Question: Assess how tax affects a project's valuation by evaluating the trade-offs of funding a project with debt vs equity and how the choice affects a

"Assess how tax affects a project's valuation by evaluating the trade-offs of funding a project with debt vs equity and how the choice affects a project’s value.

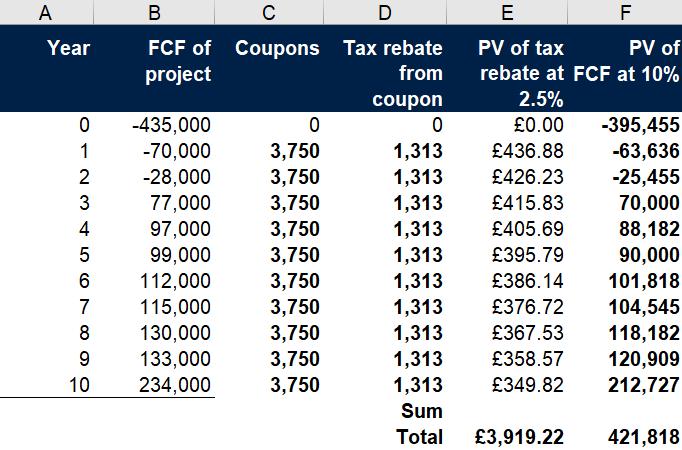

The following table shows the FCF of a project that lasts 10 years. The cost of capital of the project is 10% and the tax rate is 35%. The company running the project has an all-equity capital structure and decides to borrow against this project. The principal value of the loan, which is the amount that must be paid back to the lender either before or when the loan matures, is £150,000. In addition to the principal, coupons (a percentage of the principal amount) must be paid during the loan period, at predetermined intervals. In this case, the company pays annual coupons of 2.5% and its cost of capital for debt is 2.5%. The loan reaches maturity in 10 years, the money is raised in Year 0, and payment of coupons begins in Year 1.

Year FCF of project (£)

Q1.1 How much money does the company in question raise if the debt market is competitive?

A C D E F Year PV of FCF of Coupons Tax rebate project PV of tax from rebate at FCF at 10% coupon 2.5% -395,455 -63,636 -25,455 70,000 88,182 90,000 101,818 104,545 118,182 120,909 212,727 -435,000 -70,000 0.00 3,750 3,750 3,750 3,750 1,313 1,313 1,313 1,313 1 436.88 -28,000 426.23 3 77,000 97,000 415.83 4 405.69 5 99,000 3,750 3,750 3,750 3,750 3,750 3,750 1,313 395.79 112,000 115,000 130,000 133,000 234,000 1,313 1,313 1,313 1,313 1,313 386.14 7 376.72 8 367.53 9 358.57 10 349.82 Sum Total 3,919.22 421,818

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Year FCF of the project Tax35 FCF after tax PV Factor10 PV of FCF after Tax 0 435000 1 435000 1 7000... View full answer

Get step-by-step solutions from verified subject matter experts