Question: Assessable Homework 4 - Modules 7 & 8 (Questions) (Protected View) - Microsoft Word (Product Activation Failed) Mailings Review View Developer cert Page Layout References

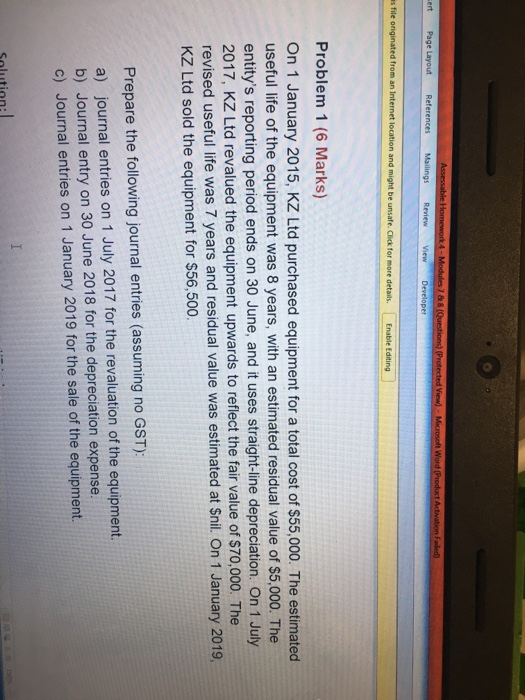

Assessable Homework 4 - Modules 7 & 8 (Questions) (Protected View) - Microsoft Word (Product Activation Failed) Mailings Review View Developer cert Page Layout References is file originated from an Internet location and might be unsafe. Click for more details Enable Editing Problem 1 (6 Marks) On 1 January 2015, KZ Ltd purchased equipment for a total cost of $55,000. The estimated useful life of the equipment was 8 years, with an estimated residual value of $5,000. The entity's reporting period ends on 30 June, and it uses straight-line depreciation. On 1 July 2017, KZ Ltd revalued the equipment upwards to reflect the fair value of $70,000. The revised useful life was 7 years and residual value was estimated at Snil. On 1 January 2019, KZ Ltd sold the equipment for $56,500. Prepare the following journal entries (assuming no GST): a) journal entries on 1 July 2017 for the revaluation of the equipment. b) Journal entry on 30 June 2018 for the depreciation expense. c) Journal entries on 1 January 2019 for the sale of the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts