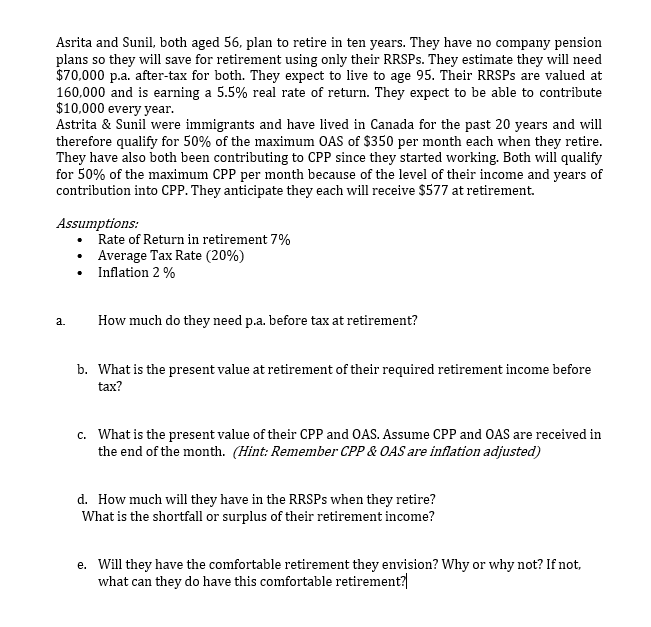

Question: Asrita and Sunil, both aged 5 6 , plan to retire in ten years. They have no company pension plans so they will save for

Asrita and Sunil, both aged plan to retire in ten years. They have no company pension

plans so they will save for retirement using only their RRSPs They estimate they will need

$ pa aftertax for both. They expect to live to age Their RRSPs are valued at

and is earning a real rate of return. They expect to be able to contribute

$ every year.

Astrita & Sunil were immigrants and have lived in Canada for the past years and will

therefore qualify for of the maximum OAS of $ per month each when they retire.

They have also both been contributing to CPP since they started working. Both will qualify

for of the maximum CPP per month because of the level of their income and years of

contribution into CPP They anticipate they each will receive $ at retirement.

Assumptions:

Rate of Return in retirement

Average Tax Rate

Inflation

a How much do they need pa before tax at retirement?

b What is the present value at retirement of their required retirement income before

tax?

c What is the present value of their CPP and OAS. Assume CPP and OAS are received in

the end of the month. Hint: Remember CPP & OAS are inflation adjusted

d How much will they have in the RRSPs when they retire?

What is the shortfall or surplus of their retirement income?

e Will they have the comfortable retirement they envision? Why or why not? If not,

what can they do have this comfortable retirement?

Could you please detail the math operations step by step

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock