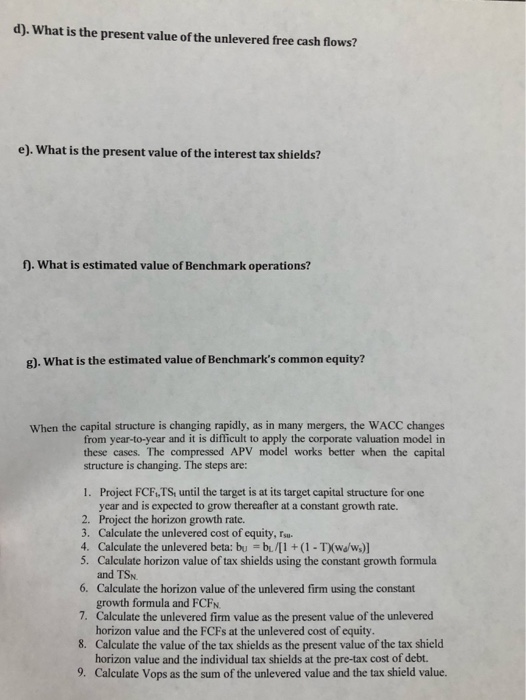

13. APV Problem SAE Corp. a large cap tech firm, is evaluating the possible acquisition of the Benchmark Company, an electronic manufacturer. SAE Corp's analyst projects the following post-merger free cash flows in (Smillions). $ $ $ Net Sales Cost of Goods Sold Selling/G&A Expenses EBIT Taxes on EBIT NOPAT Investment in Net Operating Assets Free Cash Flow 2020 200.0 130.0 20.0 50.0 10.5 39.5 10,0 29.5 $ 2021 230.0 140.0 25.0 65.0 13.7 51.4 12,0 39.4 $ 2022 257.0 145.0 30.0 82.0 17.2 64.8 13.0 51.8 $ 2023 269.8 150.0 32.0 87.8 18.4 69.4 15.0 54.4 $ $ $ $ $ $ $ $ $ $ $ Interest $ 10.0 $ 14.0 $ 16.0 $ 21.3 The acquisition, if made, would occur on December 31, 2019. All cash flows above are assumed to occur at the end of the year. Benchmark currently has a market value capital structure of 40% debt totaling $100 and costing 10%. Benchmark pays taxes at 21%. Its current market determined beta is 2.60. Required investment in net operating assets are shown. SAE expects Benchmark's free cash flows and tax shields to grow at a 3% rate beginning in 2024 (terminal growth rate). The risk-free rate is 2.5% and the market risk premium is 6%. Use the APV approach to answer the following questions. a). What is the unlevered cost of equity? b). What is the terminal value of unlevered free cash flows? c). What is the terminal value of the interest tax shields? d). What is the present value of the unlevered free cash flows? e). What is the present value of the interest tax shields? f). What is estimated value of Benchmark operations? g). What is the estimated value of Benchmark's common equity? When the capital structure is changing rapidly, as in many mergers, the WACC changes from year-to-year and it is difficult to apply the corporate valuation model in these cases. The compressed APV model works better when the capital structure is changing. The steps are: 1. Project FCF,TS, until the target is at its target capital structure for one year and is expected to grow thereafter at a constant growth rate. 2. Project the horizon growth rate. 3. Calculate the unlevered cost of equity, Tsu- 4. Calculate the unlevered beta: bu = bu/[1 + (1 - T)(wa/ws)] 5. Calculate horizon value of tax shields using the constant growth formula and TSN. 6. Calculate the horizon value of the unlevered firm using the constant growth formula and FCFN. 7. Calculate the unlevered firm value as the present value of the unlevered horizon value and the FCFs at the unlevered cost of equity. 8. Calculate the value of the tax shields as the present value of the tax shield horizon value and the individual tax shields at the pre-tax cost of debt. 9. Calculate Vops as the sum of the unlevered value and the tax shield value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts