Question: ASSESSMENT 0 3 - SCENARIO QUESTION 1 ( 5 0 marks ) ( 1 0 0 minutes ) ThinkT Ltd is a company in the

ASSESSMENT SCENARIO

QUESTION marks minutes

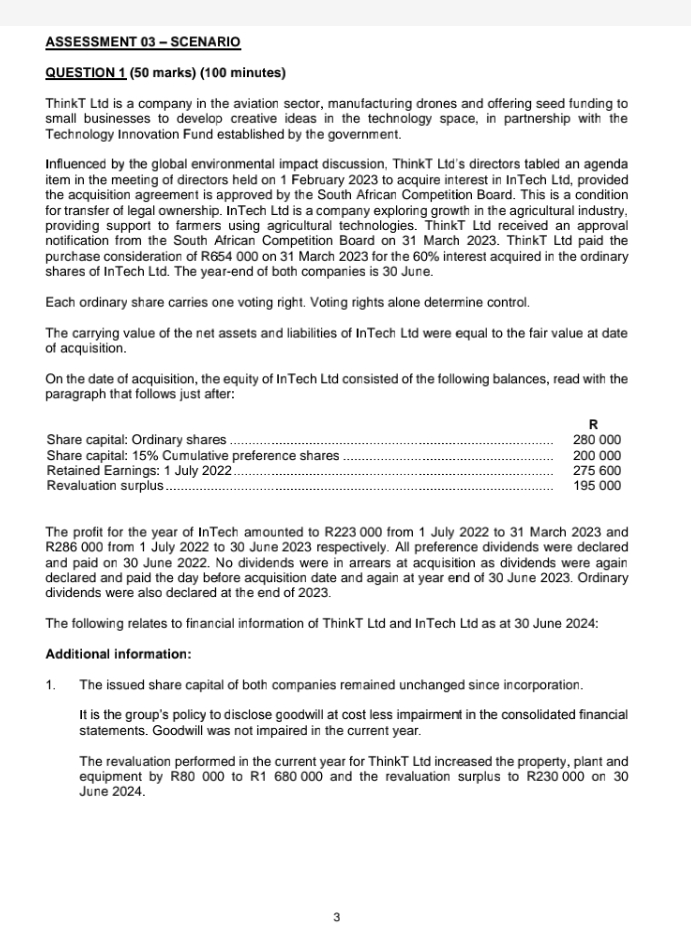

ThinkT Ltd is a company in the aviation sector, manufacturing drones and offering seed funding to small businesses to develop creative ideas in the technology space, in partnership with the Technology Innovation Fund established by the government.

Influenced by the global environmental impact discussion, ThinkT Ldds directors tabled an agenda item in the meeting of directors held on February to acquire interest in InTech Lid, provided the acquisition agreement is approved by the South African Competition Board. This is a condition for transfer of legal ownership. InTech Ltd is a company exploring growth in the agricultural industry, providing support to farmers using agricultural technologies. ThinkT Ltd received an approval notification from the South African Competition Board on March ThinkT Ltd paid the purchase consideration of R on March for the interest acquired in the ordinary shares of Tech Ltd The yearend of both companies is June.

Each ordinary share carries one voting right. Voting rights alone determine control.

The carrying value of the net assets and liabilities of InTech Ltd were equal to the fair value at date of acquisition.

On the date of acquisition, the equity of InTech Ltd consisted of the following balances, read with the paragraph that follows just after:

tableRShare capital: Ordinary shares Share capital: Cumulative,Retained Earnings: July Revaluation surplus

The profit for the year of InTech amounted to R from July to March and R from July to June respectively. All preference dividends were declared and paid on June No dividends were in arrears at acquisition as dividends were again declared and paid the day before acquisition date and again at year end of June Ordinary dividends were also declared at the end of

The following relates to financial information of ThinkT Ltd and InTech Lid as at June :

Additional information:

The issued share capital of both companies remained unchanged since incorporation.

It is the group's policy to disclose goodwill at cost less impairment in the consolidated financial statements. Goodwill was not impaired in the current year.

The revaluation performed in the current year for ThinkT Ltd increased the property, plant and equipment by R to R and the revaluation surplus to R on June

QUESTION continuedAn extract from the financial record of ThinkT Ltd and InTech Ltd presented the followingbalances for the financial year ending June :Sales.sCost of salesDividends paid: Ordinary dividendsDividends paid: cumulative preference sharesDepreciation Other expensesTaxation expenses Retained earnings: July InventoryProperty, plant and equipment at carrying value.Revaluation surplusShare capital Ordinary sharesShare capital Cumulative preference share capital...ThinkT LtdQuantity Date June MarchInventory system: FIFORThinkT LtdDetailsGPS tracking devices@ markup on costGPS tracking devices @ oPriceINTRAGROUP TRANSACTION OF INVENTORYThinkT Ltd s clients suffered losses due to the theft of livestock and agricultural produce. Asresult, ThinkT Ltd started selling GPS tracking devices purchased from InTech Ltd ThinkTLtd prepared the following document to keep record of intragroup transactions of inventorypurchased from InTech Ltd and balances at the end of each year.InTech LtdRRo unitsR RDate: JUNE Inventory atyearend inThinkT Ltd'sbooksThe use of Artificial Intelligence has transtormed the agricultural space, drones are now beingused for stock taking. On January InTech Ltd purchased a drone operating vehicle fromThinkT Ltd to service large scale agricultural sectors at a cost of R Depreciation isprovided for at on the carrying value method.Included in the other income amount of ThinkT Ltd is dividen ds received of R fromInTech Ltd profit on sale of an asset amounting to Rsee note and subscription feeamount of R The subscription fee relates to an amount paid by InTech Ltd to ThinkTLtd, for tree training offered to its client, on innovation and seed funding opportunities.

QUESTION continued

REQUIRED:

tableMarkstablea Discuss the acquisition of Intech Ltd during the financial year. You

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock